Introduction

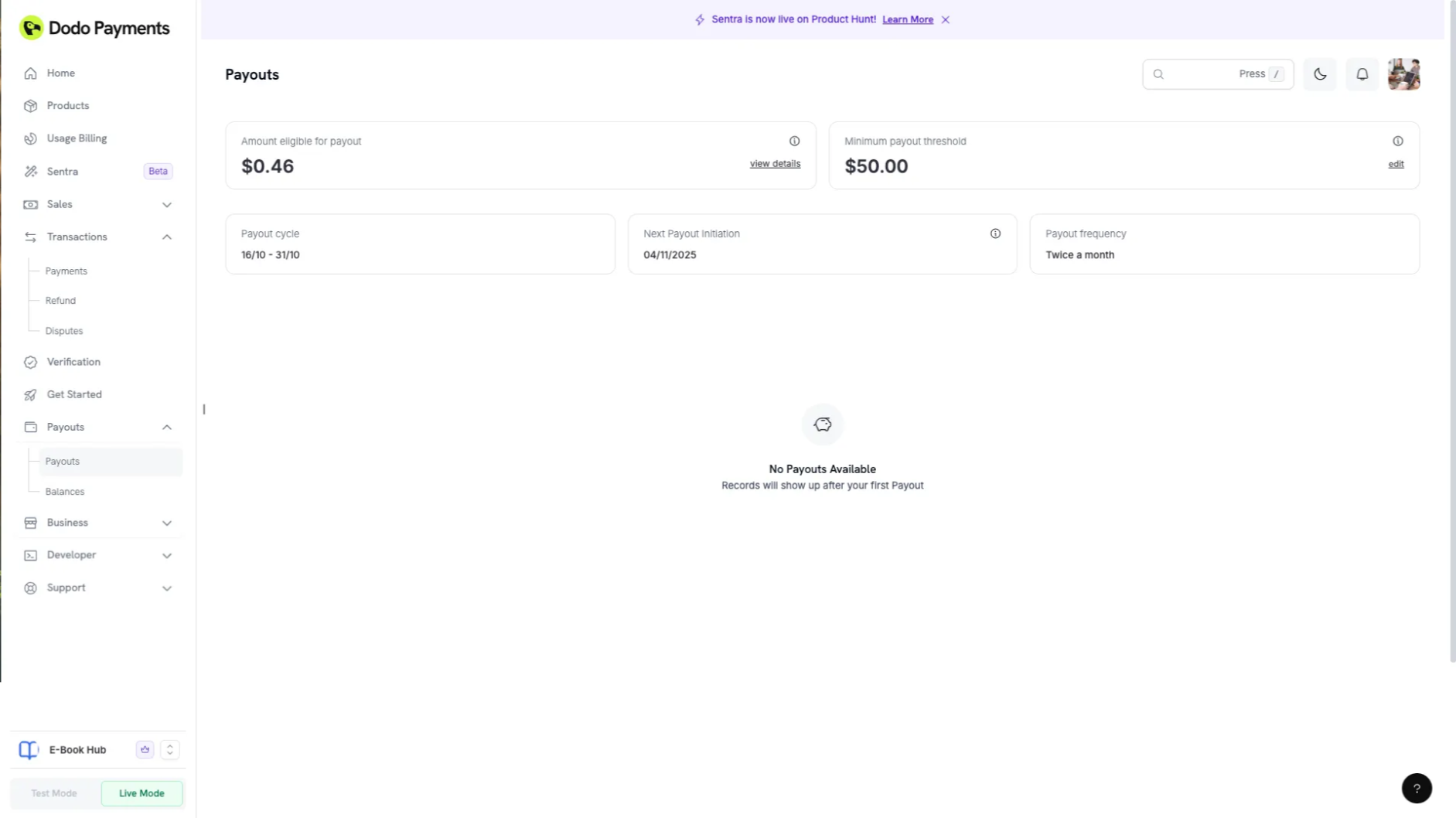

The Payouts Section consolidates all eligible earnings that can be disbursed in the next payout cycle. It provides transparency on the net available balance after accounting for all fees, refunds, and taxes.

Key Features

- Displays the total balance eligible for payout in the upcoming cycle in USD

- Automatically applies FX conversion for non-USD currencies

- Lets businesses set or modify their payout threshold directly from the wallet settings

The displayed amount is for reference only. Final payout amounts may vary based on the actual exchange rate at the time of transfer.

Payout Cycles

We support the following payout cycles:Bi-Monthly (Default)

Billing Period 1: 1st to 15th of the month

Payout Date 1: 18th of the same monthBilling Period 2: 16th to the end of the month

Payout Date 2: 4th of the following month

Payout Date 1: 18th of the same monthBilling Period 2: 16th to the end of the month

Payout Date 2: 4th of the following month

Weekly

Billing Period 1: 1st to 7th

Payout Date 1: 11th of the same monthBilling Period 2: 8th to 14th

Payout Date 2: 18th of the same monthBilling Period 3: 15th to 21st

Payout Date 3: 25th of the same monthBilling Period 4: 22nd to the end of the month

Payout Date 4: 4th of the following month

Payout Date 1: 11th of the same monthBilling Period 2: 8th to 14th

Payout Date 2: 18th of the same monthBilling Period 3: 15th to 21st

Payout Date 3: 25th of the same monthBilling Period 4: 22nd to the end of the month

Payout Date 4: 4th of the following month

- Payouts will only be initiated if all verifications are successful and Payout Threshold is crossed in the billing period.

- The default payout cycle for all businesses is bi-monthly.

- Businesses with higher transaction volumes may request weekly payouts by contacting support@dodopayments.com.

- Certain high-risk businesses may be placed on a monthly payout cycle at our discretion.

Payout Processing and Bank Timelines

- The dates provided above are the initiation dates for payouts.

- It typically takes 1-2 business days for the amount to appear in your bank account.

- Delays may occur if payout processing dates fall on weekends or bank holidays.

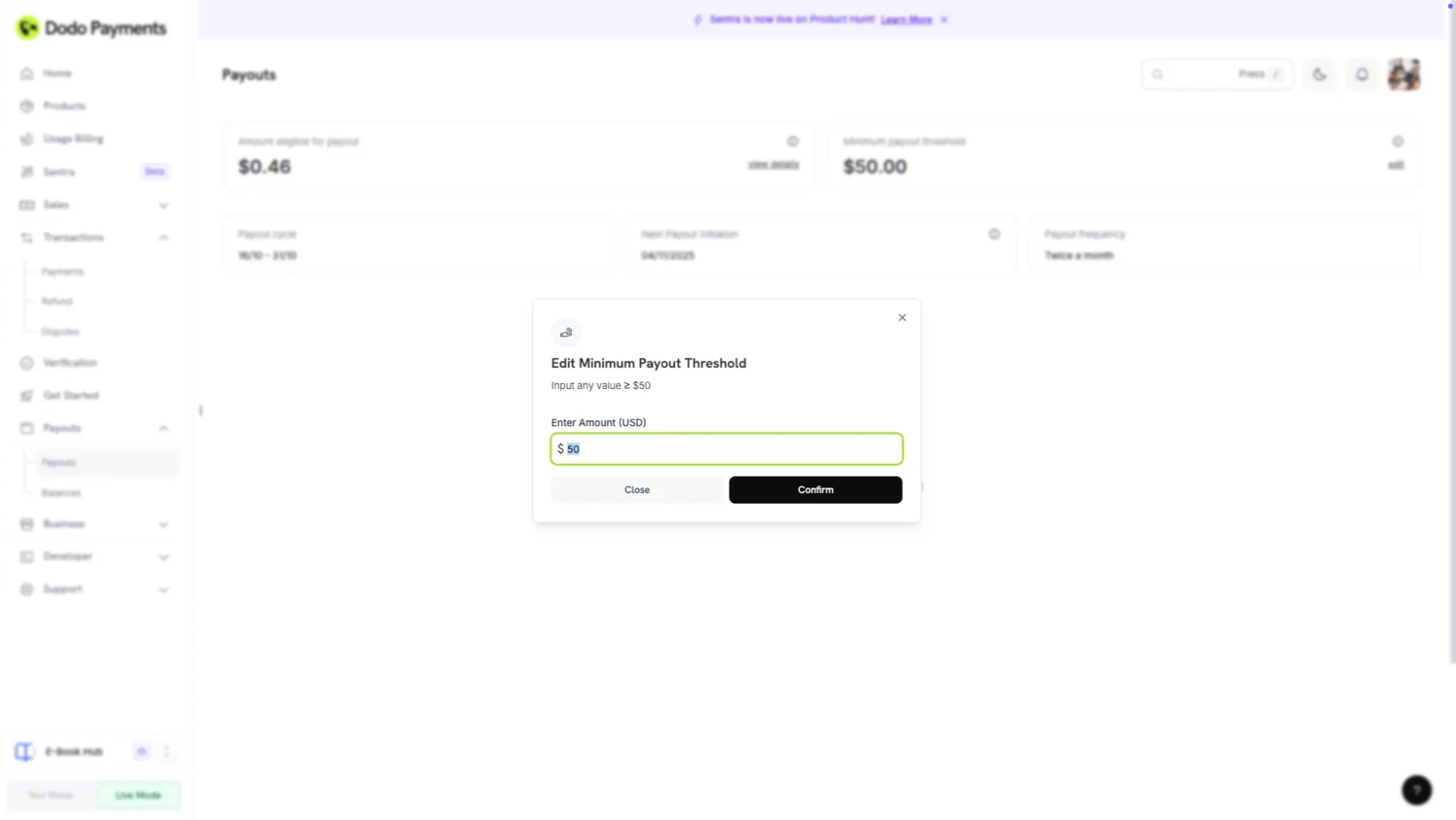

Minimum Payout Threshold

| Currency | Minimum Threshold |

|---|---|

| USD | $50 |

| INR | Rs 1,000 |

If your balance does not meet the threshold, it will carry forward to the next payout cycle.

Flexible Minimum Payout Threshold

You can customize the balance that must build up in your USD wallet before Dodo Payments triggers a payout. Configuration:- Allowed values: $50 or any higher amount

- Effective from: Your current payout cycle

- Note: Payouts already scheduled (if entry is created in the payout table) remain unchanged

How to Edit Your Threshold

This feature is only applicable to the USD/EUR/GBP Wallet as of now. The INR wallet will have no changes.

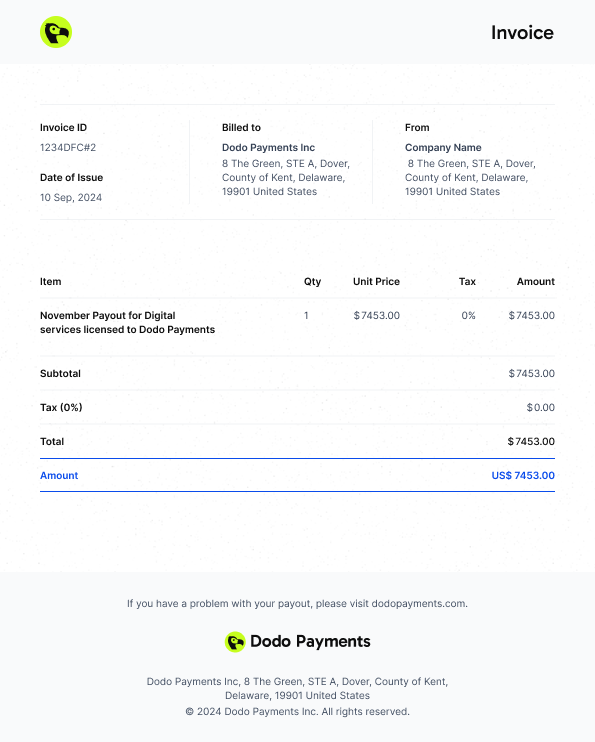

Payout Deductions

The following amounts are deducted from your sales before payout: Taxes: All applicable taxes as per the Tax Calculator will be deducted from the sales amount before payout. Fees: Dodo Payment Fees and Payout Fees will be deducted before sending the payout.Payout Status

Track the progress of your payouts through the following status indicators:| Status | Description |

|---|---|

| Not Initiated | Payout due date has not yet arrived hence it has not been initiated |

| In Progress | Payout due date has arrived and payout is in progress |

| On Hold | Payout is put on hold by the Payout Team (by backend until admin dashboard is available) |

| Successful | Payout to the business account is processed successfully |

| Failed | Payout to the business account has failed |

Payout Invoice

A reverse invoice is generated to indicate the amount paid by Dodo Payments to the business.Invoice Structure

Important Disclaimer for Indian Businesses

- INR Payouts to businesses in India are handled independently and are not part of the consolidated USD/GBP/EUR payout cycle.

- Businesses with Indian bank accounts will receive two separate payouts per cycle:

- One for INR Wallet (domestic payout)

- One for global currencies (USD/GBP/EUR consolidated payout)

- Each payout will generate a separate invoice and entry in the balance ledger.

Balances & Wallets

Get a comprehensive overview of all your USD, GBP, EUR, and INR wallet balances, transaction ledgers, and payout-related financial activity.