- Submitting a Product Information Form

- Completing Payout Details

- Compliance team review of your submitted information

For the most up-to-date and comprehensive details on supported and prohibited product categories, as well as restricted and accepted business locations, please refer to our Merchant Acceptance Policy.

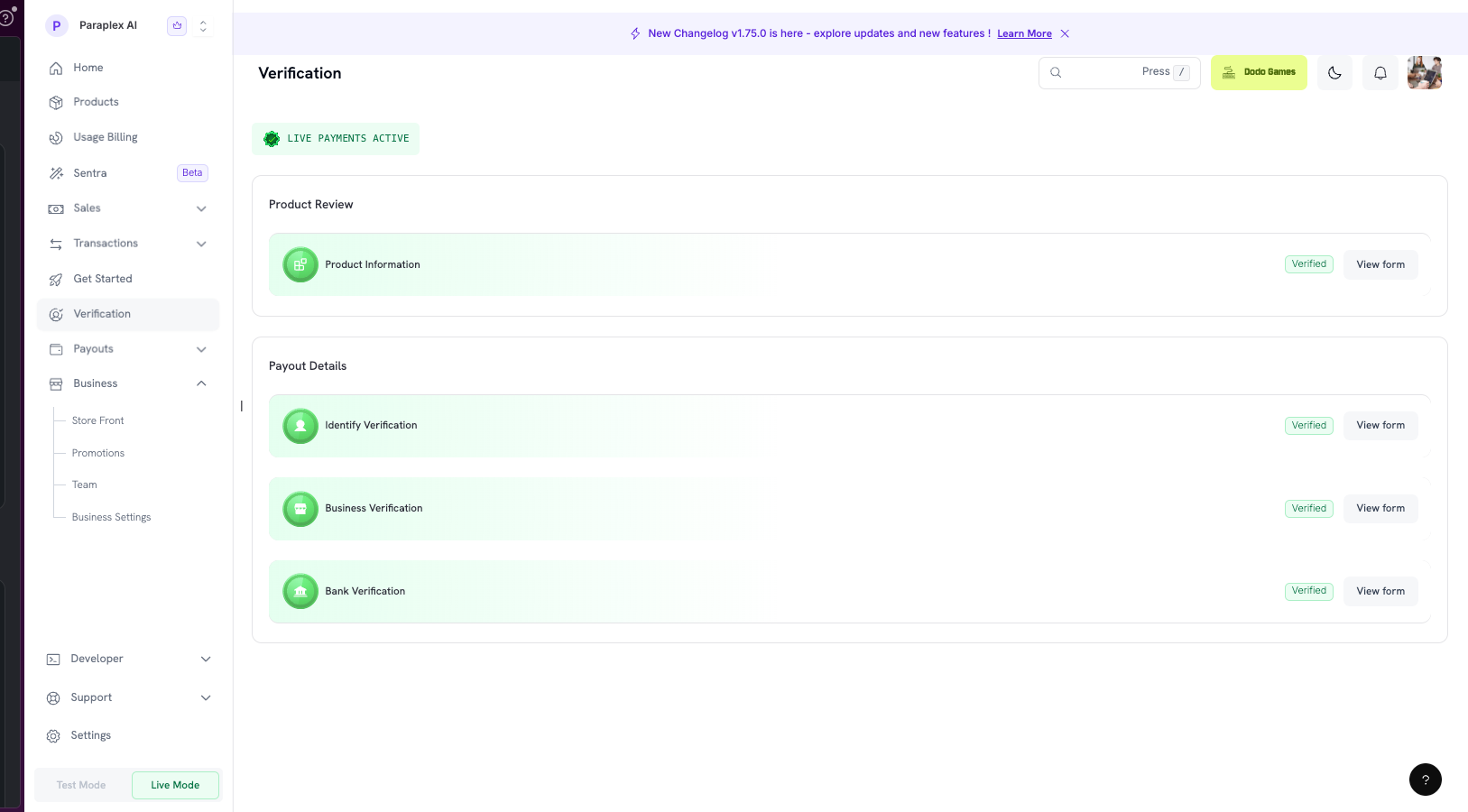

Account Verification

The Verification section is available in your dashboard.When Do You Need to Complete Verification?

Complete the verification process after sign-up to receive access to live payments and enable payouts as soon as possible.

Steps to Activate Payouts

Access the Verification section

Visit the Verification section in your dashboard (see screenshot above).

Submit Product Information Form

Complete and submit the Product Information Form. This short form helps us understand your business.

Required Forms by Account Type

The forms you need to complete depend on your account type:| Account Type | Required Forms |

|---|---|

| Individual | Product Information Form + KYC + Bank Form |

| Registered Business | Product Information Form + KYC + KYB + Bank Form |

If you are a UK registered business, you must also submit a Tax Form W-8BEN-E as part of the verification process.

1. Product Information Form

Before collecting payout details, all merchants must complete a Product Information Form. This form helps us understand your business and ensure compliance with our Merchant Acceptance Policy.This form is required for both individuals and registered businesses.

Information Required

The Product Information Form collects the following details:- Product website or landing page The URL where customers learn about or purchase your product

- Product description A brief, one-sentence explanation of what your product does

- Product category Select from options such as SaaS, digital content, services, marketplace, or physical goods

- Delivery method How customers receive the product after payment (e.g., instant access, email delivery, subscriptions, manual fulfillment)

- Level of automation Whether product delivery is fully automated, partially automated, or human-driven

- Compliance-sensitive areas Disclosure of any regulated, restricted, or higher-risk product types (if applicable)

- Dodo Payments integration method How you plan to collect payments (e.g., payment links, checkout sessions, APIs, SDKs)

- Product stage and customer acquisition Information about your product’s maturity and go-to-market approach

- Social media presence Links to your product or founder social media profiles

- Confirmation and declaration Acknowledgement that the information provided is accurate and policy-compliant

This information is used only for compliance review and does not impact your ability to integrate, test, or accept live payments.

2. Identity Verification

We use Persona, a leading global verification provider following industry standard security measure and following global data privacy guidelines. KYC ensures the authenticity of individual businesses through:- Government-issued ID verification (passport, national ID, driver’s license etc)

- Selfie check to confirm liveness and match with ID

Camera Access Issues: If you encounter a “Can’t access your camera” error during identity verification, you’ll need to enable camera permissions for your device and browser. The steps vary by browser and device:

- Chrome: Enable camera permissions through your browser settings (Desktop, iPhone & iPad, or Android)

- Safari: For desktop, enable through Safari preferences. For mobile devices, go to Settings → Safari → Camera and set permission to “Ask” or “Allow”

- iOS Apps: Go to Settings → Apps → [Your App] → Allow Camera permissions. Also ensure Lockdown Mode is not blocking the app

- Android Apps: Go to Settings → Apps → [Your App] → Allow Camera permissions

3. Bank Form

The Bank Form collects your bank account details and contact information. ⚠️ Important:- Bank account details must match the verified identity or registered business name.

- For individuals, the account holder’s name should match the Identity Verification document.

- For registered businesses, it should match the company’s legal name as per Business Verification.

- Dodo Payments cannot process payouts to mismatched or third-party accounts.

4. Business Verification

Business Verification is required only for registered businesses. If you have an individual account, you can skip this section.

Required Details

Company Registration Number

Company Registration Number

Provide your Company Registration Number and supporting document (Certificate of Incorporation or similar as per your jurisdiction).

Tax ID (Optional)

Tax ID (Optional)

If you want your tax number reflected on payout invoices for claiming tax benefits, please provide a valid Tax ID and documents.Examples of tax identifiers across regions: EIN, CRN, VAT ID, GSTIN

Director / UBO Information

Director / UBO Information

Provide details about all Director’s or UBO’s of the company in the verification form.Beneficial Owner(s)The beneficial owner is any natural person who, whether acting alone or together, or through other companies, LLPs, or legal persons, owns or is entitled to 10% or more of the shares or capital or profits of the connected user, or who exercises control over the connected user through other means, including enjoying the right to appoint the majority of its directors or to control its management or policy decisions through shareholding or management rights or through shareholders agreements or voting agreements. If the connected user has more than 1 beneficial owner, please provide us with the requisite documents for all.Business Director(s)Individuals appointed and currently serving as directors on the board of directors for the connected user in accordance with your local laws. Please provide us with the government issued ID’s of all Directors.

5. Additional Compliance

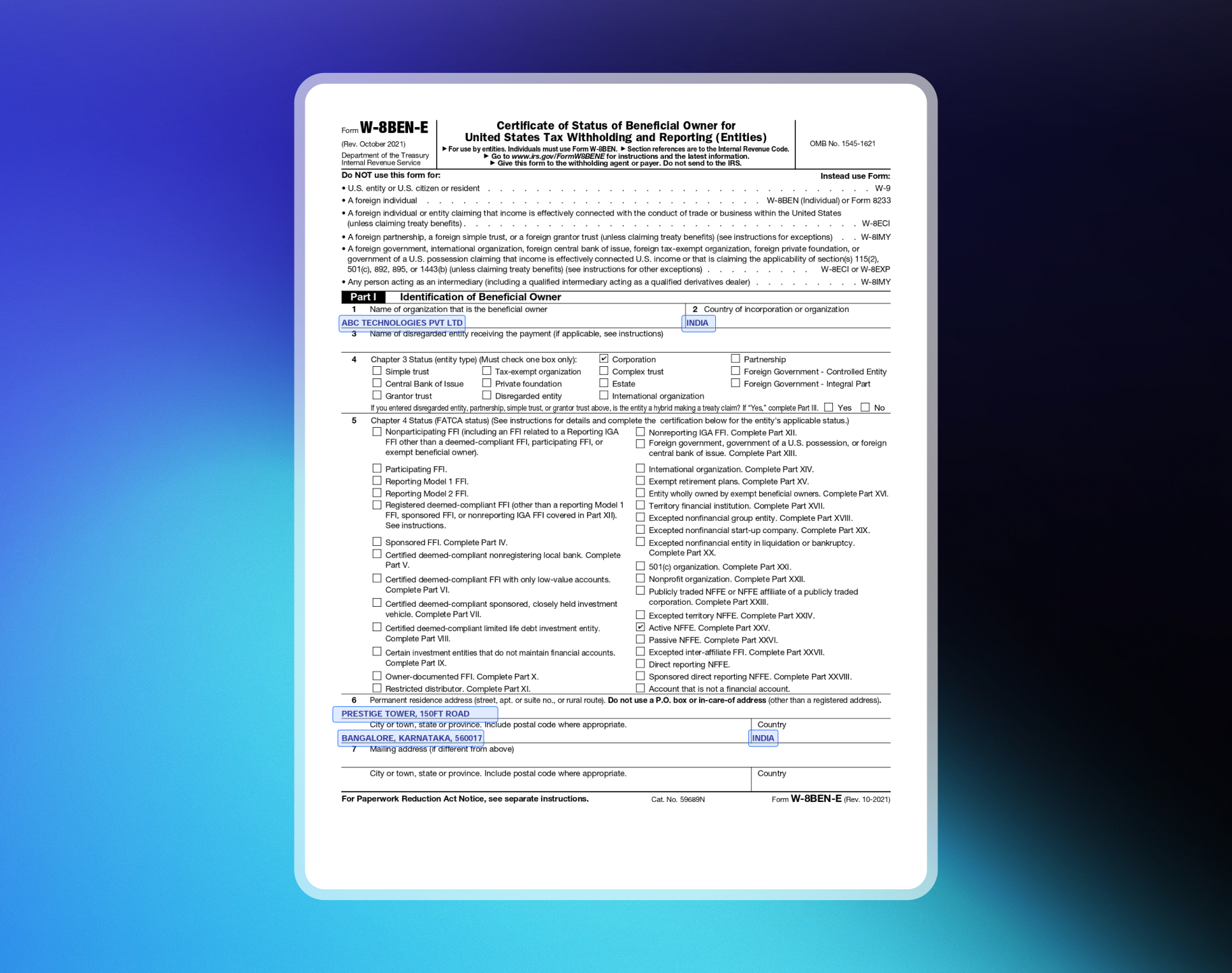

W-8BEN-E: Only required for UK registered businesses. Ensure you fill out this form if your company is based in the United Kingdom.

What is Form W-8 BEN-E?

W-8 BEN-E forms are Internal Revenue Service (IRS) forms that foreign businesses must file to verify their country of residence for tax purposes, certifying that they qualify for a lower rate of tax withholding.How to Fill Out Form W-8 BEN-E

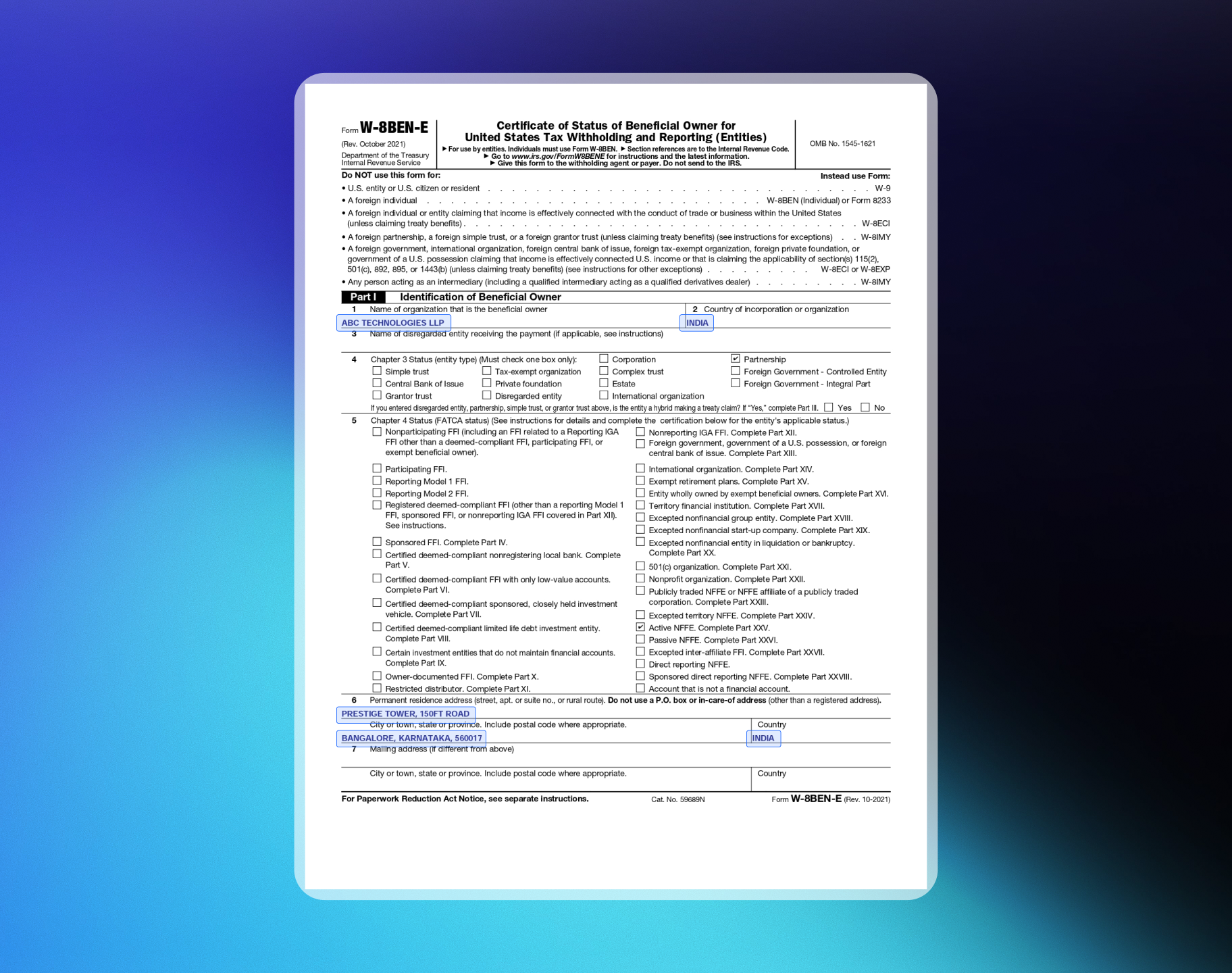

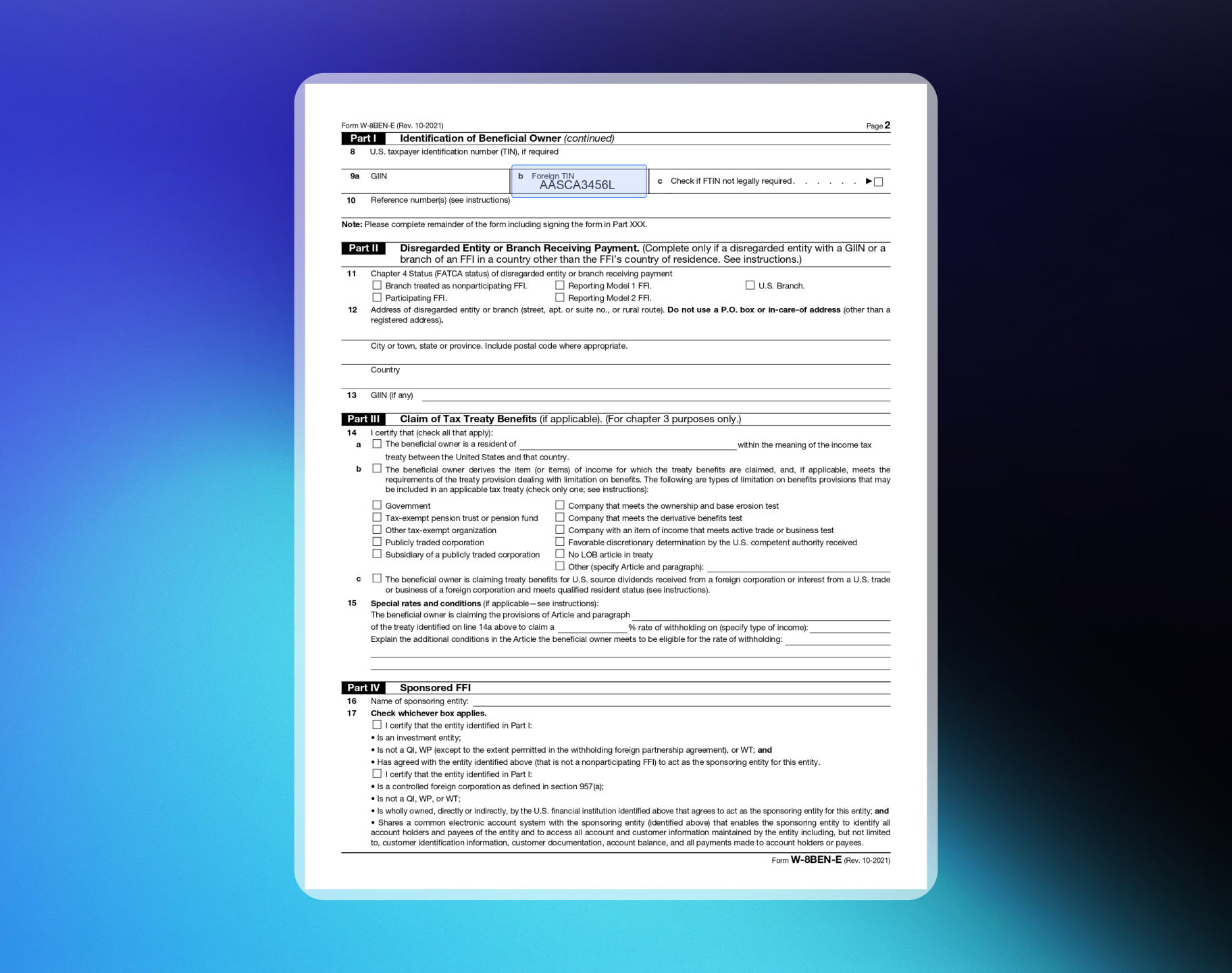

Part I – Identification of Beneficial Owner

Part I – Identification of Beneficial Owner

1. Name of Organization That is the Beneficial OwnerThis is your entity name.2. Country of Incorporation or OrganizationThis is the country of residence (where the business is registered). For a corporation, it is the country of incorporation. If you are another type of entity, enter the country under whose laws you are created, organized, or governed.3. Chapter 3 StatusIn this section, the most commonly checked box is “Corporation”. The majority of foreign entities that are doing business fall under “Corporation” or “Partnership” status. Other options include:

- Foreign government – Controlled Entity

- Foreign government – Integral Part

- Estate

- Simple trust (grantor and complex, too)

- Central Bank of Issue

- Tax-exempt organization

- Private foundation

- International organization

- Disregarded entity

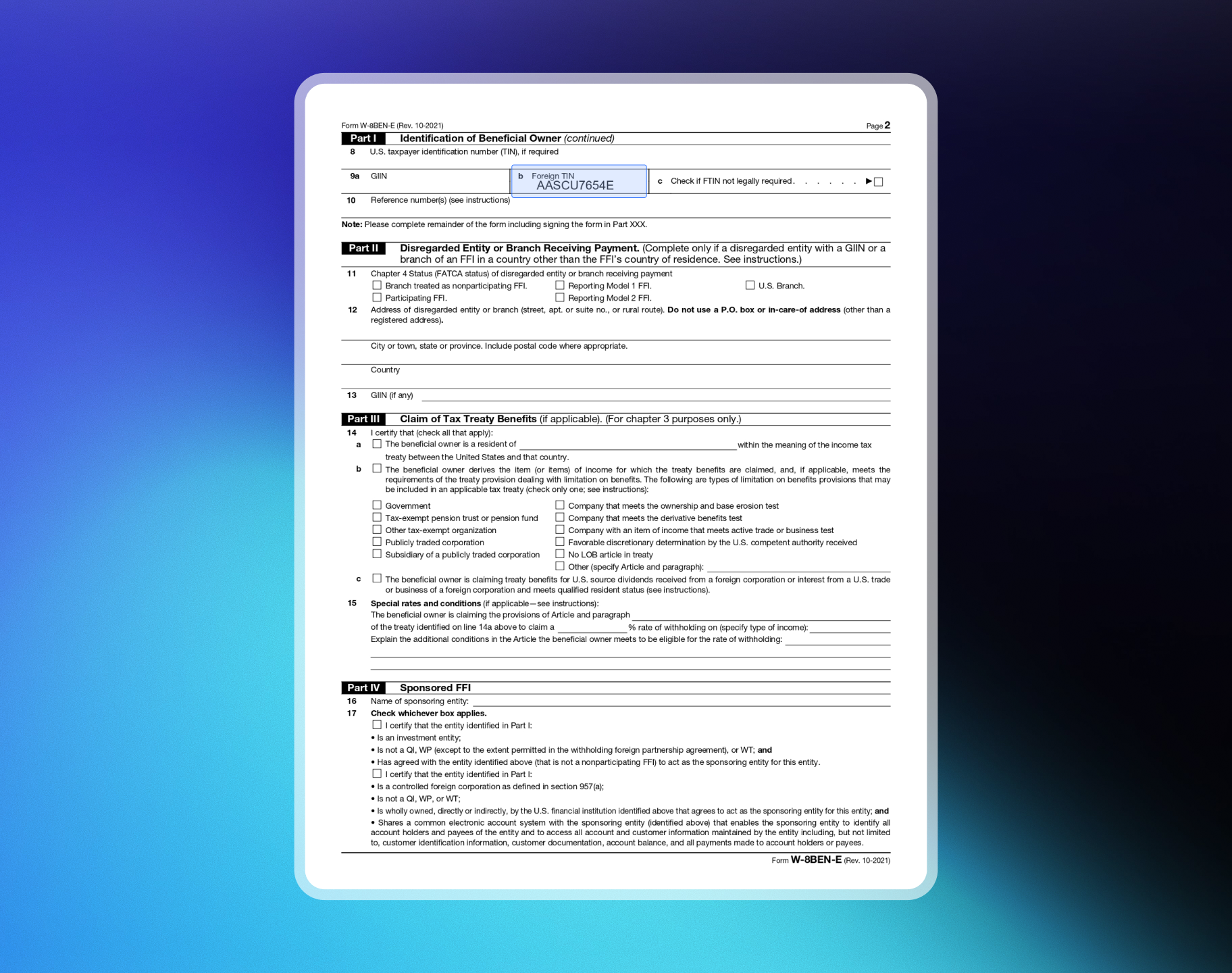

Part XXV – Active NFFE

Part XXV – Active NFFE

In this part of the form, you simply need to check box 39 to certify that:

- The entity in Part I is a foreign entity that is not a bank or financial institution.

- Less than 50% of the gross income for the preceding calendar year is passive income.

- Less than 50% of assets held are assets that produce or are held for the production of passive income (calculated as a weighted average of the % of quarterly passive assets).

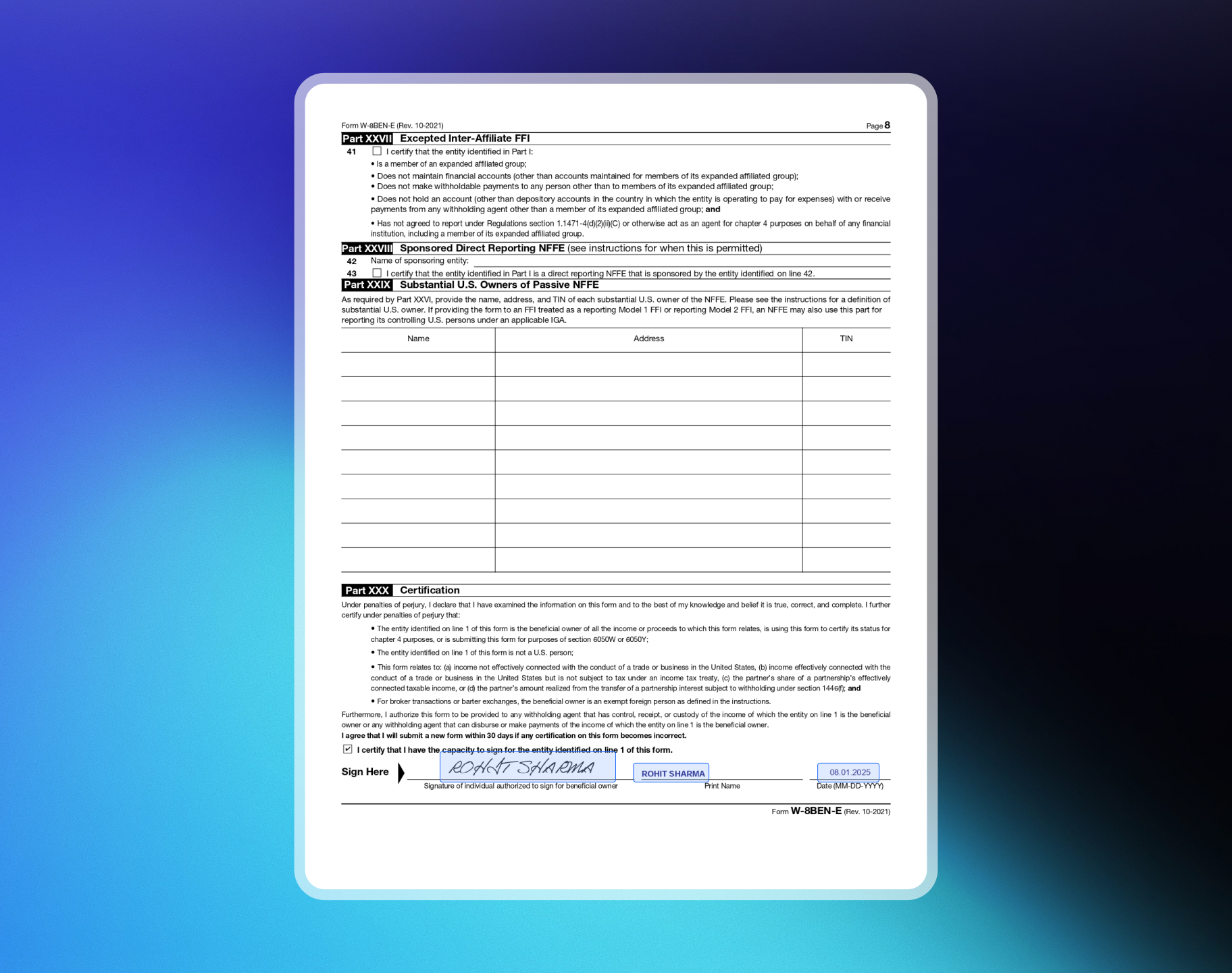

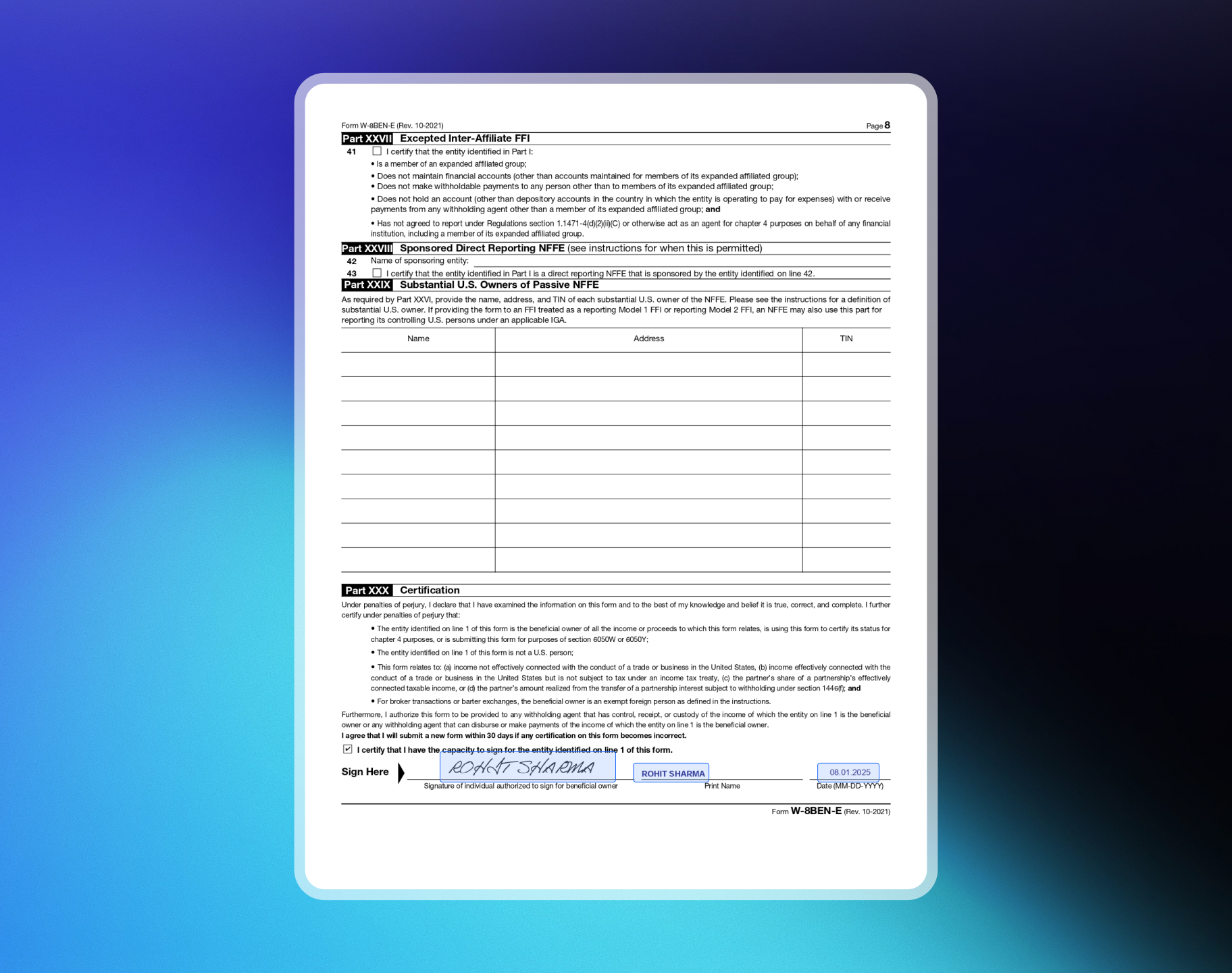

Part XXX – Certification

Part XXX – Certification

The most important part of the document is the certification and signature. Here, in writing, there needs to be a first name, last name, and date (on which the form was signed). The person signing the W-8BEN-E form must be authorized to sign for the beneficial owner.

View Sample W-8 BEN-E Forms

Private Limited Company

Private Limited Company

Sample Profile:

- Company: ABC Technologies PVT LTD

- Type: SaaS / Digital Products

- Country: India (example)

- TIN: PAN or equivalent tax ID in your country

Limited Liability Partnership (LLP)

Limited Liability Partnership (LLP)

Sample Profile:

- Company: ABC Technologies LLP

- Type: SaaS / Digital Products

- Country: India (example)

- TIN: PAN or equivalent tax ID in your country

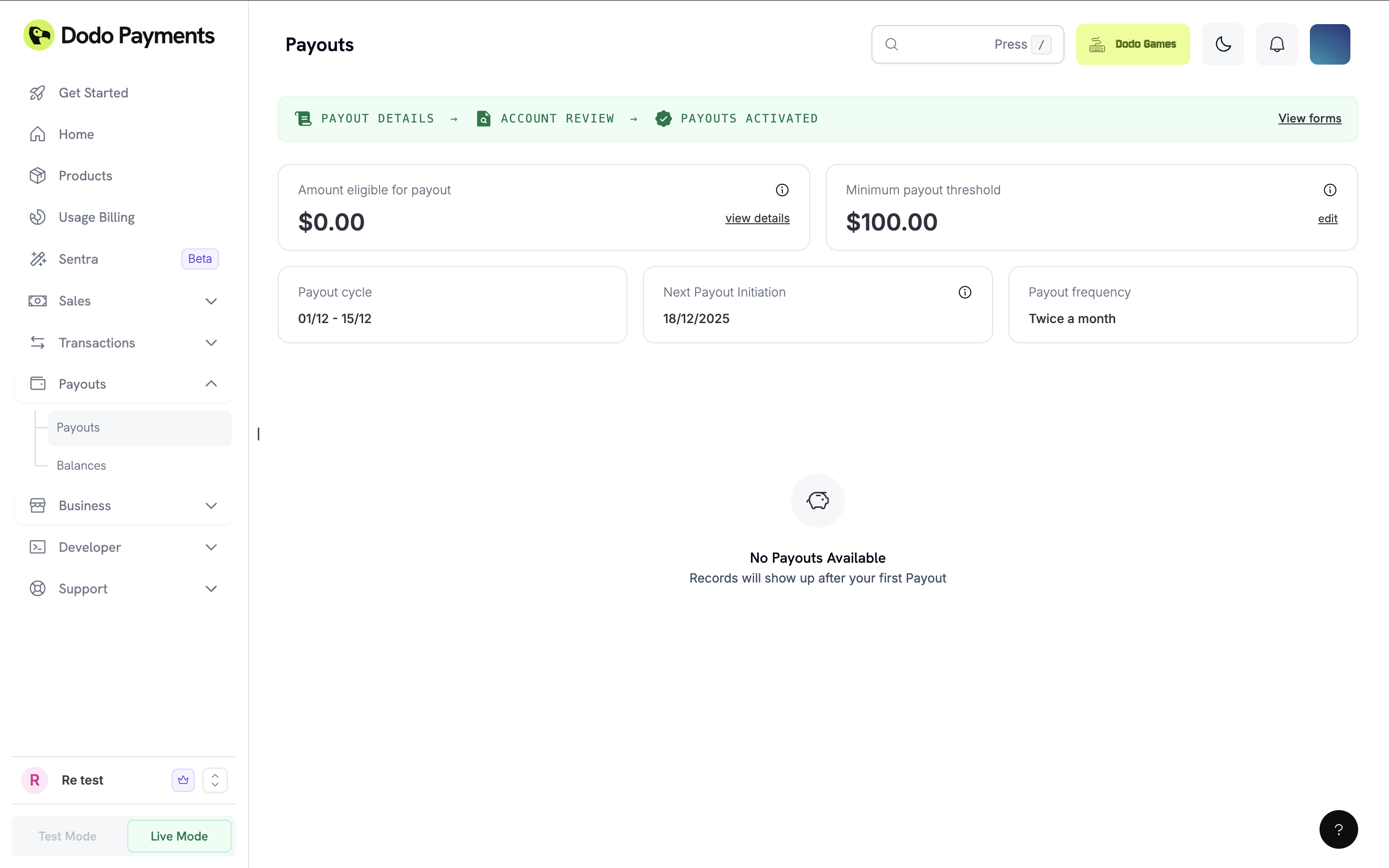

Account Monitoring and Compliance Review

Once your Payout Details are reviewed and approved, our compliance team performs a manual Monitoring Review in accordance with our Review & Monitoring Policy. This is a standard compliance check for all merchants on Dodo PaymentsWhy do we do this?

As a MoR platform, we handle payment processing, invoicing, taxes, and refunds on your behalf. To keep your business - and our entire merchant community protected, we follow monitoring practices that check for:- The type of products/services you’re selling and compliance with our Merchant Acceptance Policy.

- Card-network rules and AML regulations

- Potential fraud indicators or unusual activity patterns

What does this mean for you?

💡 If your business operates in line with our Merchant Acceptance Policy and general platform rules, you have nothing to worry about. This review is designed to ensure everything looks good before we enable payouts. Most merchants pass this step smoothly with no action required. The process is quick, lightweight, and intended to safeguard your payouts and long-term account stability. Once the review is complete and everything looks good, payouts will be enabled for your account- You will be able to view your payout schedule, next payout date, payout threshold and eligible balance directly in the dashboard

Ongoing Monitoring

Dodo Payments also performs ongoing monitoring periodically so we can keep accounts compliant over time. This is routine monitoring and if your business remains compliant, you can continue operating without concern. If we have any concern about your account during this check then necessary action will be taken in accordance with our Review & Monitoring PolicyAdditional Information Requests

As part of our ongoing monitoring, our compliance team may request additional information from time to time. These requests can be completed directly from the dashboard and do not block payments or payouts, but failure to submit them may trigger pauses in payouts/payments processing, further compliance reviews or account restrictions.Timeline & Support

- Typical verification time: 1–3 business days (excludes weekends and public holidays)

- If additional review is needed, you will be notified via email and dashboard.

- For help, reach out to support@dodopayments.com

Resubmission of Documents

If there are issues with the documents submitted during the onboarding process, the Dodo Payments Verification Team may request that you resubmit specific documents. You can resubmit documents using the resubmit option in your dashboard.When Can You Resubmit Documents?

- Missing or Incomplete Information: If essential details such as identification numbers, business name, or other key data are missing.

- Document Mismatch: When the documents submitted do not match the business or personal information provided.

- Unreadable or Expired Documents: If the uploaded documents are unclear, illegible, or have expired.

- Additional Clarification Needed: If the verification team requires further documentation to clarify your identity or business information.

How to Resubmit Documents

Check your dashboard

Check your Dodo Payments Dashboard for a resubmission request (you will also receive an email notification if resubmission is required).

Access the resubmit option

The verification team will enable the Resubmit option, allowing you to upload new documents.

Upload correct documents

Navigate to the Verification Section in the dashboard and upload the correct documents.

Merchant Acceptance Policy

Review our comprehensive acceptance standards, including supported and prohibited products, and ensure your business is eligible for onboarding.

Review Monitoring Policy

Understand how ongoing compliance is monitored, learn about triggers for document review, and stay proactive with your account status.