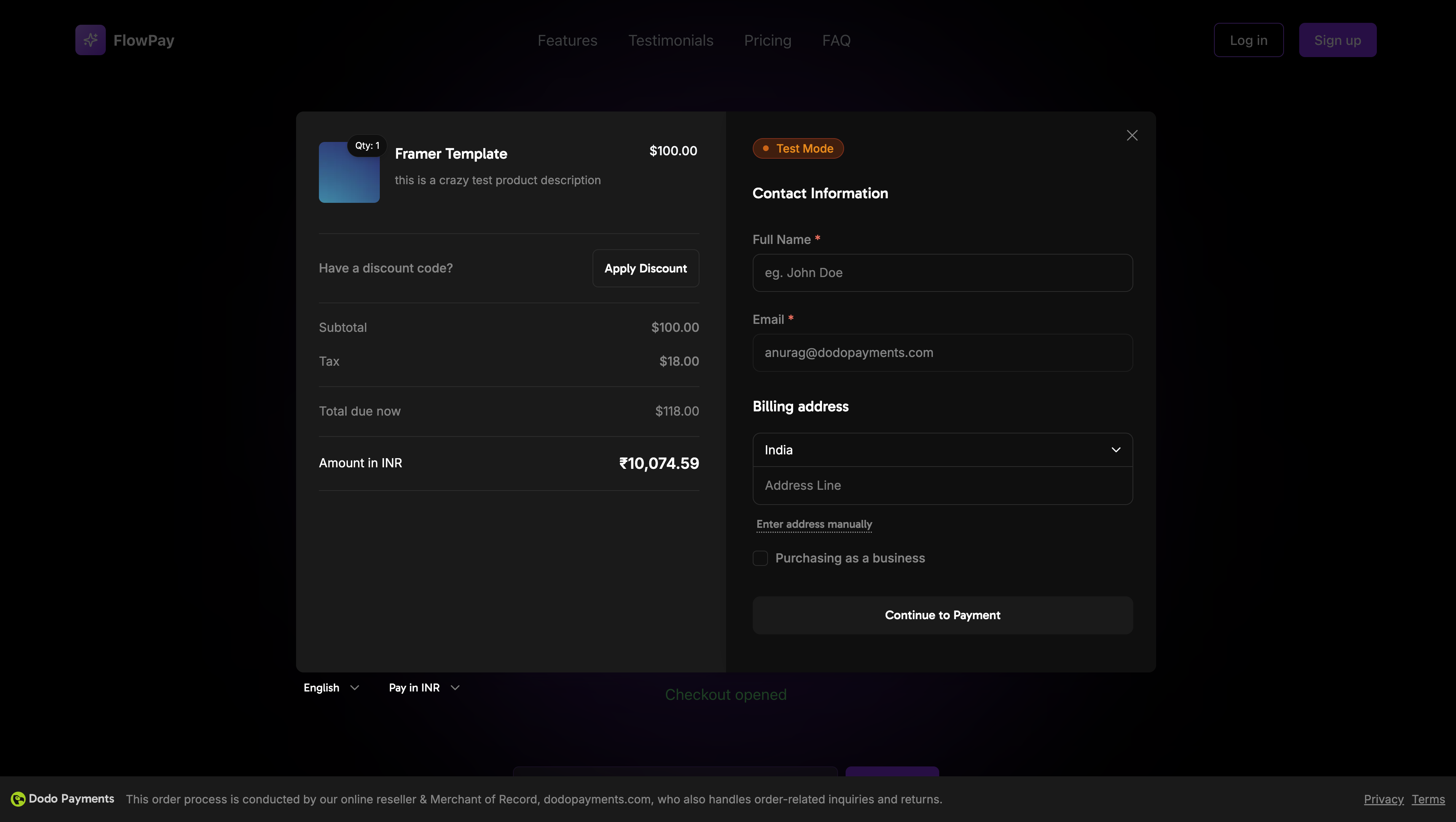

* Live Demo: [https://atlas.dodopayments.com](https://atlas.dodopayments.com#overlay-checkout)

* Github code for demo: [https://github.com/dodopayments/dodo-checkout-demo](https://github.com/dodopayments/dodo-checkout-demo/blob/main/src/components/Home/OverlayCheckout.tsx)

## Installation

```bash

# Using npm

npm install dodopayments-checkout

# Using yarn

yarn add dodopayments-checkout

# Using pnpm

pnpm add dodopayments-checkout

```

## Quick Start

```typescript

import { DodoPayments } from "dodopayments-checkout";

// Initialize the SDK

DodoPayments.Initialize({

mode: "test", // 'test' or 'live'

onEvent: (event) => {

console.log("Checkout event:", event);

},

theme: "light", // 'light' or 'dark'

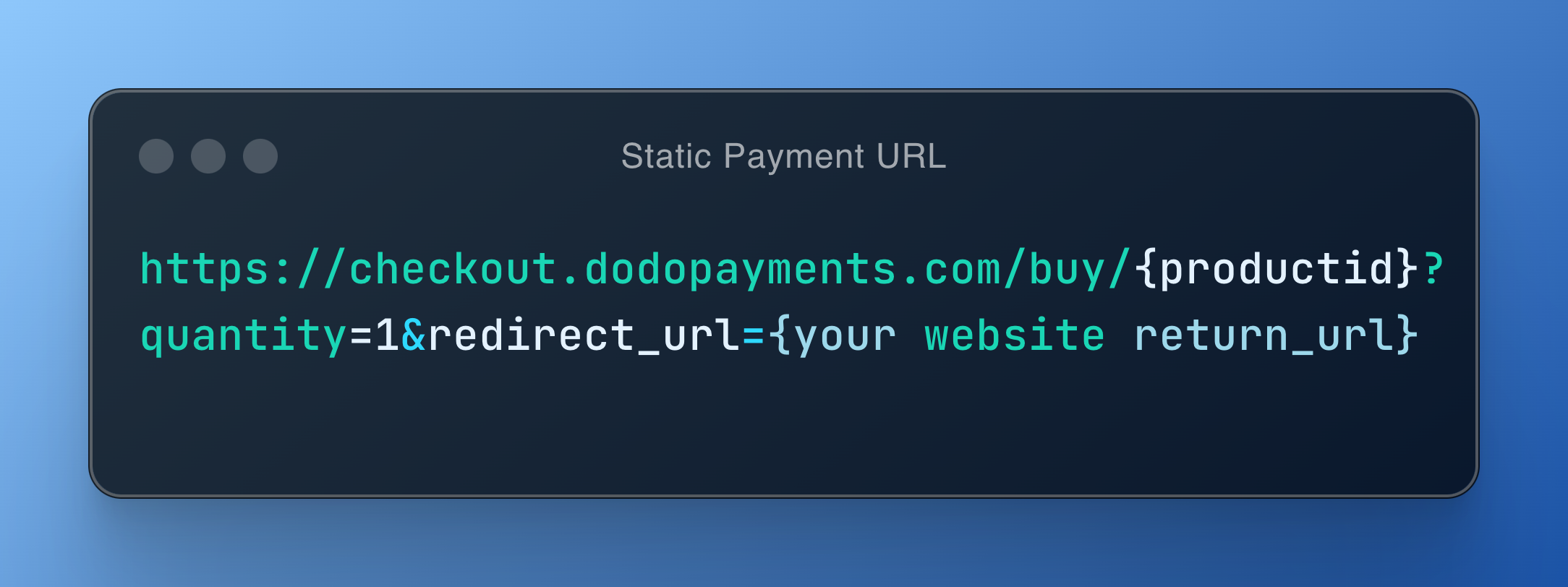

linkType: "static", // 'static' or 'dynamic'

displayType: "overlay"

});

// Open checkout

DodoPayments.Checkout.open({

products: [

{

productId: "pdt_your_product_id",

quantity: 1,

},

],

redirectUrl: "https://your-website.com/success",

});

```

## Configuration

### Initialize Options

```typescript

interface InitializeOptions {

mode: "test" | "live";

onEvent: (event: CheckoutEvent) => void;

theme?: "light" | "dark";

linkType?: "static" | "dynamic";

displayType: "overlay";

}

```

| Option | Type | Required | Description |

| ------------- | -------- | -------- | ---------------------------------------------- |

| `mode` | string | Yes | Environment mode: 'test' or 'live' |

| `onEvent` | function | Yes | Callback function for handling checkout events |

| `theme` | string | No | UI theme: 'light' or 'dark' |

| `linkType` | string | No | Payment link type: 'static' or 'dynamic' |

| `displayType` | string | Yes | Display type, must be 'overlay' |

### Checkout Options

```typescript

interface CheckoutOptions {

products?: {

productId: string;

quantity: number;

}[];

paymentLink?: string;

redirectUrl?: string;

queryParams?: Record

* Live Demo: [https://atlas.dodopayments.com](https://atlas.dodopayments.com#overlay-checkout)

* Github code for demo: [https://github.com/dodopayments/dodo-checkout-demo](https://github.com/dodopayments/dodo-checkout-demo/blob/main/src/components/Home/OverlayCheckout.tsx)

## Installation

```bash

# Using npm

npm install dodopayments-checkout

# Using yarn

yarn add dodopayments-checkout

# Using pnpm

pnpm add dodopayments-checkout

```

## Quick Start

```typescript

import { DodoPayments } from "dodopayments-checkout";

// Initialize the SDK

DodoPayments.Initialize({

mode: "test", // 'test' or 'live'

onEvent: (event) => {

console.log("Checkout event:", event);

},

theme: "light", // 'light' or 'dark'

linkType: "static", // 'static' or 'dynamic'

displayType: "overlay"

});

// Open checkout

DodoPayments.Checkout.open({

products: [

{

productId: "pdt_your_product_id",

quantity: 1,

},

],

redirectUrl: "https://your-website.com/success",

});

```

## Configuration

### Initialize Options

```typescript

interface InitializeOptions {

mode: "test" | "live";

onEvent: (event: CheckoutEvent) => void;

theme?: "light" | "dark";

linkType?: "static" | "dynamic";

displayType: "overlay";

}

```

| Option | Type | Required | Description |

| ------------- | -------- | -------- | ---------------------------------------------- |

| `mode` | string | Yes | Environment mode: 'test' or 'live' |

| `onEvent` | function | Yes | Callback function for handling checkout events |

| `theme` | string | No | UI theme: 'light' or 'dark' |

| `linkType` | string | No | Payment link type: 'static' or 'dynamic' |

| `displayType` | string | Yes | Display type, must be 'overlay' |

### Checkout Options

```typescript

interface CheckoutOptions {

products?: {

productId: string;

quantity: number;

}[];

paymentLink?: string;

redirectUrl?: string;

queryParams?: RecordPayment Successful!

Thank you for your purchase.

Payment Failed

Please try again or contact support.

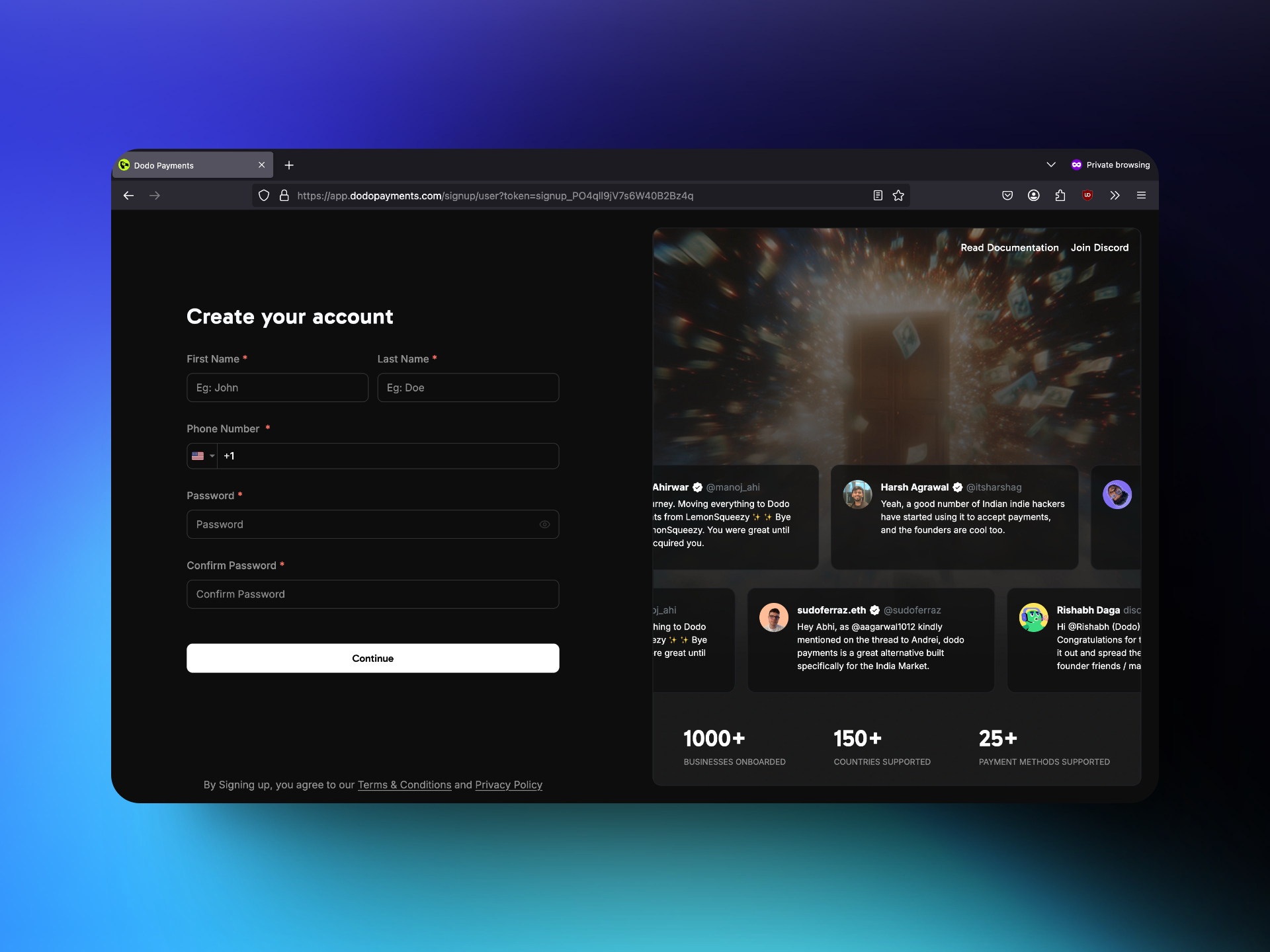

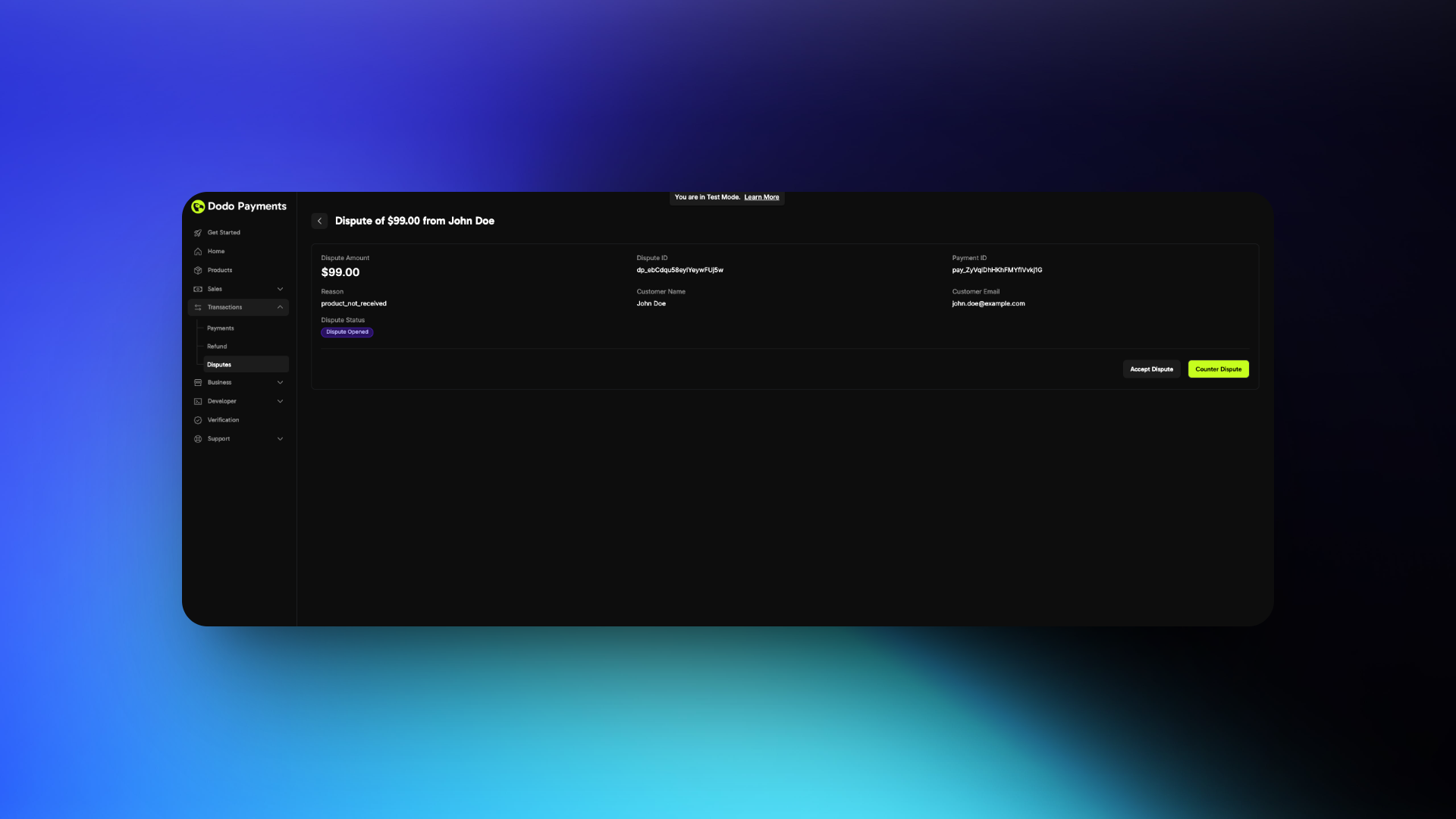

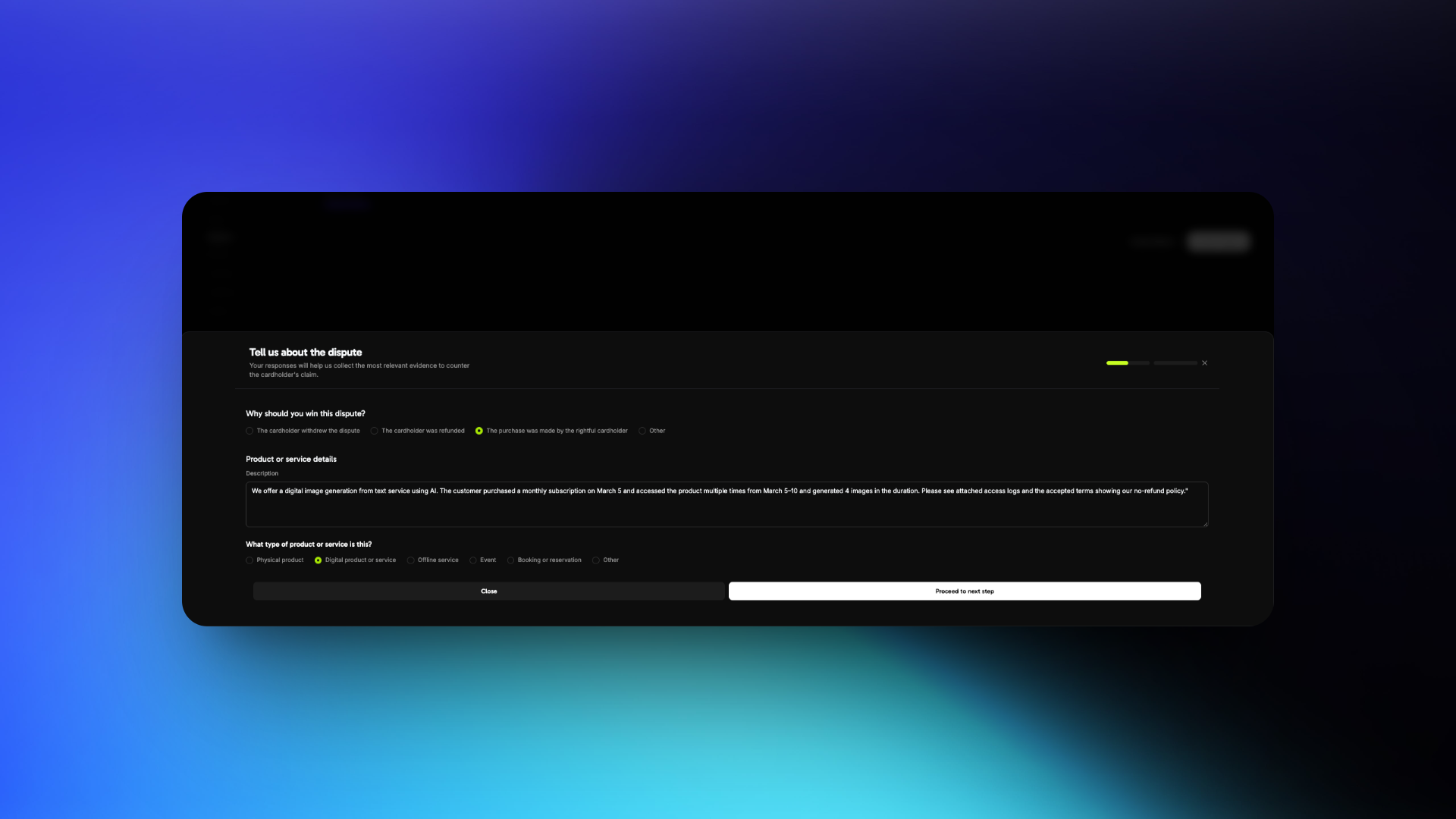

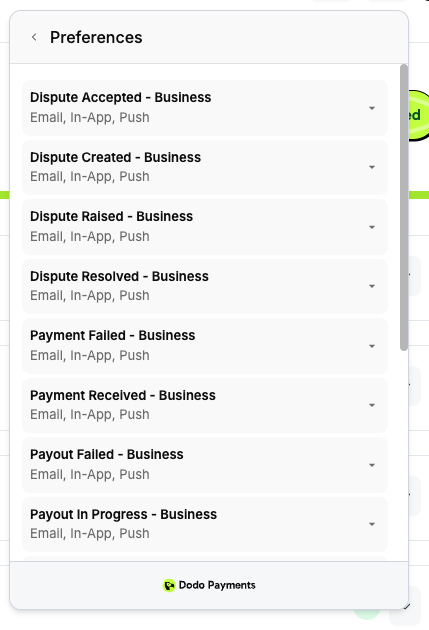

# Introduction

This guide will walk you through setting up and securely handling webhooks.

Our implementation follows the [Standard Webhooks](https://standardwebhooks.com/) specification.

## Getting Started

# Introduction

This guide will walk you through setting up and securely handling webhooks.

Our implementation follows the [Standard Webhooks](https://standardwebhooks.com/) specification.

## Getting Started

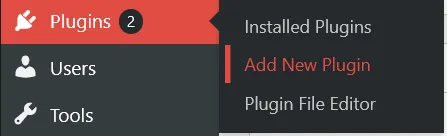

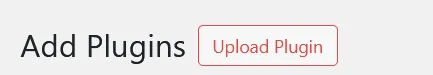

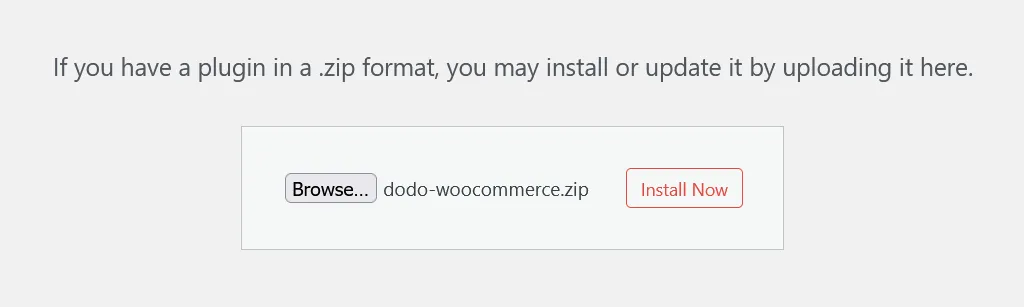

4. Click on the **Upload Plugin** button and a file selection dialog will appear

4. Click on the **Upload Plugin** button and a file selection dialog will appear

5. Click **Browse…** and select the zip file you downloaded

6. Click the **Install Now** button to begin the installation process

5. Click **Browse…** and select the zip file you downloaded

6. Click the **Install Now** button to begin the installation process

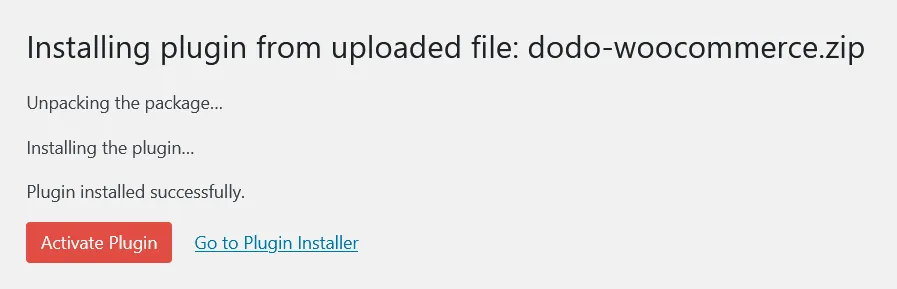

7. After installation completes, click **Activate Plugin** or activate it from the **Installed Plugins** section

7. After installation completes, click **Activate Plugin** or activate it from the **Installed Plugins** section

8. The plugin is now installed, but configuration is still required. Continue to the setup guide below.

## Configuration Guide

### Setting Up API Keys and Webhooks

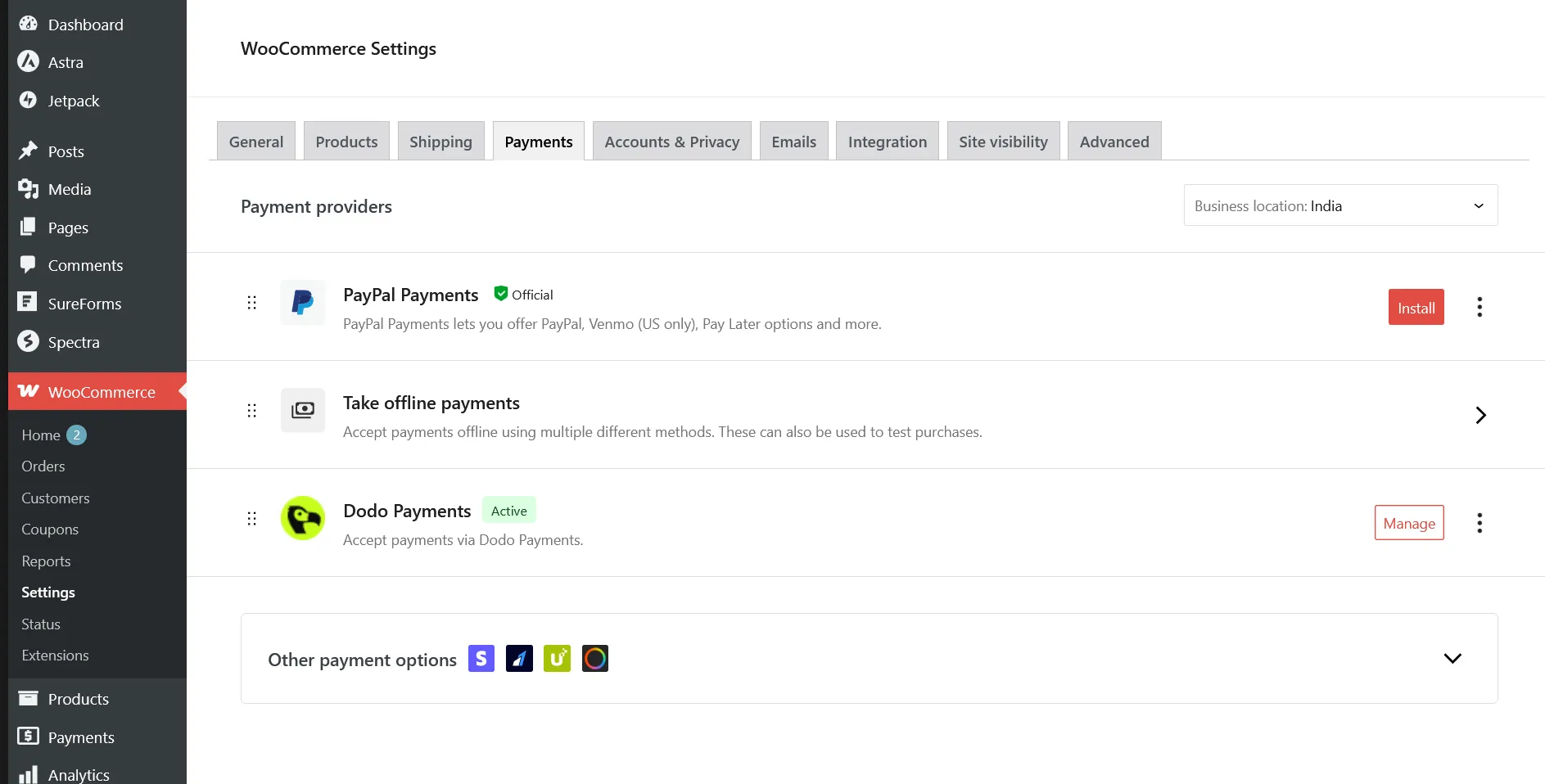

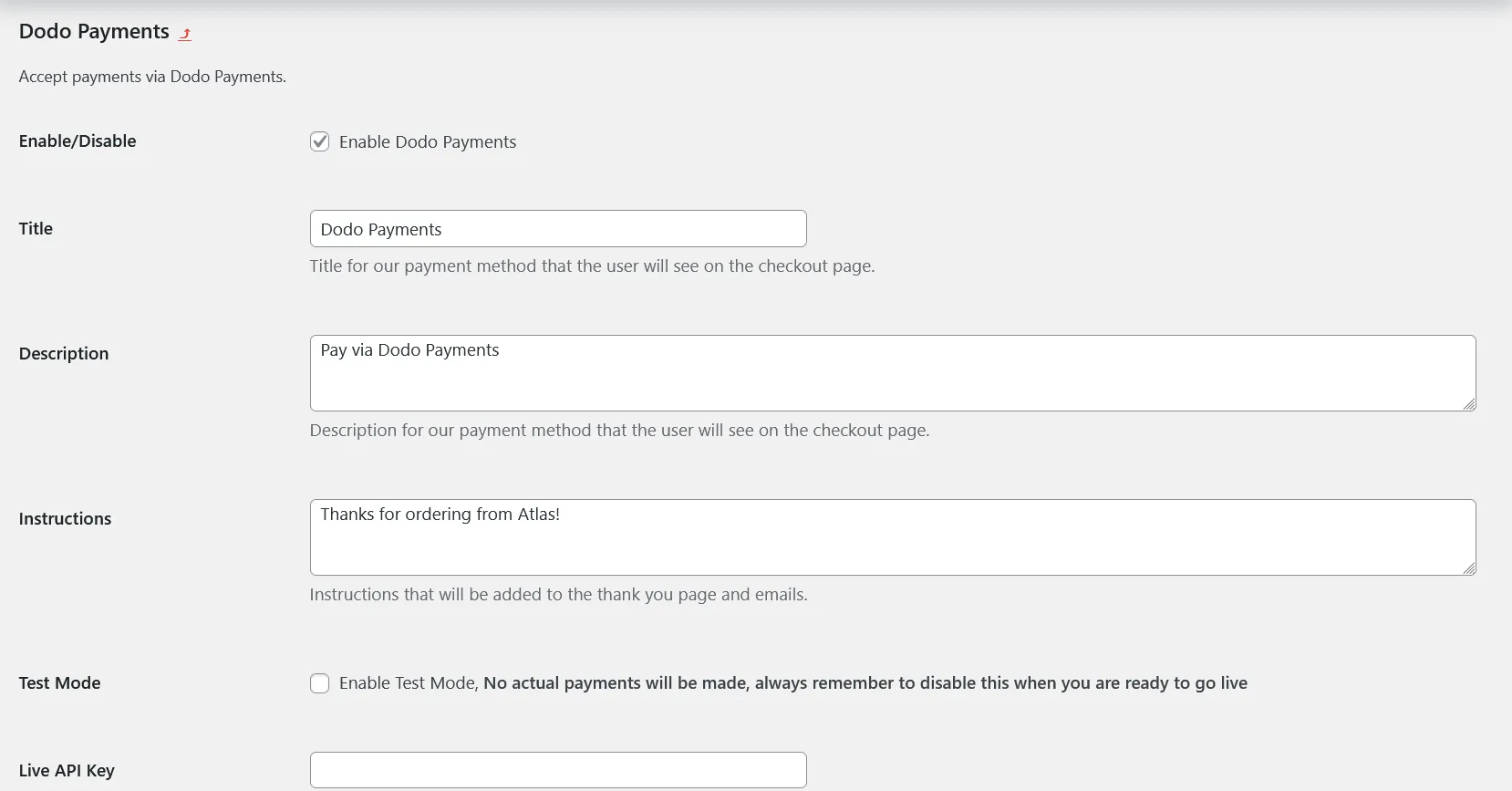

1. Navigate to **WooCommerce → Settings → Payments** or click the **Payments** button in the left sidebar below the WooCommerce menu item

8. The plugin is now installed, but configuration is still required. Continue to the setup guide below.

## Configuration Guide

### Setting Up API Keys and Webhooks

1. Navigate to **WooCommerce → Settings → Payments** or click the **Payments** button in the left sidebar below the WooCommerce menu item

2. Enable the **Dodo Payments** payment provider if not already enabled, then click **Manage** to configure the plugin

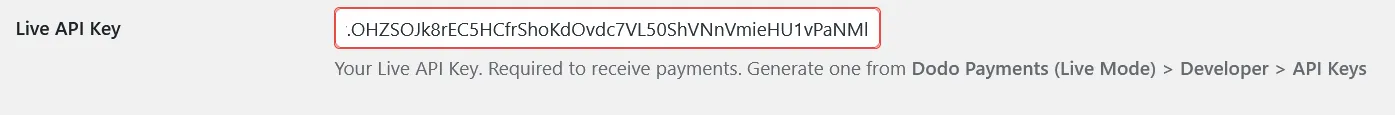

3. You'll see various configuration options, each with helpful explanatory text. Begin by setting up your Live API Key

2. Enable the **Dodo Payments** payment provider if not already enabled, then click **Manage** to configure the plugin

3. You'll see various configuration options, each with helpful explanatory text. Begin by setting up your Live API Key

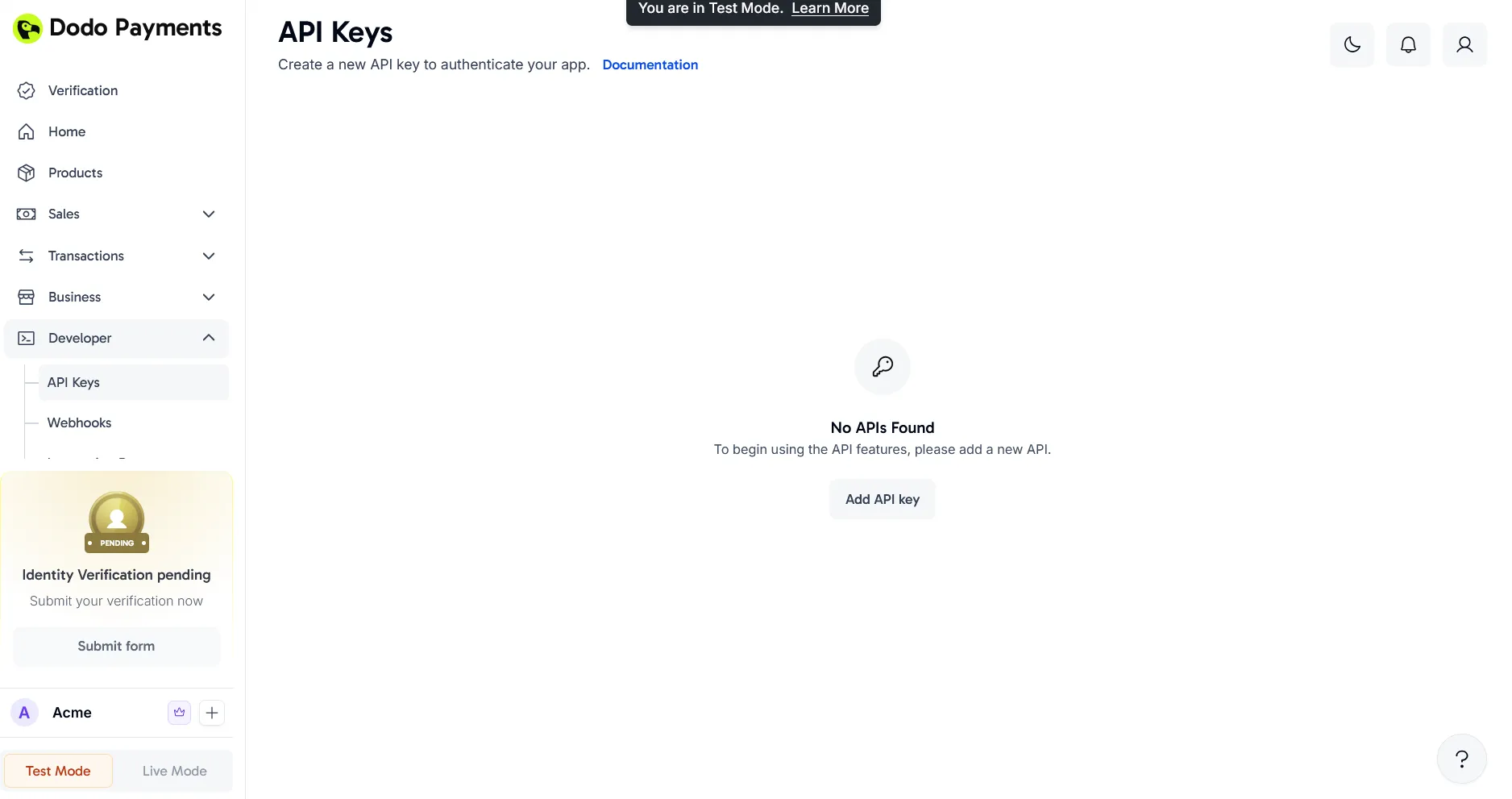

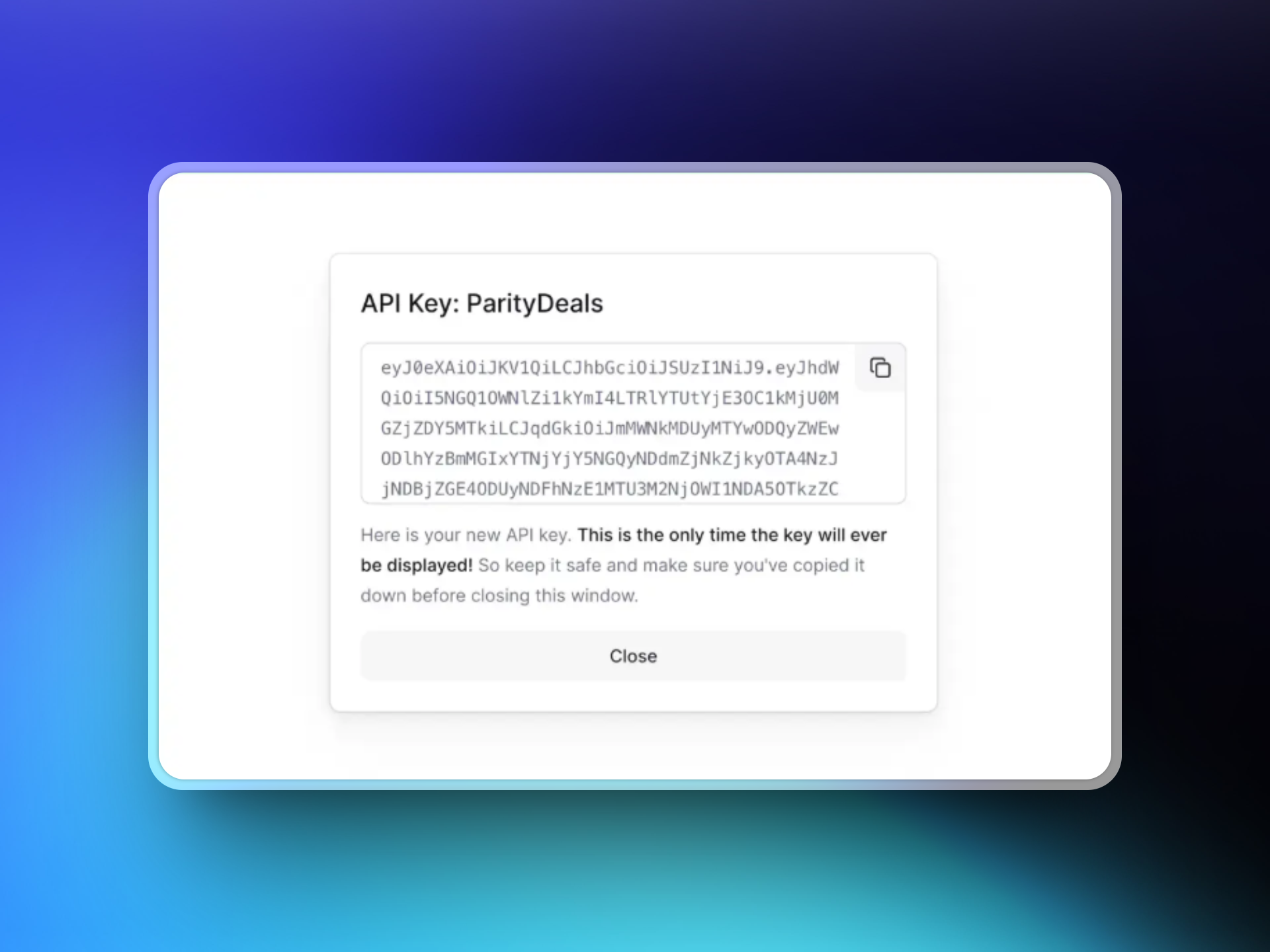

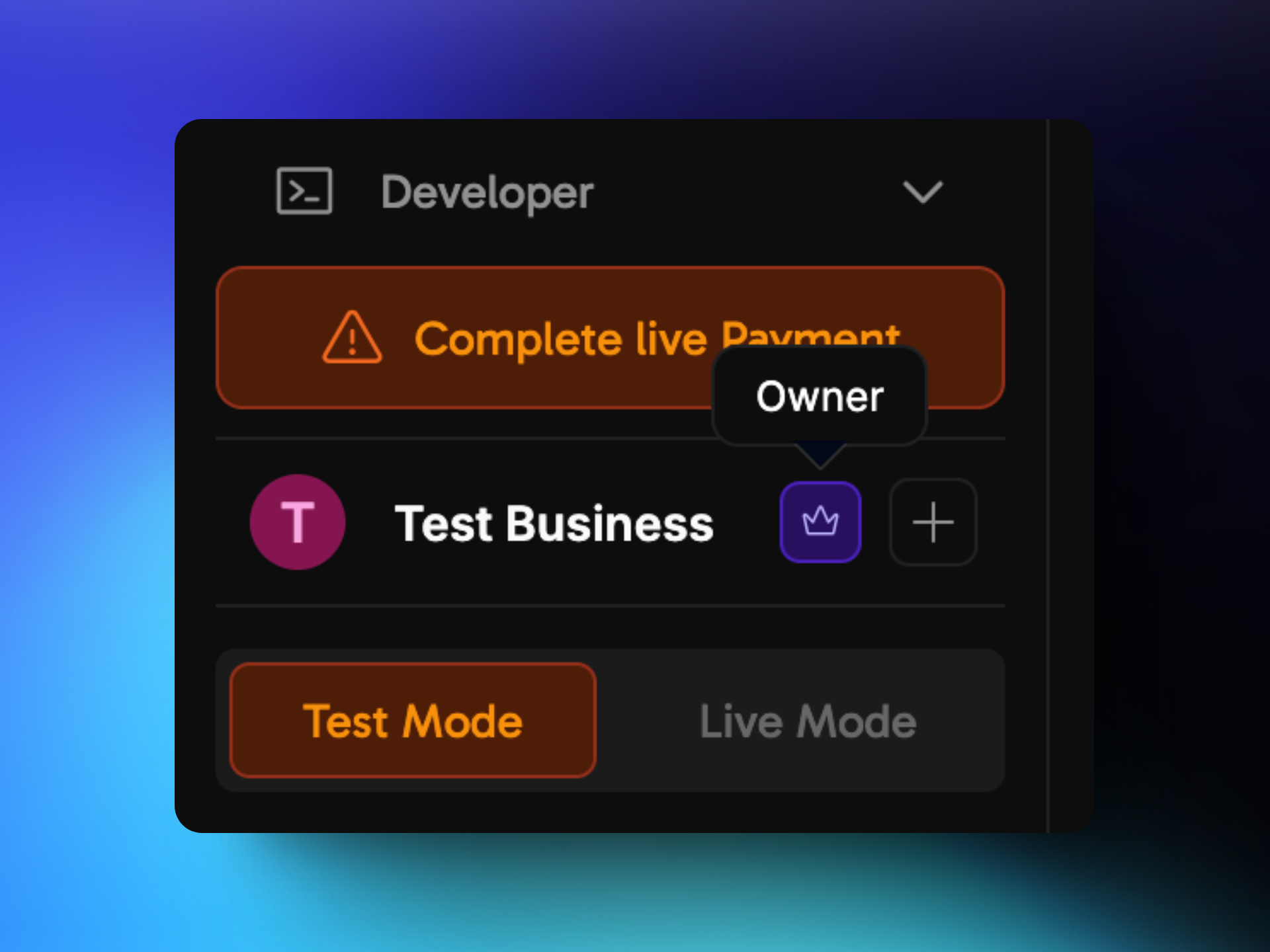

4. Log in to your Dodo Payments dashboard in **Live Mode**, then navigate to **Dodo Payments (Live Mode) > Developer > API Keys** or visit [this direct link](https://app.dodopayments.com/developer/api-keys) and click **Add API Key**

4. Log in to your Dodo Payments dashboard in **Live Mode**, then navigate to **Dodo Payments (Live Mode) > Developer > API Keys** or visit [this direct link](https://app.dodopayments.com/developer/api-keys) and click **Add API Key**

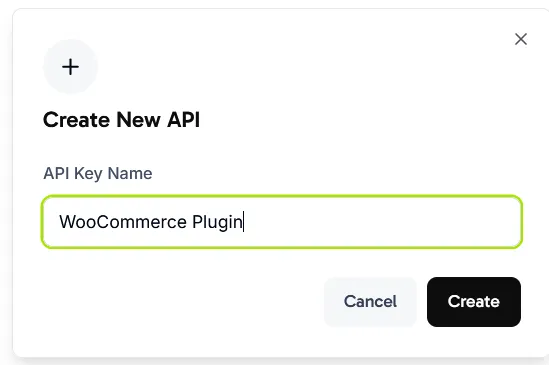

5. Give your API Key a descriptive name and click **Create**

5. Give your API Key a descriptive name and click **Create**

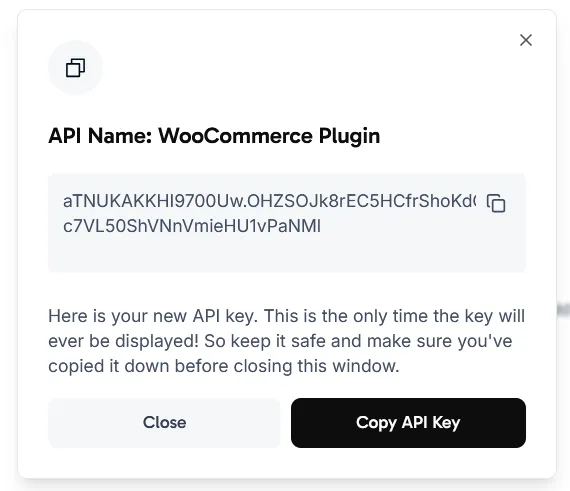

6. Copy the generated API Key and paste it into the **Live API Key** field in your WooCommerce plugin settings

6. Copy the generated API Key and paste it into the **Live API Key** field in your WooCommerce plugin settings

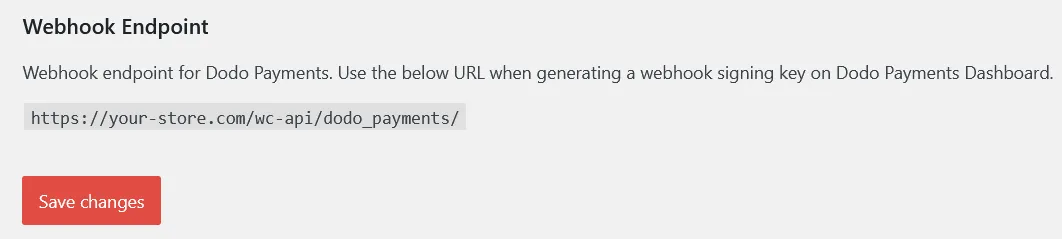

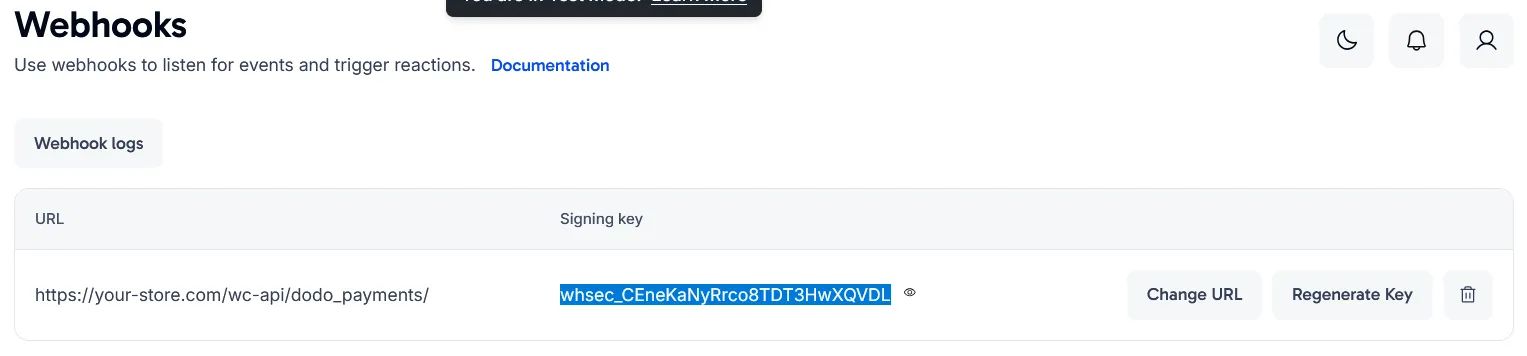

7. Next, set up the Webhook Signing Key to enable payment status synchronization between Dodo Payments and WooCommerce

8. Scroll to the bottom of the plugin settings page and copy the webhook URL displayed there

7. Next, set up the Webhook Signing Key to enable payment status synchronization between Dodo Payments and WooCommerce

8. Scroll to the bottom of the plugin settings page and copy the webhook URL displayed there

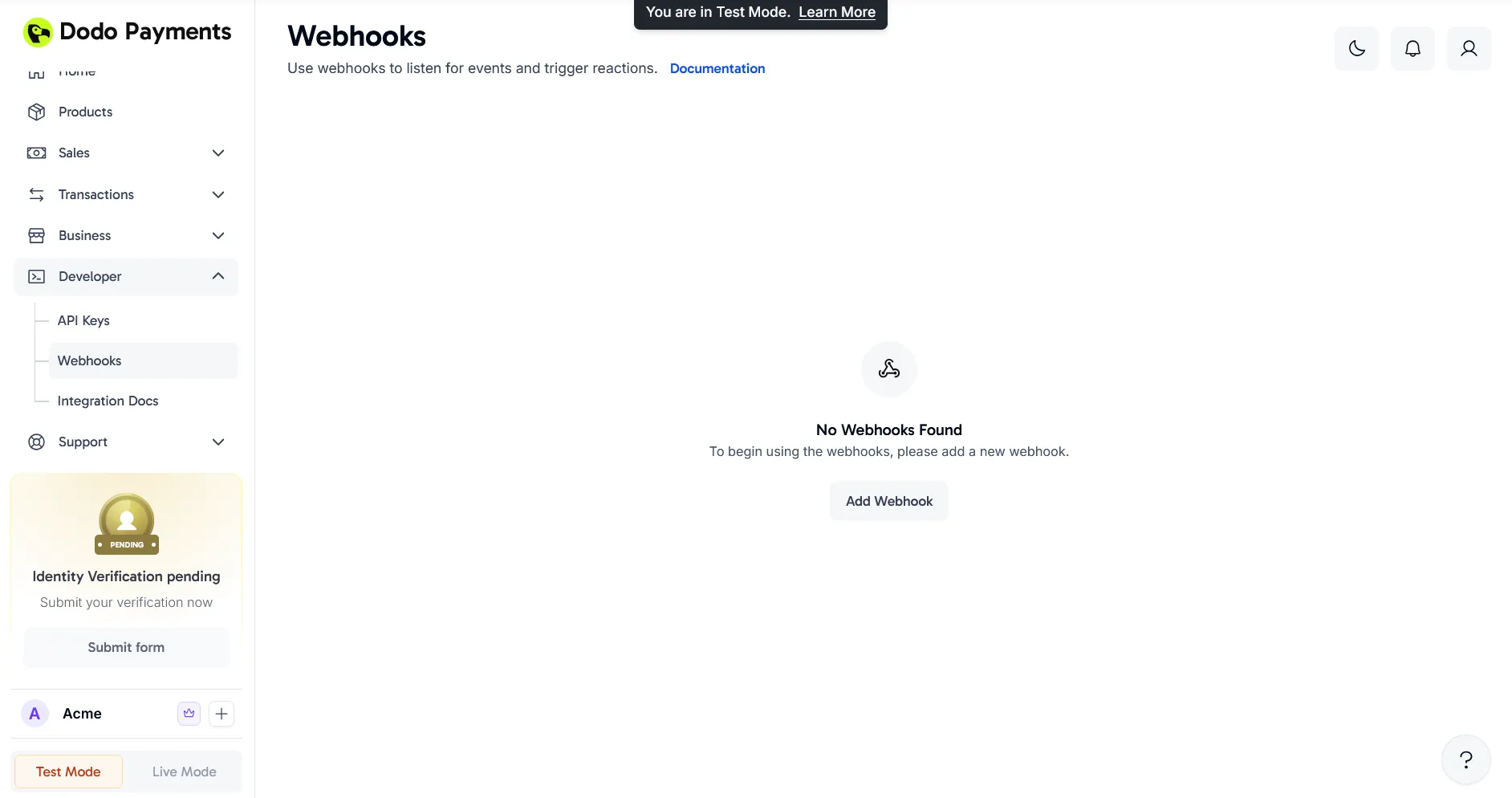

9. Return to your Dodo Payments dashboard and navigate to **Dodo Payments (Live Mode) > Developer > Webhooks** and click **Add Webhook**

9. Return to your Dodo Payments dashboard and navigate to **Dodo Payments (Live Mode) > Developer > Webhooks** and click **Add Webhook**

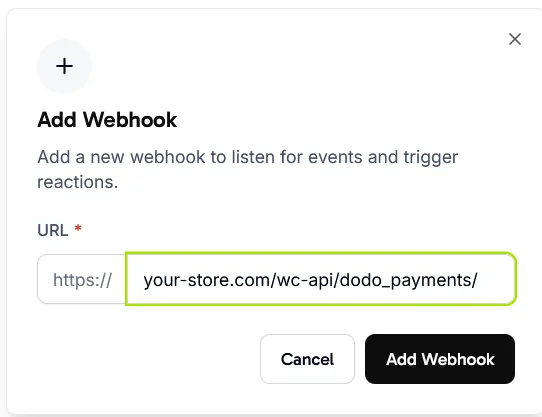

10. Paste the URL you copied in step 8 into the dialog and click **Add Webhook**

10. Paste the URL you copied in step 8 into the dialog and click **Add Webhook**

11. After creating the webhook, click the eye icon next to the redacted **Signing Key** to reveal and copy it

11. After creating the webhook, click the eye icon next to the redacted **Signing Key** to reveal and copy it

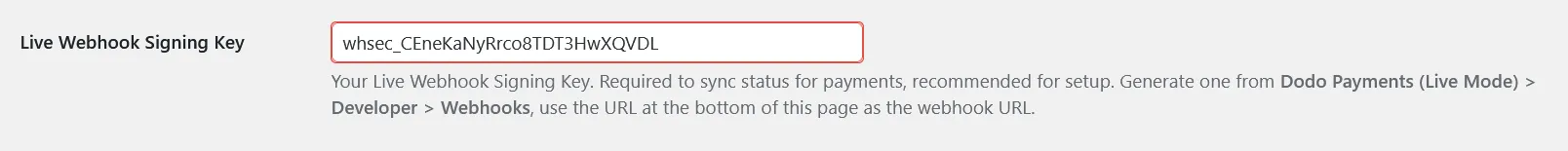

12. Paste the Signing Key into the **Live Webhook Signing Key** field in your plugin settings and save the changes

12. Paste the Signing Key into the **Live Webhook Signing Key** field in your plugin settings and save the changes

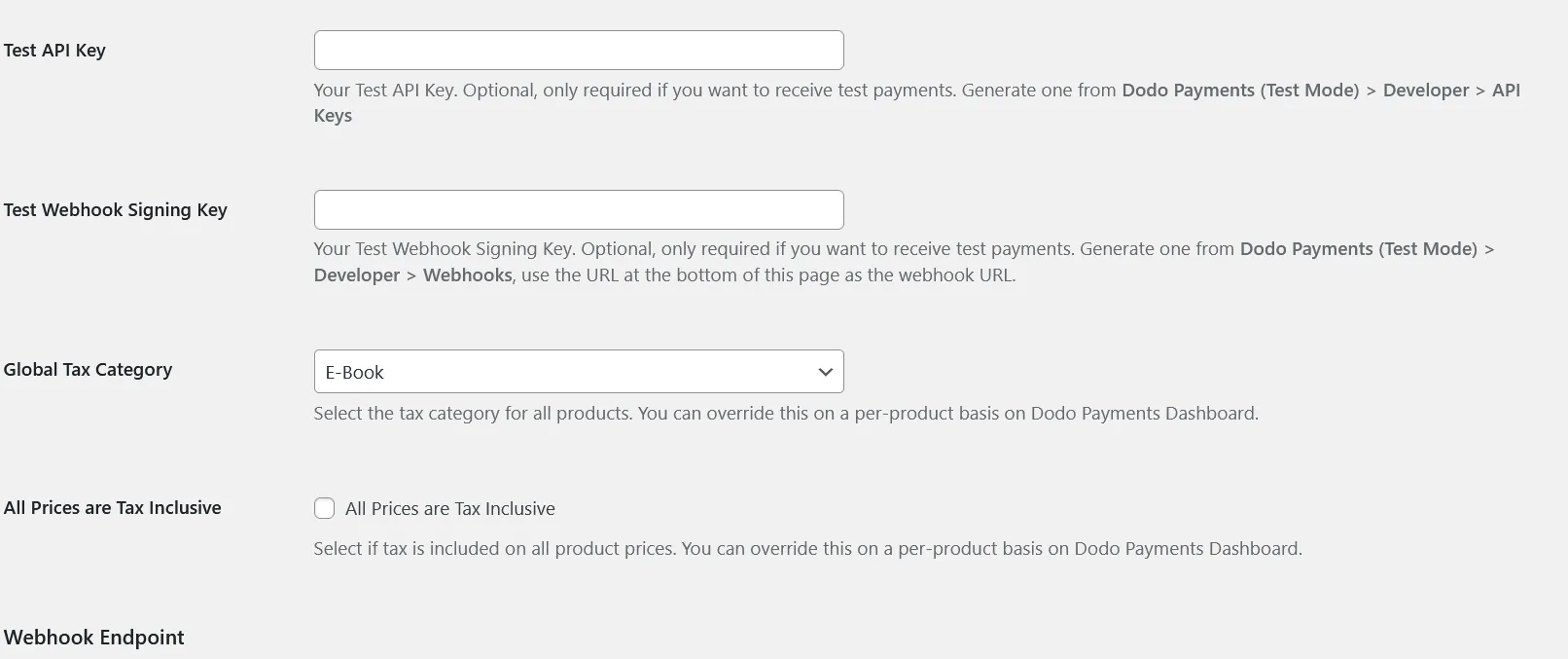

13. Review the remaining settings such as **Global Tax Category** and **All Prices are Tax Inclusive**, as these options determine how products sync from WooCommerce to Dodo Payments. Note that **Test API Key** and **Test Webhook Signing Key** are only needed if you plan to use Test Mode

13. Review the remaining settings such as **Global Tax Category** and **All Prices are Tax Inclusive**, as these options determine how products sync from WooCommerce to Dodo Payments. Note that **Test API Key** and **Test Webhook Signing Key** are only needed if you plan to use Test Mode

## You're All Set!

Your WooCommerce store is now integrated with Dodo Payments! Customers can select Dodo Payments at checkout to access all supported payment methods.

## You're All Set!

Your WooCommerce store is now integrated with Dodo Payments! Customers can select Dodo Payments at checkout to access all supported payment methods.

When customers choose Dodo Payments, they'll be seamlessly redirected to the Dodo Payments checkout page to complete their transaction.

When customers choose Dodo Payments, they'll be seamlessly redirected to the Dodo Payments checkout page to complete their transaction.

## Key Features

* **Seamless Checkout Experience**: Redirect customers to a secure, optimized checkout page

* **Multiple Payment Methods**: Support for various local and international payment options

* **Real-time Status Updates**: Instant order status synchronization via webhooks

* **Detailed Transaction Records**: Comprehensive payment history in your WooCommerce dashboard

* **Multi-currency Support**: Accept payments in multiple currencies

## Troubleshooting

### Common Issues

1. **Payment Processing Failures**

* Verify API keys are correctly configured

* Ensure webhook URL is properly set up

* Check that your SSL certificate is valid

2. **Webhook Synchronization Problems**

* Confirm webhook signing key matches

* Review server logs for potential errors

* Verify your server can receive incoming webhook requests

### Support Resources

For additional assistance:

* Contact us at [support@dodopayments.com](mailto:support@dodopayments.com)

* Refer to our [comprehensive documentation](https://docs.dodopayments.com)

## Maintenance Best Practices

1. Regularly update the plugin for security patches and new features

2. Test all payment flows in sandbox mode before processing live transactions

3. Keep WordPress and WooCommerce updated to the latest versions

4. Implement regular site backups

5. Monitor transaction logs for any unusual activity

6. Store API keys securely and never share them publicly

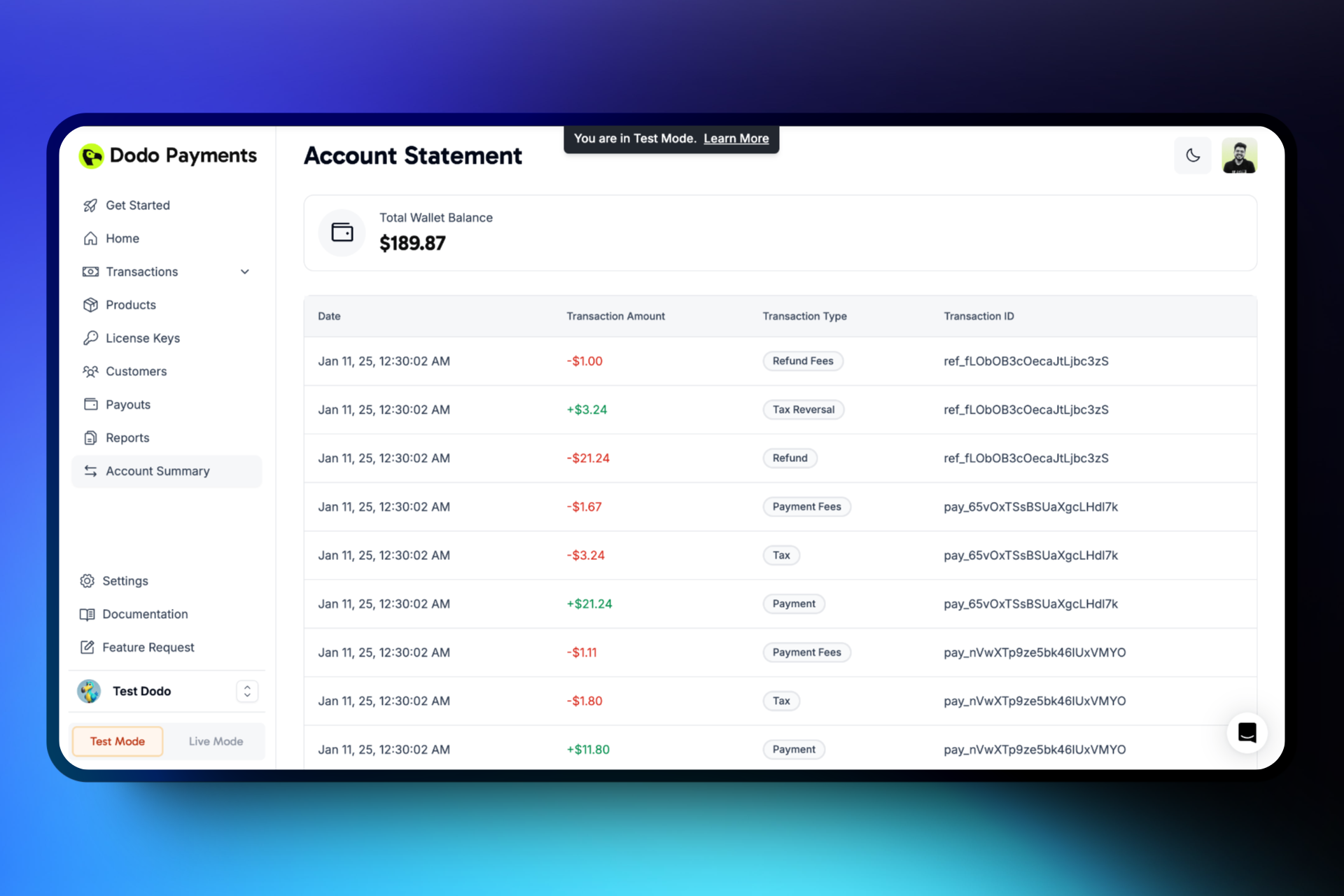

# Account Summary & Payout Wallet

Source: https://docs.dodopayments.com/features/account-summary-payout-wallet

Learn about the Account Summary and Payout Wallet features in Dodo Payments. This guide provides a comprehensive overview of transaction types, and amounts, as well as insights into managing your payout wallet for seamless financial operations.

## Introduction

The **Account Summary** offers a detailed breakdown of all financial transactions, including payments, refunds, payouts, transaction fees, and taxes. This ensures full visibility into the merchant’s earnings and deductions.

## Key Details

1. **Transaction Types**

* **Payment (+)**: Successful payments (Credit).

* **Refund (-)**: Returned amounts (Debit).

* **Transaction Fees (-)**: Processing fees for payments (Debit).

* **Refund Fees (-)**: Transaction fees for refunds (Debit).

* **Sales Tax (-)**: Tax charged on payments (Debit).

* **Sales Tax Refund (+)**: Refunded sales tax on refunds (Credit).

* **Payout (-)**: Amount paid out to the merchant (Debit).

* **Payout Fees (-)**: Transaction fees associated with the payout (Debit).

2. **Transaction Amount**

* Total amount associated with the transaction.

3. **Transaction Timestamp**

* Timestamp of each transaction.

4. **Transaction ID**

* Unique identifier for easy tracking.

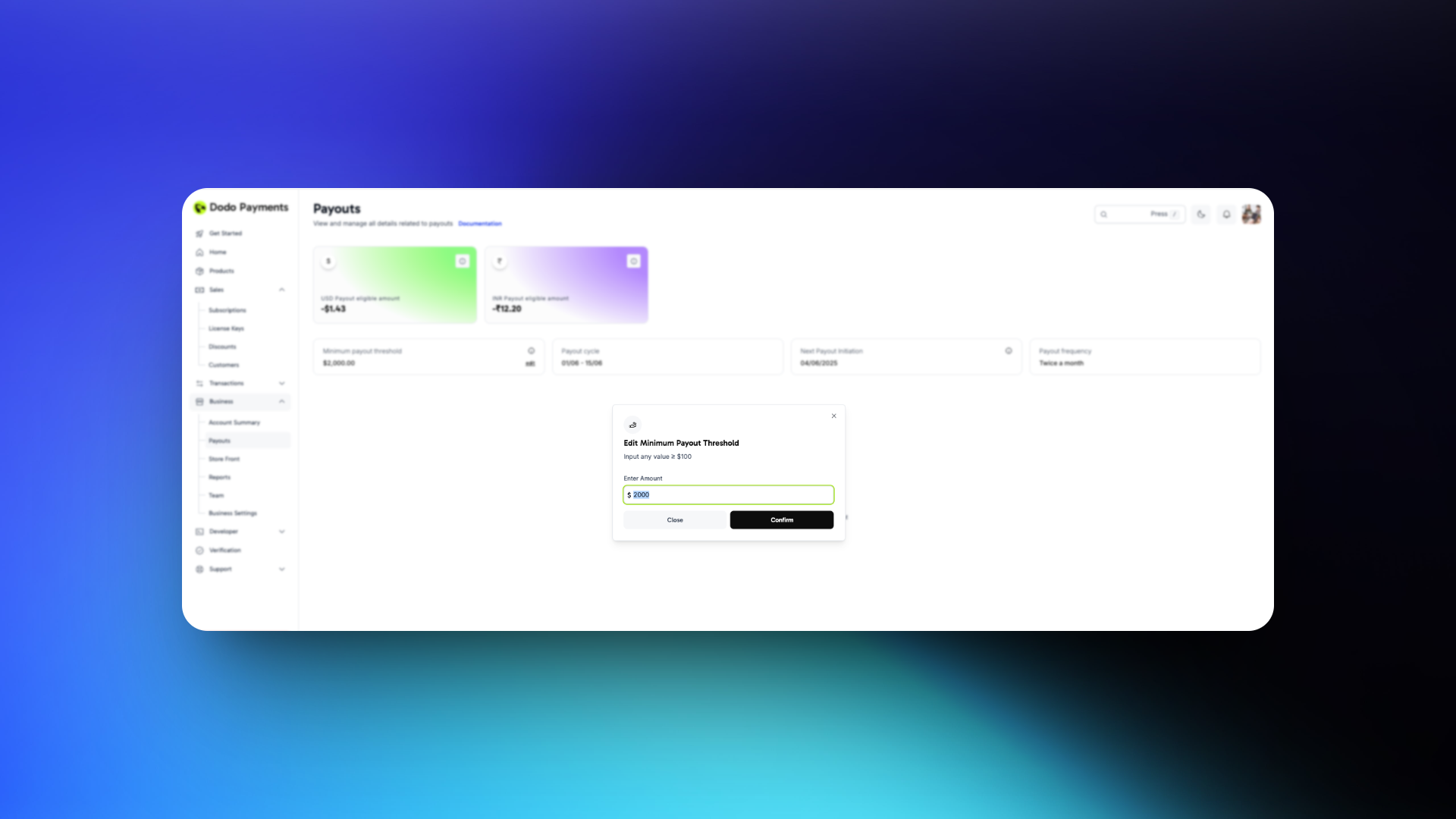

## Payout Wallet

The **Payout Wallet** provides merchants with a clear overview of their eligible earnings. This feature simplifies the payout process, offering transparency over financial disbursements. The wallet amount summarizes all the transactions in the account summary and displays the amount eligible for the next payout cycle.

## Conclusion

Both the **Payout Wallet** and **Account Summary** features streamline financial operations for merchants, offering transparency. These tools ensure a seamless payout experience and accurate transaction tracking, vital for effective financial management. In case of any discrepancy noticed in the transactions, please reach out to us at [support@dodopayments.com](mailto:support@dodopayments.com) with the transaction ID and issue.

# Adaptive Currency

Source: https://docs.dodopayments.com/features/adaptive-currency

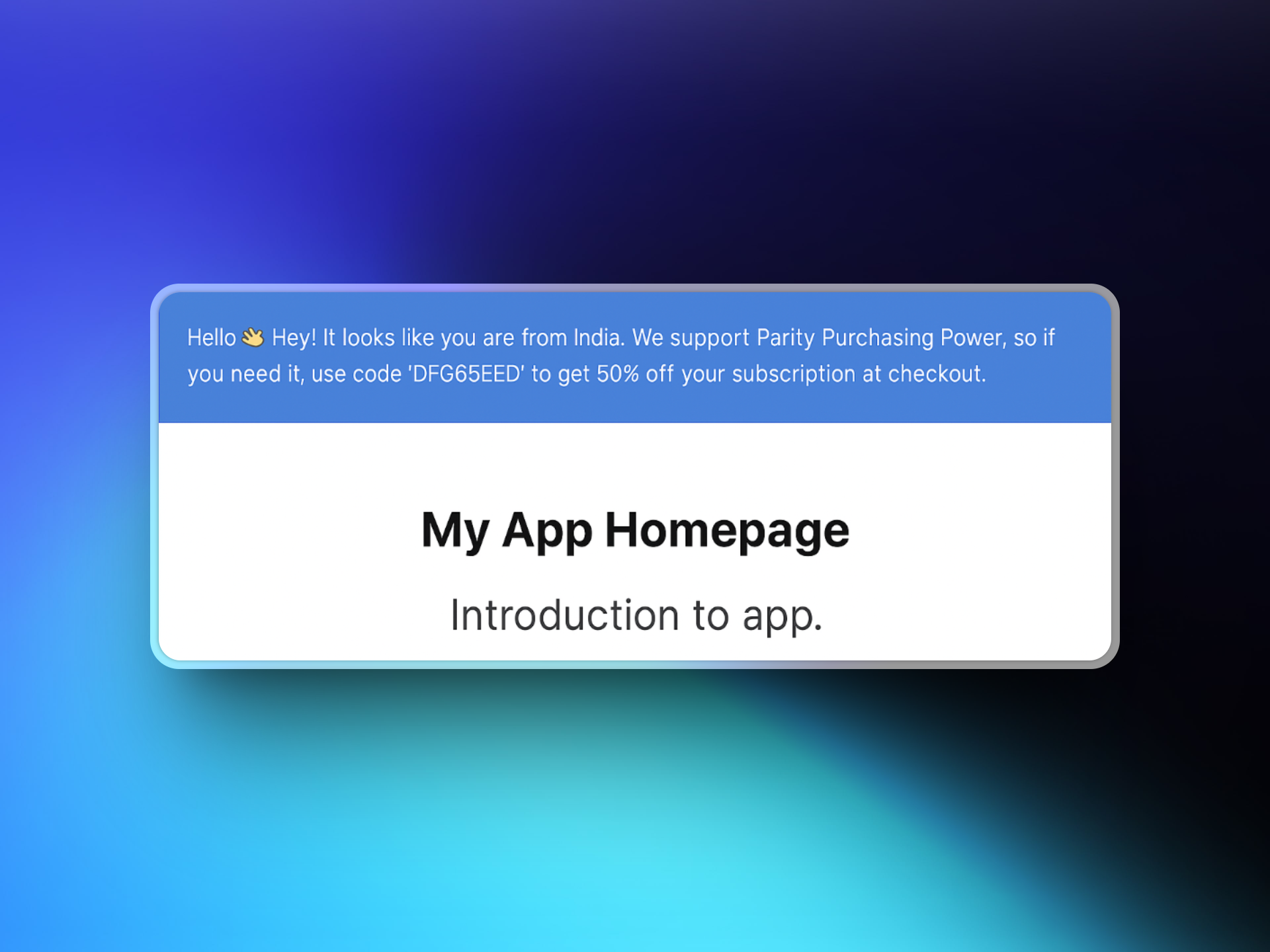

Adaptive Currency enables merchants to display prices in customers' local currencies, reducing friction at checkout and improving conversion rates by providing a localized payment experience with automatic currency detection and conversion.

## Introduction & Highlights

**What is Adaptive Currency?**

Adaptive Currency allows merchants to show product prices in the **customer's local currency** rather than a fixed global currency (e.g., USD or INR). This reduces friction at checkout, improves user trust, and increases the likelihood of successful payments.

**Key Benefits:**

* ✨ **Localized Payment Experience**: Show customers prices in their local currencies

* 🔓 **Unlock more payment methods**: Show customers more payment methods associated with their local currency

* 💱 **Same Currency Refunds**: Customers get refunded in the currency they paid with

## How to Enable It on the Dashboard

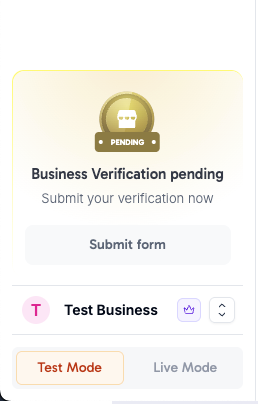

1. Log into your **Merchant Dashboard**

2. Navigate to Business **→ Business Settings**

3. Toggle the switch to **Enable Adaptive Pricing**

4. You can disable it at any time

5. Changes apply **only to future transactions**

## Key Features

* **Seamless Checkout Experience**: Redirect customers to a secure, optimized checkout page

* **Multiple Payment Methods**: Support for various local and international payment options

* **Real-time Status Updates**: Instant order status synchronization via webhooks

* **Detailed Transaction Records**: Comprehensive payment history in your WooCommerce dashboard

* **Multi-currency Support**: Accept payments in multiple currencies

## Troubleshooting

### Common Issues

1. **Payment Processing Failures**

* Verify API keys are correctly configured

* Ensure webhook URL is properly set up

* Check that your SSL certificate is valid

2. **Webhook Synchronization Problems**

* Confirm webhook signing key matches

* Review server logs for potential errors

* Verify your server can receive incoming webhook requests

### Support Resources

For additional assistance:

* Contact us at [support@dodopayments.com](mailto:support@dodopayments.com)

* Refer to our [comprehensive documentation](https://docs.dodopayments.com)

## Maintenance Best Practices

1. Regularly update the plugin for security patches and new features

2. Test all payment flows in sandbox mode before processing live transactions

3. Keep WordPress and WooCommerce updated to the latest versions

4. Implement regular site backups

5. Monitor transaction logs for any unusual activity

6. Store API keys securely and never share them publicly

# Account Summary & Payout Wallet

Source: https://docs.dodopayments.com/features/account-summary-payout-wallet

Learn about the Account Summary and Payout Wallet features in Dodo Payments. This guide provides a comprehensive overview of transaction types, and amounts, as well as insights into managing your payout wallet for seamless financial operations.

## Introduction

The **Account Summary** offers a detailed breakdown of all financial transactions, including payments, refunds, payouts, transaction fees, and taxes. This ensures full visibility into the merchant’s earnings and deductions.

## Key Details

1. **Transaction Types**

* **Payment (+)**: Successful payments (Credit).

* **Refund (-)**: Returned amounts (Debit).

* **Transaction Fees (-)**: Processing fees for payments (Debit).

* **Refund Fees (-)**: Transaction fees for refunds (Debit).

* **Sales Tax (-)**: Tax charged on payments (Debit).

* **Sales Tax Refund (+)**: Refunded sales tax on refunds (Credit).

* **Payout (-)**: Amount paid out to the merchant (Debit).

* **Payout Fees (-)**: Transaction fees associated with the payout (Debit).

2. **Transaction Amount**

* Total amount associated with the transaction.

3. **Transaction Timestamp**

* Timestamp of each transaction.

4. **Transaction ID**

* Unique identifier for easy tracking.

## Payout Wallet

The **Payout Wallet** provides merchants with a clear overview of their eligible earnings. This feature simplifies the payout process, offering transparency over financial disbursements. The wallet amount summarizes all the transactions in the account summary and displays the amount eligible for the next payout cycle.

## Conclusion

Both the **Payout Wallet** and **Account Summary** features streamline financial operations for merchants, offering transparency. These tools ensure a seamless payout experience and accurate transaction tracking, vital for effective financial management. In case of any discrepancy noticed in the transactions, please reach out to us at [support@dodopayments.com](mailto:support@dodopayments.com) with the transaction ID and issue.

# Adaptive Currency

Source: https://docs.dodopayments.com/features/adaptive-currency

Adaptive Currency enables merchants to display prices in customers' local currencies, reducing friction at checkout and improving conversion rates by providing a localized payment experience with automatic currency detection and conversion.

## Introduction & Highlights

**What is Adaptive Currency?**

Adaptive Currency allows merchants to show product prices in the **customer's local currency** rather than a fixed global currency (e.g., USD or INR). This reduces friction at checkout, improves user trust, and increases the likelihood of successful payments.

**Key Benefits:**

* ✨ **Localized Payment Experience**: Show customers prices in their local currencies

* 🔓 **Unlock more payment methods**: Show customers more payment methods associated with their local currency

* 💱 **Same Currency Refunds**: Customers get refunded in the currency they paid with

## How to Enable It on the Dashboard

1. Log into your **Merchant Dashboard**

2. Navigate to Business **→ Business Settings**

3. Toggle the switch to **Enable Adaptive Pricing**

4. You can disable it at any time

5. Changes apply **only to future transactions**

## Customer Flow

1. 🏁 **User Begins Checkout**

* System detects the user's country based on billing address

2. 💵 **Currency Selection**

* If Adaptive Pricing is enabled and the country is supported, prices are shown in the local currency by default

* Users can switch to global currency (USD) if preferred

3. 🔄 **Conversion & Fees**

Adaptive Currency allows your customer to pay in their local currency using the latest exchange rates

**Fees**

* **You Pay 0%**

* **Your customers pay 2-4% based on the order value**

You (the business) don’t directly pay any additional fees for adaptive currency as all the fees are borne by your customer. We have a tiered fees structure which will be applied during checkout as mentioned below

* Fees are tiered:

* 4% for orders under \$500

* 3% for \$500–\$1,500

* 2% for over \$1,500

4. 💳 **Payment Experience**

* User sees localized payment methods (where applicable)

* Checkout and payment are completed in the selected currency

5. 📝 **Transaction Record**

* Merchant dashboard shows the transaction in global currency (USD) only

## Supported Currencies

| Currency Code | **Currency Name** | **Countries** | **Min Amount** |

| ------------- | ------------------------------ | ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ | -------------- |

| AED | UAE Dirham | United Arab Emirates | 2.00 AED |

| ALL | Albanian Lek | Albania | 50 ALL |

| AUD | Australian Dollar | Australia, Nauru | \$0.50 |

| BRL | Brazilian Real | Brazil | R\$0.50 |

| CAD | Canadian Dollar | Canada | \$0.50 |

| CHF | Swiss Franc | Switzerland, Liechtenstein | 0.50 Fr |

| CNY | Chinese Yuan | China | 4 Yuan |

| CZK | Czech Koruna | Czech Republic | 15.00Kč |

| DKK | Danish Krone | Denmark, Greenland | 2.50-kr. |

| EUR | Euro | Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain, Andorra, San Marino, Montenegro | €0.50 |

| GBP | Pound Sterling (British Pound) | United Kingdom | £0.30 |

| HKD | Hong Kong Dollar | Hong Kong | \$4.00 |

| HUF | Hungarian Forint | Hungary | 175.00 Ft |

| IDR | Indonesian Rupiah | Indonesia | 8500 IDR |

| MXN | Mexican Peso | Mexico | Mex\$10 |

| NOK | Norwegian Krone | Norway | 3.00-kr. |

| PLN | Polish Zloty | Poland | 2.00 zł |

| RON | Romanian Leu | Romania | lei2.00 |

| RSD | Serbian Dinar | Serbia | 60 RSD |

| SAR | Saudi Riyal | Saudi Arabia | 2 SAR |

| SEK | Swedish Krona | Sweden | 3.00-kr. |

| SGD | Singapore Dollar | Singapore | \$0.50 |

| TRY | Turkish Lira | Turkey | 20 TRY |

| TWD | New Taiwan Dollar | Taiwan | 20NT\$ |

## Additional Details

### 🔄 Refunds

Dodo Payments pays out refunds in the currency your customer pays in using the latest exchange rate. The global currency (USD) amount remains fixed and the same will be shown on your dashboard and invoices and the same is refunded. This means that your customer may get more or less than the original paid amount depending on how the exchange rate changes during refund transfer. Adaptive Currency fees are not refunded.

#### Example Refund

We ignore Dodo Payment fees in this example for simplicity. Suppose:

1. You’re a US business that uses Checkout to sell a product for 100 USD and have activated Adaptive Currency

2. A customer in Canada views your Checkout page, sees the localized price of 137 CAD at an exchange rate of 1.37 CAD per 1 USD, and completes the purchase.

3. We process the payment, converting the 137 CAD to 100 USD to pay you in your settlement currency.

4. Later, when the exchange rate has changed to 1.40 CAD per 1 USD, you issue a full refund to the customer.

5. We deduct 100 USD from your account and transfer the same to your customer. He will receive 140 CAD as the refund amount.

**📄 Invoice & Taxation**

* Invoices show only the **global currency (USD)** value.

* Taxes and platform fees are calculated based on this global amount.

* For example, a \$10 sale converted to 36 AED will still reflect as \$10 in the Dashboard and invoices

**🔢 Fee Rounding**

* All amounts are rounded according to Dodo Payments internal rounding logic

# Affiliates

Source: https://docs.dodopayments.com/features/affiliates

Launch and manage your affiliate program while processing transactions through Dodo Payments.

## Introduction

This guide walks you through how to track affiliate referrals, handle commission events, and grow your revenue with trusted affiliate partnerships via Dodo Payments.

## Key Features

## Customer Flow

1. 🏁 **User Begins Checkout**

* System detects the user's country based on billing address

2. 💵 **Currency Selection**

* If Adaptive Pricing is enabled and the country is supported, prices are shown in the local currency by default

* Users can switch to global currency (USD) if preferred

3. 🔄 **Conversion & Fees**

Adaptive Currency allows your customer to pay in their local currency using the latest exchange rates

**Fees**

* **You Pay 0%**

* **Your customers pay 2-4% based on the order value**

You (the business) don’t directly pay any additional fees for adaptive currency as all the fees are borne by your customer. We have a tiered fees structure which will be applied during checkout as mentioned below

* Fees are tiered:

* 4% for orders under \$500

* 3% for \$500–\$1,500

* 2% for over \$1,500

4. 💳 **Payment Experience**

* User sees localized payment methods (where applicable)

* Checkout and payment are completed in the selected currency

5. 📝 **Transaction Record**

* Merchant dashboard shows the transaction in global currency (USD) only

## Supported Currencies

| Currency Code | **Currency Name** | **Countries** | **Min Amount** |

| ------------- | ------------------------------ | ------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------ | -------------- |

| AED | UAE Dirham | United Arab Emirates | 2.00 AED |

| ALL | Albanian Lek | Albania | 50 ALL |

| AUD | Australian Dollar | Australia, Nauru | \$0.50 |

| BRL | Brazilian Real | Brazil | R\$0.50 |

| CAD | Canadian Dollar | Canada | \$0.50 |

| CHF | Swiss Franc | Switzerland, Liechtenstein | 0.50 Fr |

| CNY | Chinese Yuan | China | 4 Yuan |

| CZK | Czech Koruna | Czech Republic | 15.00Kč |

| DKK | Danish Krone | Denmark, Greenland | 2.50-kr. |

| EUR | Euro | Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Portugal, Slovakia, Slovenia, Spain, Andorra, San Marino, Montenegro | €0.50 |

| GBP | Pound Sterling (British Pound) | United Kingdom | £0.30 |

| HKD | Hong Kong Dollar | Hong Kong | \$4.00 |

| HUF | Hungarian Forint | Hungary | 175.00 Ft |

| IDR | Indonesian Rupiah | Indonesia | 8500 IDR |

| MXN | Mexican Peso | Mexico | Mex\$10 |

| NOK | Norwegian Krone | Norway | 3.00-kr. |

| PLN | Polish Zloty | Poland | 2.00 zł |

| RON | Romanian Leu | Romania | lei2.00 |

| RSD | Serbian Dinar | Serbia | 60 RSD |

| SAR | Saudi Riyal | Saudi Arabia | 2 SAR |

| SEK | Swedish Krona | Sweden | 3.00-kr. |

| SGD | Singapore Dollar | Singapore | \$0.50 |

| TRY | Turkish Lira | Turkey | 20 TRY |

| TWD | New Taiwan Dollar | Taiwan | 20NT\$ |

## Additional Details

### 🔄 Refunds

Dodo Payments pays out refunds in the currency your customer pays in using the latest exchange rate. The global currency (USD) amount remains fixed and the same will be shown on your dashboard and invoices and the same is refunded. This means that your customer may get more or less than the original paid amount depending on how the exchange rate changes during refund transfer. Adaptive Currency fees are not refunded.

#### Example Refund

We ignore Dodo Payment fees in this example for simplicity. Suppose:

1. You’re a US business that uses Checkout to sell a product for 100 USD and have activated Adaptive Currency

2. A customer in Canada views your Checkout page, sees the localized price of 137 CAD at an exchange rate of 1.37 CAD per 1 USD, and completes the purchase.

3. We process the payment, converting the 137 CAD to 100 USD to pay you in your settlement currency.

4. Later, when the exchange rate has changed to 1.40 CAD per 1 USD, you issue a full refund to the customer.

5. We deduct 100 USD from your account and transfer the same to your customer. He will receive 140 CAD as the refund amount.

**📄 Invoice & Taxation**

* Invoices show only the **global currency (USD)** value.

* Taxes and platform fees are calculated based on this global amount.

* For example, a \$10 sale converted to 36 AED will still reflect as \$10 in the Dashboard and invoices

**🔢 Fee Rounding**

* All amounts are rounded according to Dodo Payments internal rounding logic

# Affiliates

Source: https://docs.dodopayments.com/features/affiliates

Launch and manage your affiliate program while processing transactions through Dodo Payments.

## Introduction

This guide walks you through how to track affiliate referrals, handle commission events, and grow your revenue with trusted affiliate partnerships via Dodo Payments.

## Key Features

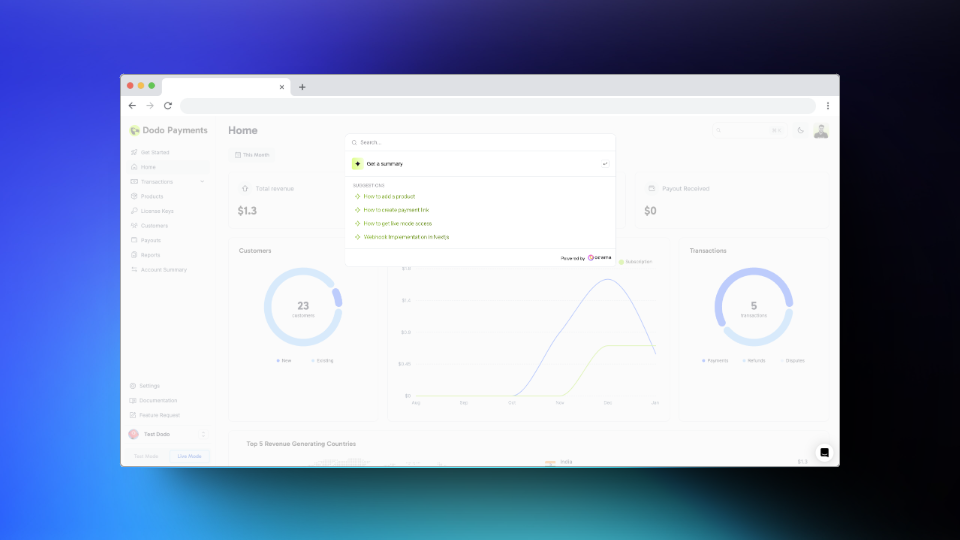

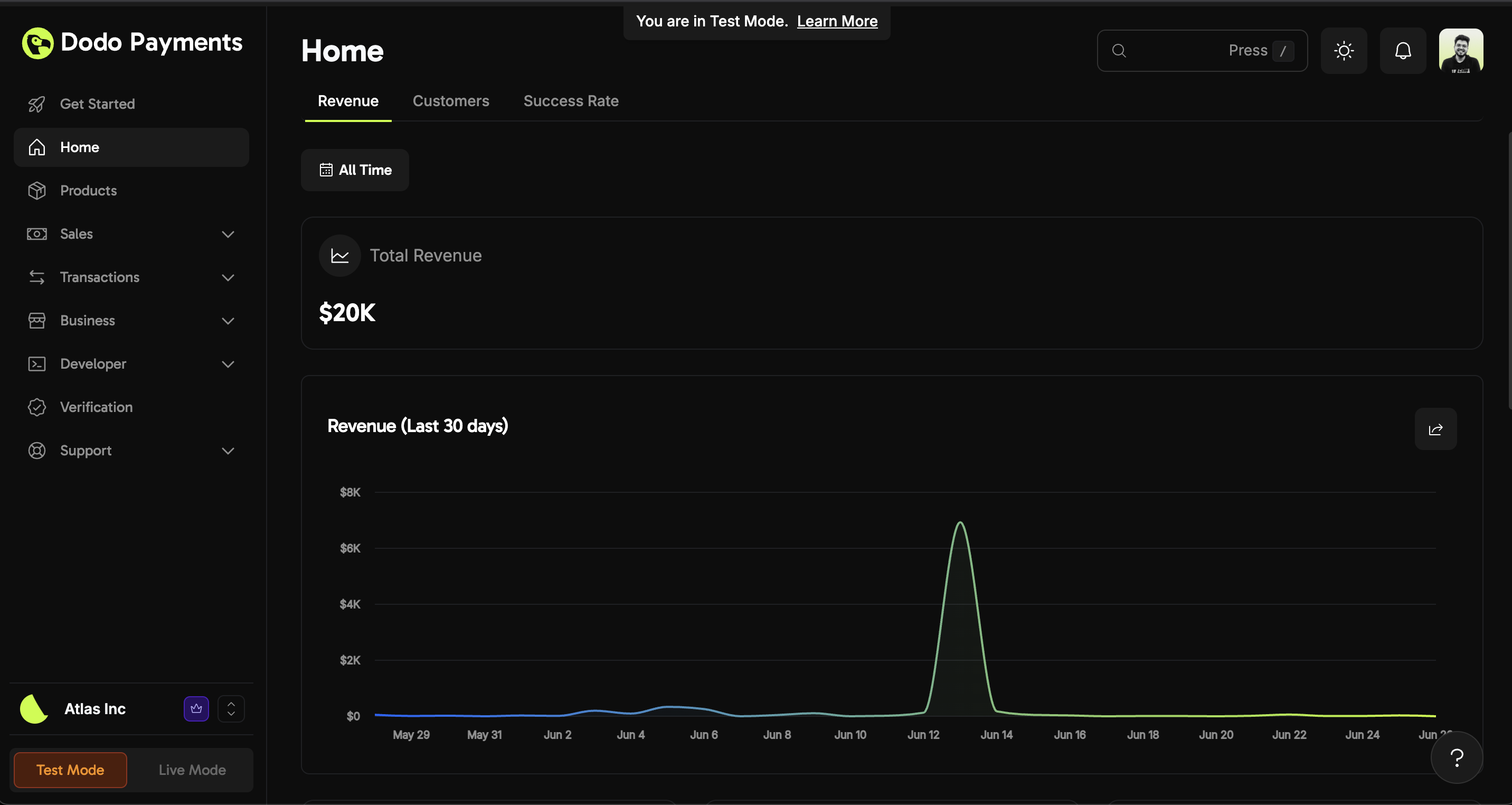

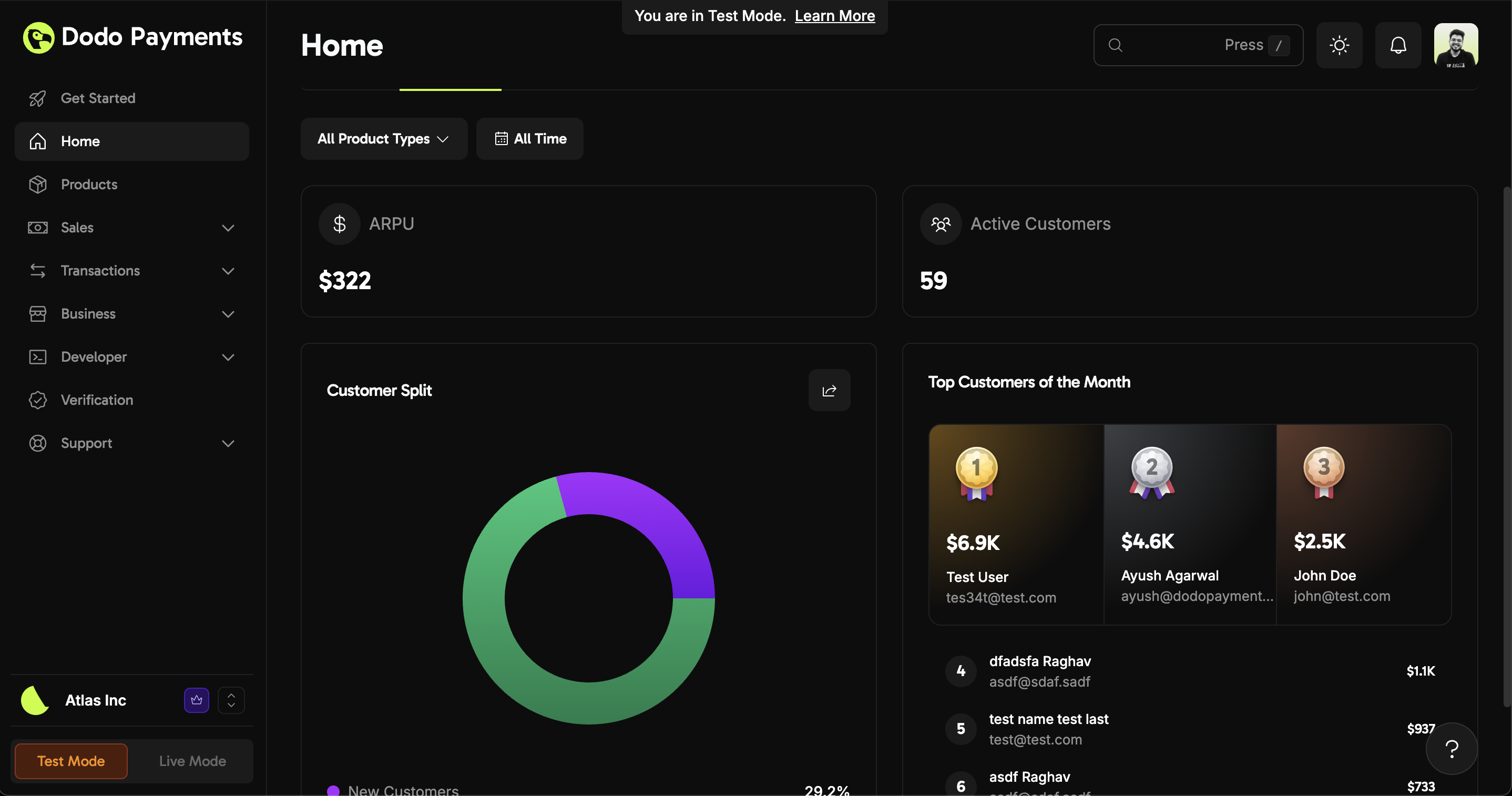

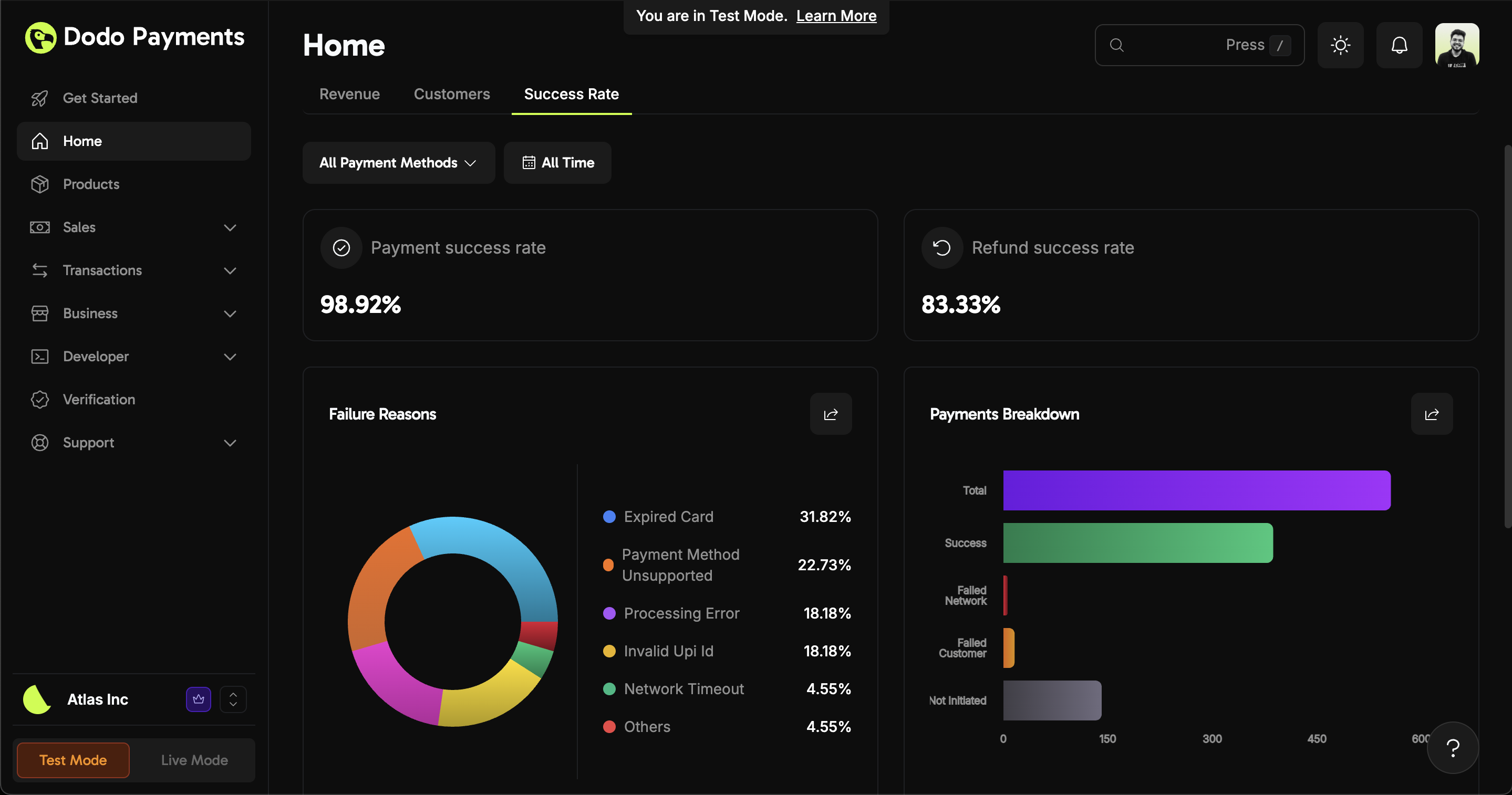

## Introduction

The Analytics and Reporting feature in Dodo Payments provides merchants with powerful insights into their business' financial health and performance. This feature enables merchants to track key metrics, analyze sales data, review customer behavior, and monitor overall transaction activity. By offering a wide range of customizable reports, Dodo Payments helps businesses make data-driven decisions to optimize their payment flows, product offerings, and revenue growth.

## Key Highlights

## Introduction

The Analytics and Reporting feature in Dodo Payments provides merchants with powerful insights into their business' financial health and performance. This feature enables merchants to track key metrics, analyze sales data, review customer behavior, and monitor overall transaction activity. By offering a wide range of customizable reports, Dodo Payments helps businesses make data-driven decisions to optimize their payment flows, product offerings, and revenue growth.

## Key Highlights

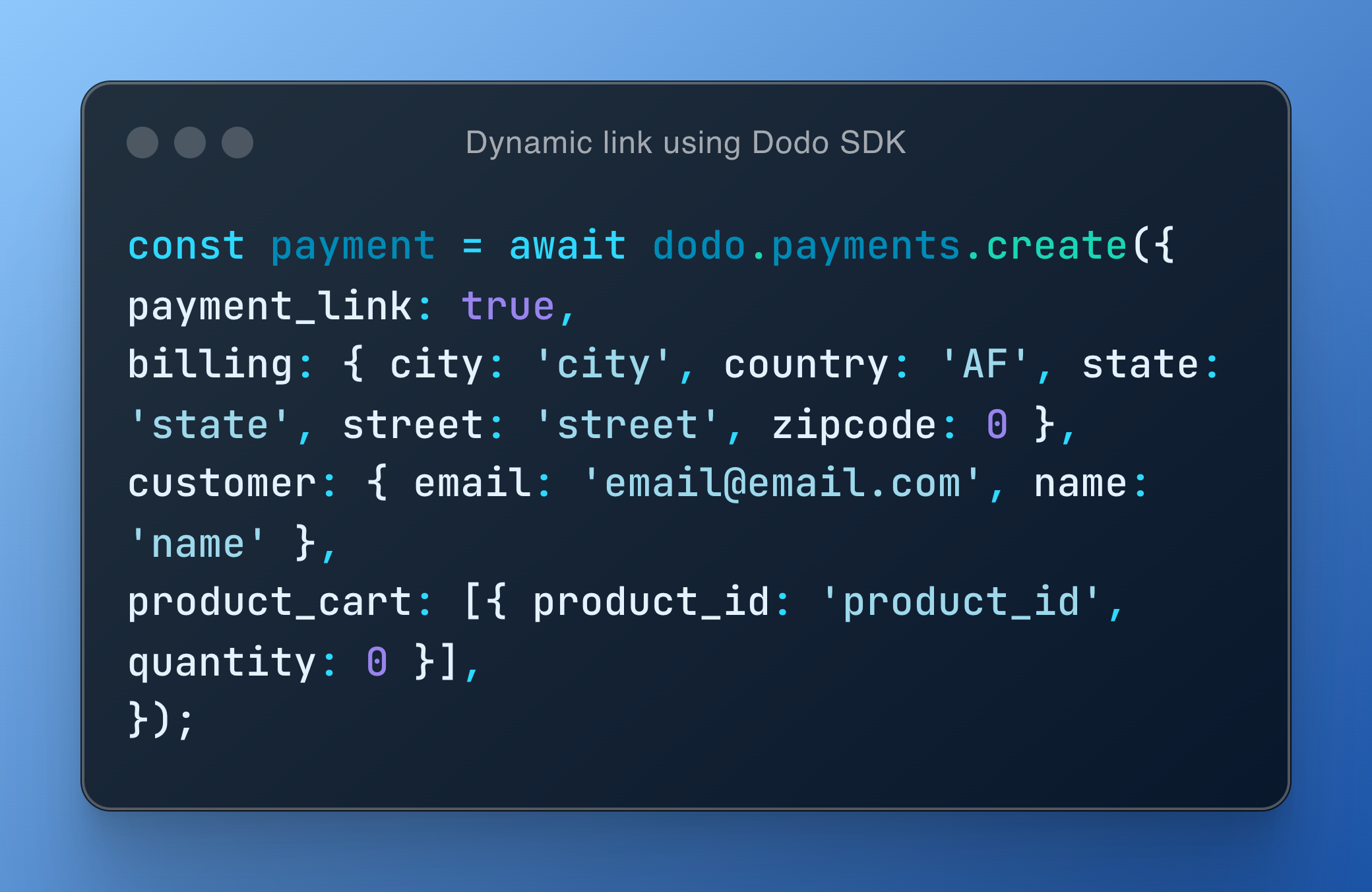

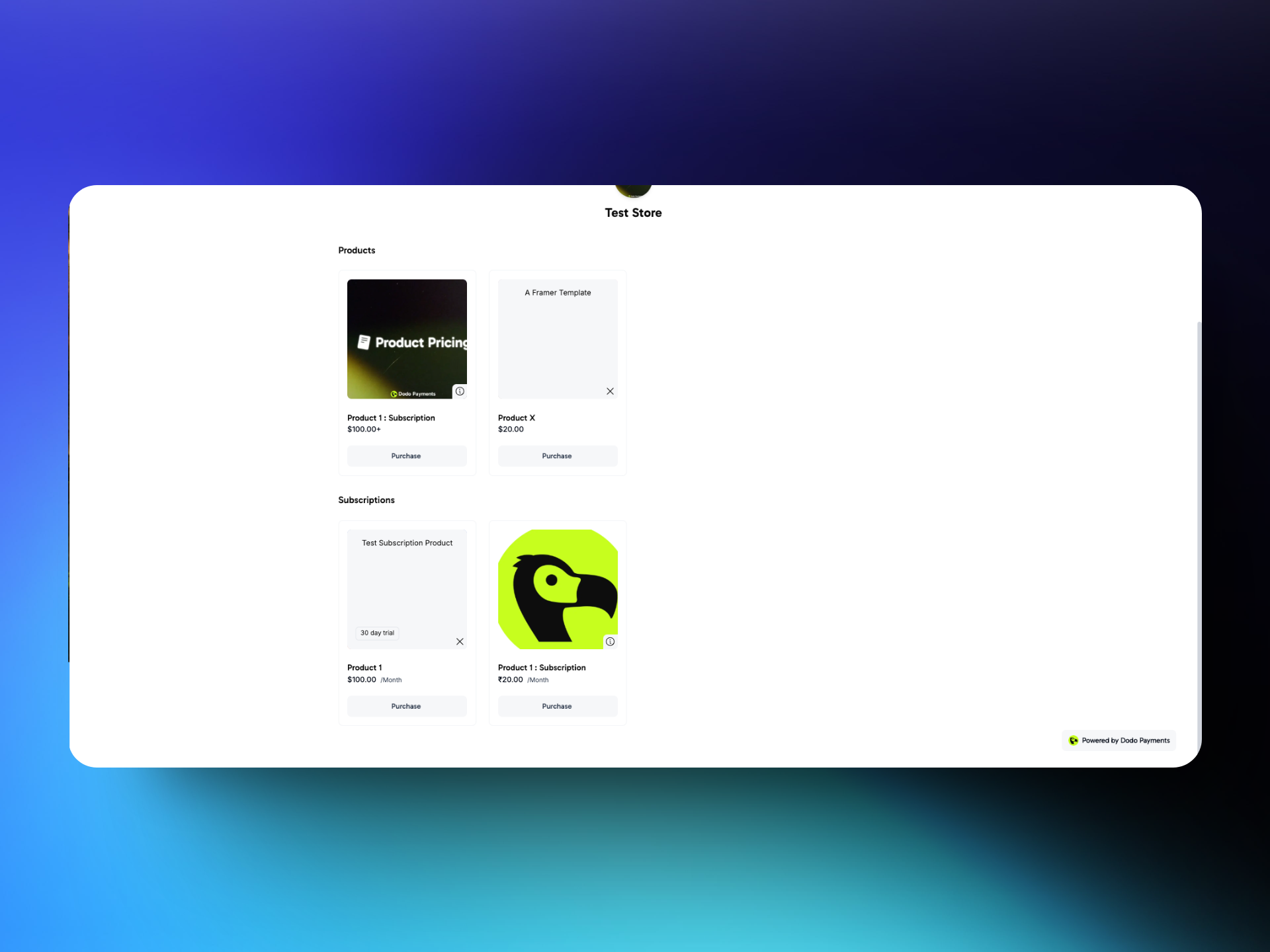

Atlas is powered by [Dodo Payments Node SDK](https://github.com/dodopayments/dodopayments-node.git) which is just a few lines of code

Follow this guide for integration: [Guide](/developer-resources/integration-guide)

This project is open source check it out [here](https://github.com/dodopayments/dodo-checkout-demo.git)

The **Atlas Demo Product** is a **realistic** environment demonstrating how merchants can **embed** Dodo Payments' checkout flows for both **subscription** and **one-time** transactions. A **post-purchase "My Account"** feature further illustrates how purchased digital assets can be managed and accessed, ensuring a smooth and professional user journey.

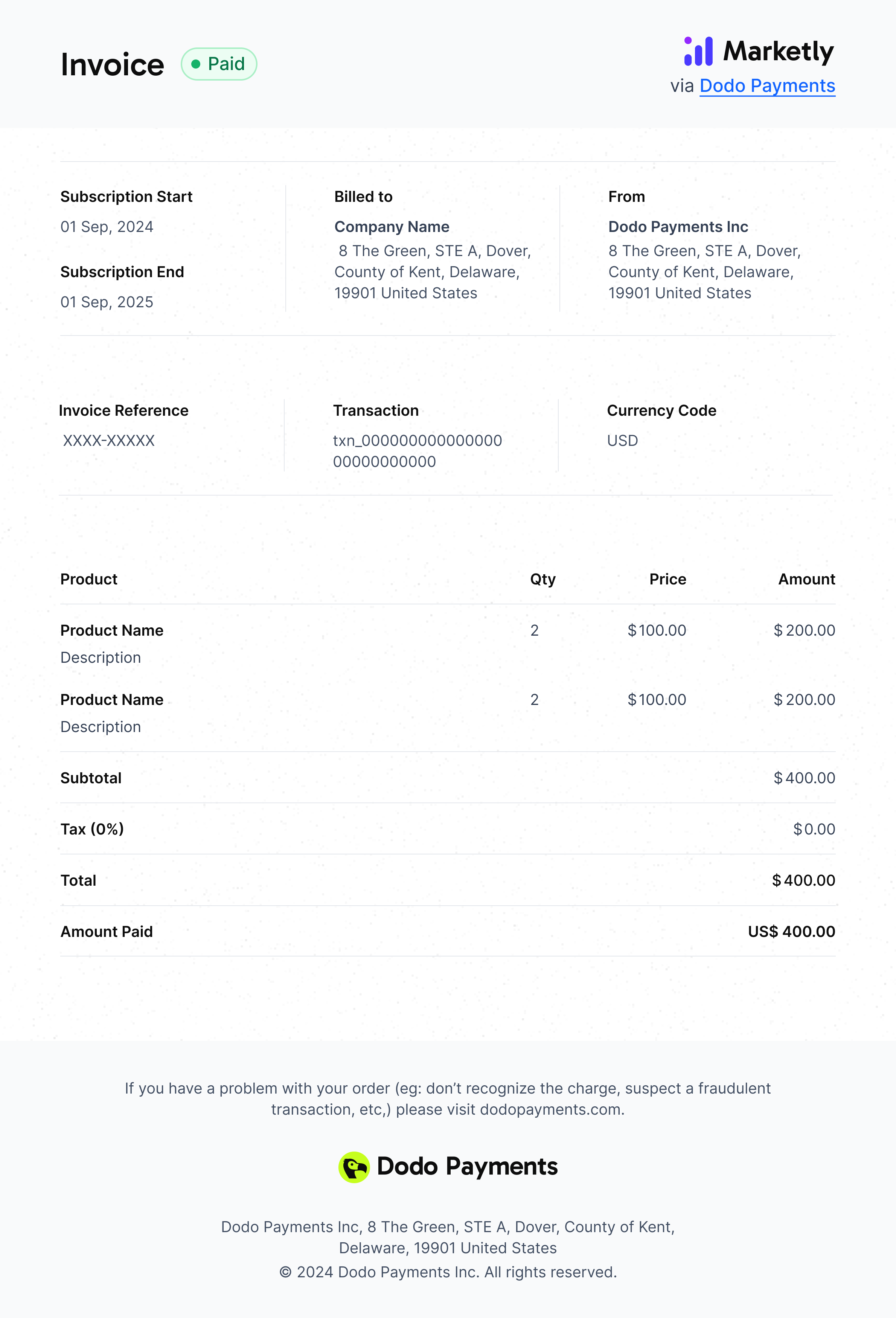

# B2B Payments

Source: https://docs.dodopayments.com/features/b2b-payments

The B2B Payments feature ensures that merchants processing B2B transactions have their customer’s Tax IDs verified during checkout, ensuring accurate tax application based on the customer's country and applicable regulations. This validation helps determine whether input tax collection applies or if the transaction falls under a reverse charge mechanism.

## **Tax ID Validation for B2B Transactions**

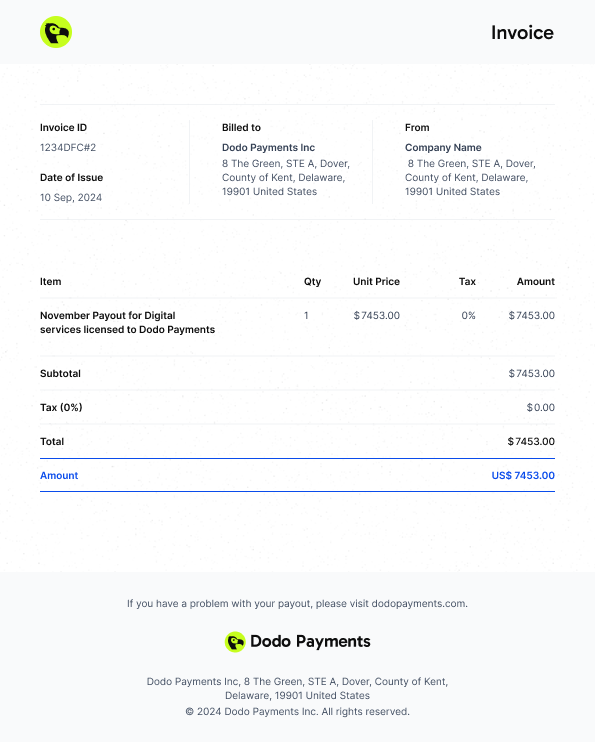

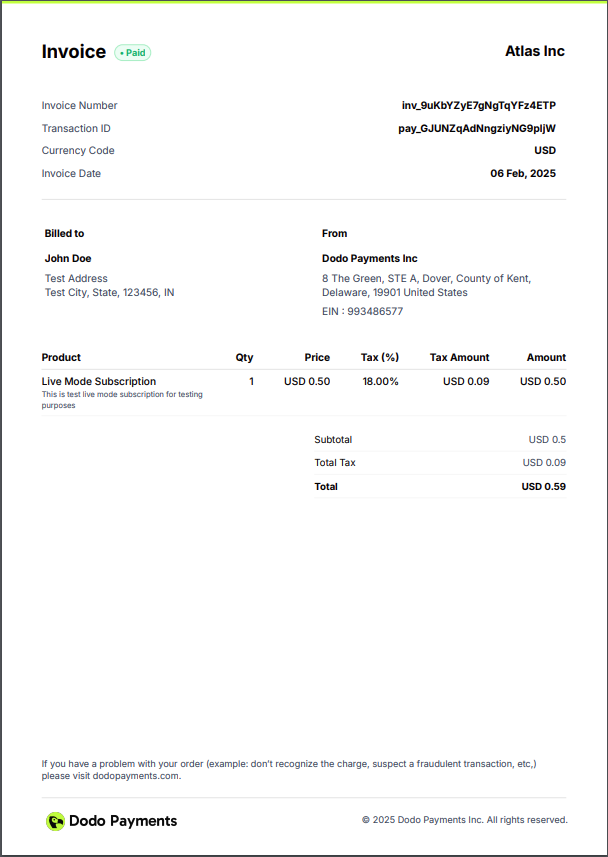

* If a **valid Tax ID** is provided during checkout, the invoice will include:

* The **customer’s Tax ID**.

* Tax deductions will be determined based on the applicable regulations for the customer’s country.

* The invoice will include **Dodo Payments’ tax details**, along with the tax applied to the transaction.

## **Tax Treatment for B2C Transactions**

* Transactions where a valid Tax ID is **not provided** will be treated as **B2C transactions**, and tax will be deducted as per the applicable tax regulations in the customer’s country.

* The invoice will include **Dodo Payments’ tax details**, along with the tax applied to the transaction.

## Reverse Charge Mechanism

Generally, the supplier of goods or services is liable to pay VAT/Service Tax/GST.

However, in specified cases like imports and other notified supplies, the liability is on the recipient (customer) under the reverse charge mechanism. Reverse Charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply.

## **Reverse Charge Applicability**

* In certain cases, where applicable by law, tax will **not be deducted** at checkout and the transaction will be subject to a **reverse charge mechanism**.

* The invoice will clearly indicate when a reverse charge applies, as per regulatory requirements.

# Customers

Source: https://docs.dodopayments.com/features/customers

The Customers Page in Dodo Payments allows merchants to manage their customer relationships by providing a detailed view of all customers who have made a purchase.

Atlas is powered by [Dodo Payments Node SDK](https://github.com/dodopayments/dodopayments-node.git) which is just a few lines of code

Follow this guide for integration: [Guide](/developer-resources/integration-guide)

This project is open source check it out [here](https://github.com/dodopayments/dodo-checkout-demo.git)

The **Atlas Demo Product** is a **realistic** environment demonstrating how merchants can **embed** Dodo Payments' checkout flows for both **subscription** and **one-time** transactions. A **post-purchase "My Account"** feature further illustrates how purchased digital assets can be managed and accessed, ensuring a smooth and professional user journey.

# B2B Payments

Source: https://docs.dodopayments.com/features/b2b-payments

The B2B Payments feature ensures that merchants processing B2B transactions have their customer’s Tax IDs verified during checkout, ensuring accurate tax application based on the customer's country and applicable regulations. This validation helps determine whether input tax collection applies or if the transaction falls under a reverse charge mechanism.

## **Tax ID Validation for B2B Transactions**

* If a **valid Tax ID** is provided during checkout, the invoice will include:

* The **customer’s Tax ID**.

* Tax deductions will be determined based on the applicable regulations for the customer’s country.

* The invoice will include **Dodo Payments’ tax details**, along with the tax applied to the transaction.

## **Tax Treatment for B2C Transactions**

* Transactions where a valid Tax ID is **not provided** will be treated as **B2C transactions**, and tax will be deducted as per the applicable tax regulations in the customer’s country.

* The invoice will include **Dodo Payments’ tax details**, along with the tax applied to the transaction.

## Reverse Charge Mechanism

Generally, the supplier of goods or services is liable to pay VAT/Service Tax/GST.

However, in specified cases like imports and other notified supplies, the liability is on the recipient (customer) under the reverse charge mechanism. Reverse Charge means the liability to pay tax is on the recipient of supply of goods or services instead of the supplier of such goods or services in respect of notified categories of supply.

## **Reverse Charge Applicability**

* In certain cases, where applicable by law, tax will **not be deducted** at checkout and the transaction will be subject to a **reverse charge mechanism**.

* The invoice will clearly indicate when a reverse charge applies, as per regulatory requirements.

# Customers

Source: https://docs.dodopayments.com/features/customers

The Customers Page in Dodo Payments allows merchants to manage their customer relationships by providing a detailed view of all customers who have made a purchase.

## **Customers Page**

Merchants begin by logging into the Dodo Payments dashboard and navigating to the **Customers** section. This section provides a complete view of all customers who have interacted with the business.

* **How to Access**:

1. From the dashboard, click on **Customers** in the navigation menu.

2. The Customers Page will display a list of all current and past customers.

## **Customer Details**

On the **Customers Page**, merchants can see an overview of their entire customer base. This list provides basic information for each customer, such as:

* **Customer Name**: The full name of the customer.

* **Email Address**: The customer’s email address for communication.

* **Last Transaction**: The date of the customer’s most recent purchase or payment.

* **Subscription Status**: If applicable, shows whether the customer has an active, paused, or canceled subscription.

* **Search and Filter**: Merchants can search for specific customers or use filters to narrow down the list by purchase history, subscription status, or recent activity.

* **Download :** Merchants can download the list of merchants for the selected date range in CSV format

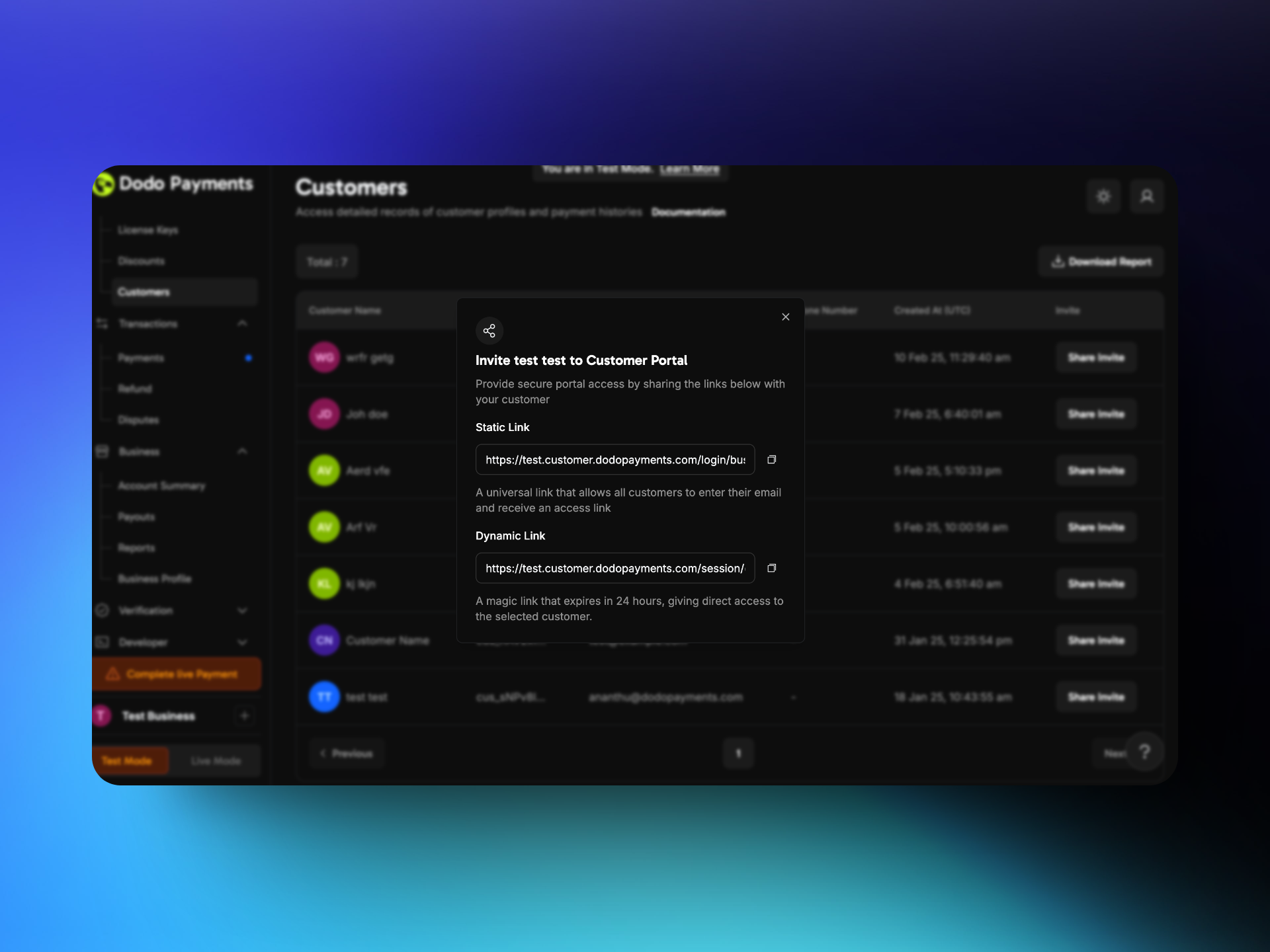

## Customer Portal

The Customer Portal offers a seamless self-service experience, allowing customers to manage Subscriptions, Billing, License Keys and Profile information.

## How it works?

Your customers can access the Customer Portal through a link that you share with them. This can be either a static or a dynamic link.

## **Customers Page**

Merchants begin by logging into the Dodo Payments dashboard and navigating to the **Customers** section. This section provides a complete view of all customers who have interacted with the business.

* **How to Access**:

1. From the dashboard, click on **Customers** in the navigation menu.

2. The Customers Page will display a list of all current and past customers.

## **Customer Details**

On the **Customers Page**, merchants can see an overview of their entire customer base. This list provides basic information for each customer, such as:

* **Customer Name**: The full name of the customer.

* **Email Address**: The customer’s email address for communication.

* **Last Transaction**: The date of the customer’s most recent purchase or payment.

* **Subscription Status**: If applicable, shows whether the customer has an active, paused, or canceled subscription.

* **Search and Filter**: Merchants can search for specific customers or use filters to narrow down the list by purchase history, subscription status, or recent activity.

* **Download :** Merchants can download the list of merchants for the selected date range in CSV format

## Customer Portal

The Customer Portal offers a seamless self-service experience, allowing customers to manage Subscriptions, Billing, License Keys and Profile information.

## How it works?

Your customers can access the Customer Portal through a link that you share with them. This can be either a static or a dynamic link.

## Static Link

A static link allows any customer to request access to the Customer Portal by entering their email address. This link never expires.

**Merchant Flow**

1. Go to Sales→Customer.

2. Click on ***share invite***

3. Copy the link under *static link* to share it with your customer.

**Customer Flow**

1. Customer visits the static link you share.

2. Customer enters their email address

3. Receives a link to login to their customer portal.

## Dynamic Link

A dynamic link is a personalized, one-time link that grants direct access to the Customer Portal. This magic link expires in 24 hours.

**Merchant Flow**

1. Go to Sales→Customer.

2. Click on ***share invite***

3. Copy the link under *Dynamic link* to share it with your customer.

**Customer Flow**

1. Customer visits the *Dynamic link* you share.

2. They are taken directly to the Customer Portal without needing an access link.

## Customer Portal Features

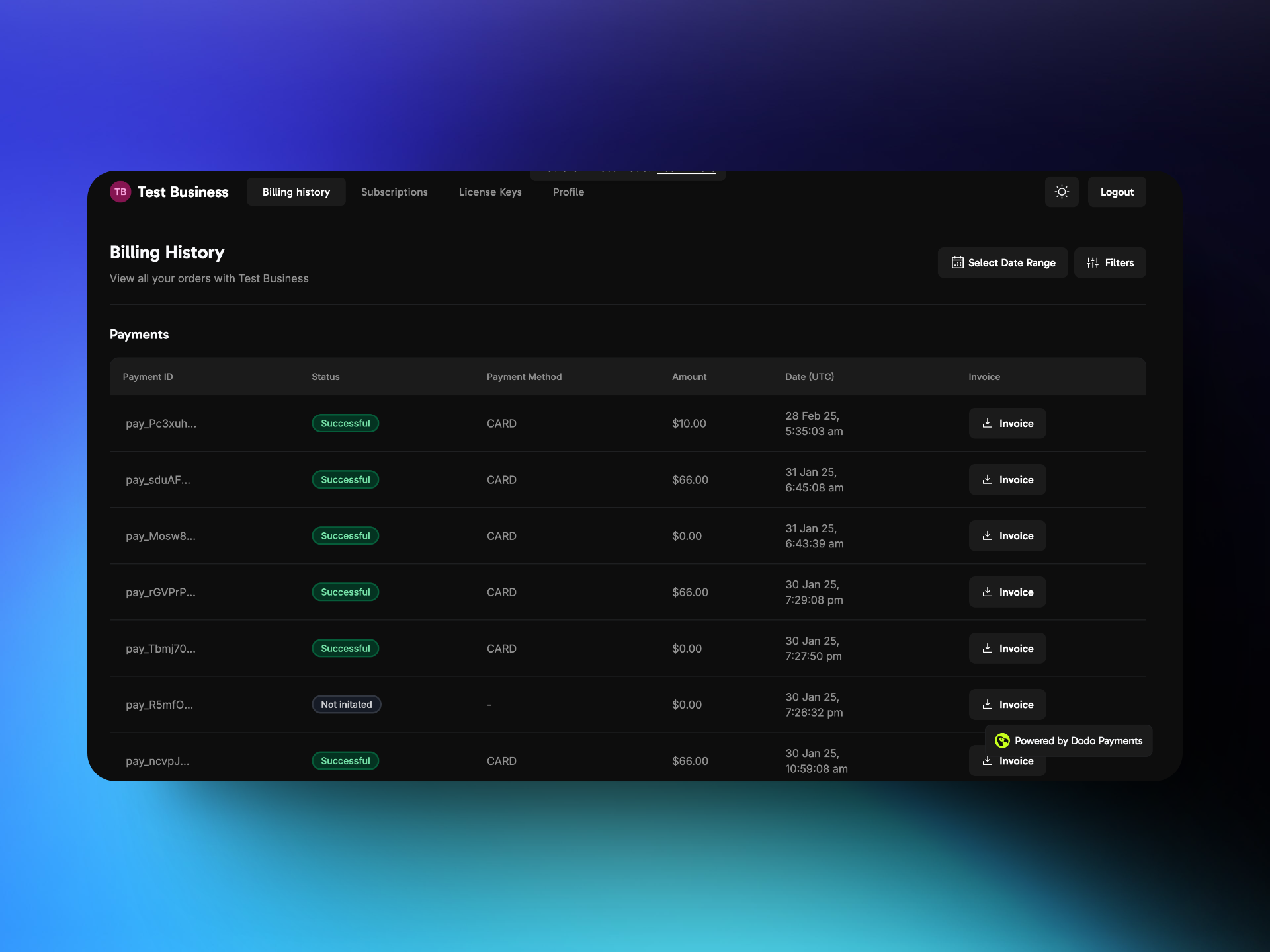

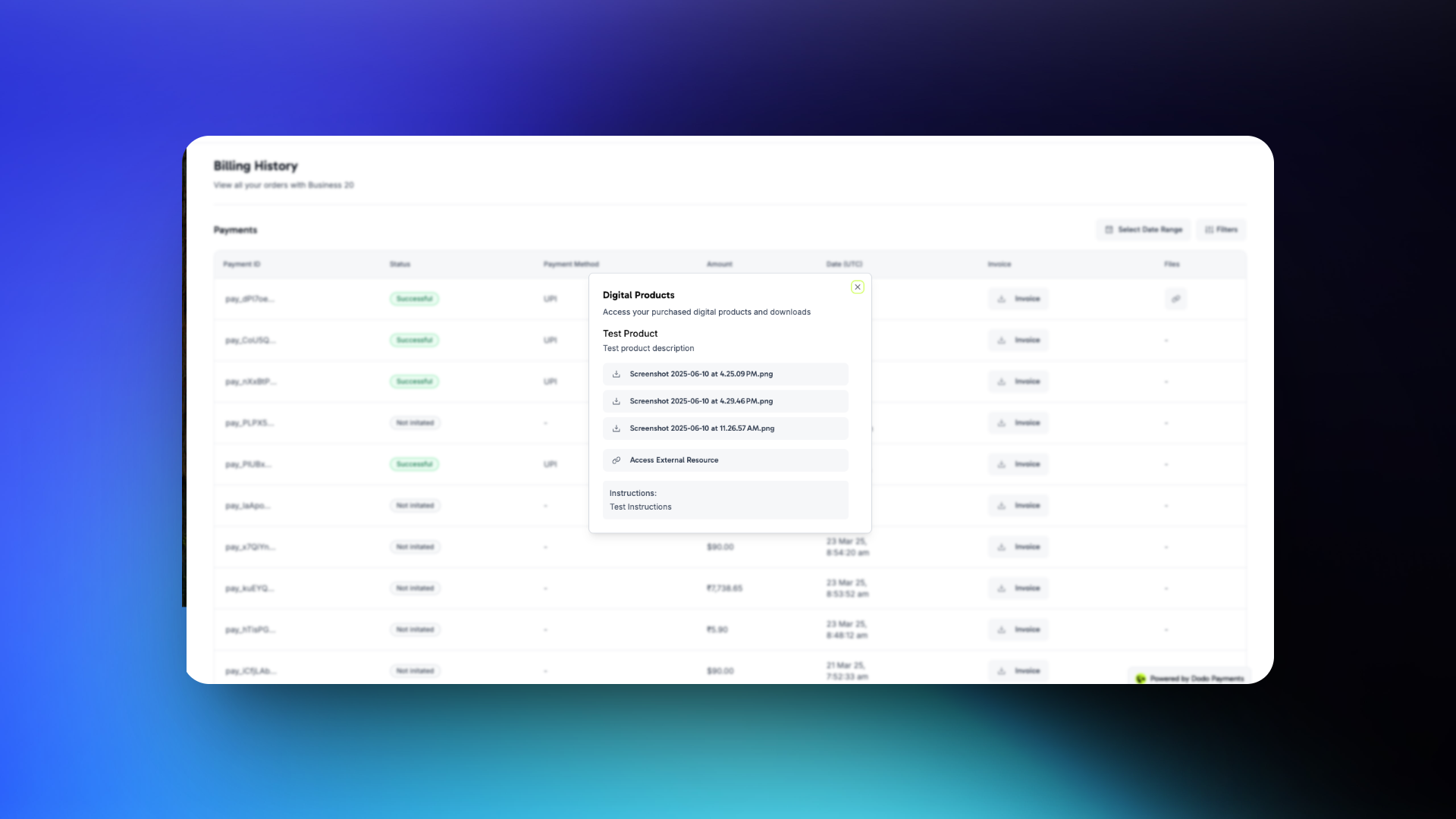

### Billing History

## Static Link

A static link allows any customer to request access to the Customer Portal by entering their email address. This link never expires.

**Merchant Flow**

1. Go to Sales→Customer.

2. Click on ***share invite***

3. Copy the link under *static link* to share it with your customer.

**Customer Flow**

1. Customer visits the static link you share.

2. Customer enters their email address

3. Receives a link to login to their customer portal.

## Dynamic Link

A dynamic link is a personalized, one-time link that grants direct access to the Customer Portal. This magic link expires in 24 hours.

**Merchant Flow**

1. Go to Sales→Customer.

2. Click on ***share invite***

3. Copy the link under *Dynamic link* to share it with your customer.

**Customer Flow**

1. Customer visits the *Dynamic link* you share.

2. They are taken directly to the Customer Portal without needing an access link.

## Customer Portal Features

### Billing History

* Displays a list of all past transactions.

* Provides an option to download invoices.

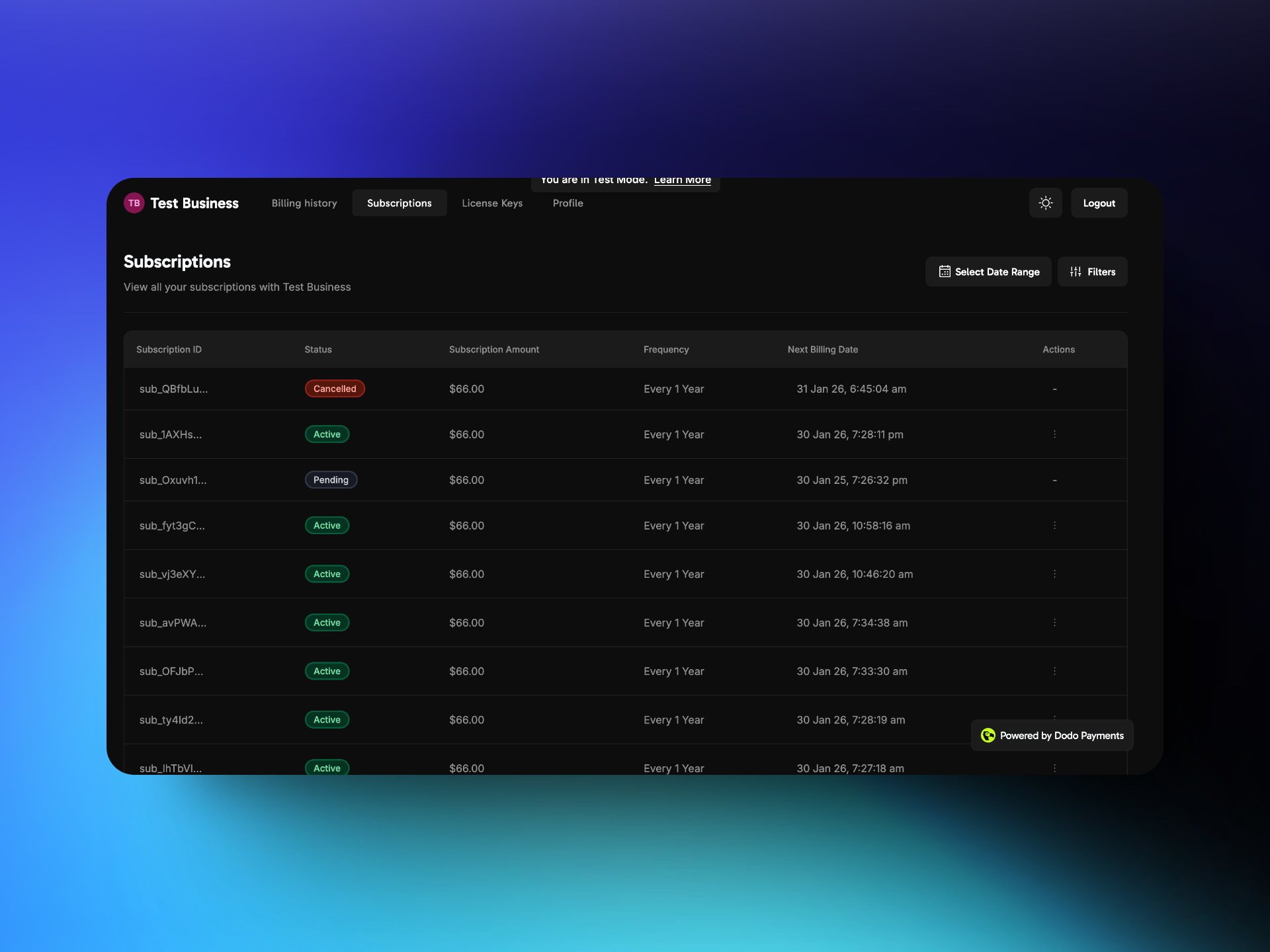

### Subscriptions Management

* Displays a list of all past transactions.

* Provides an option to download invoices.

### Subscriptions Management

Lists all subscriptions.

Allows customers to cancel their active subscriptions.

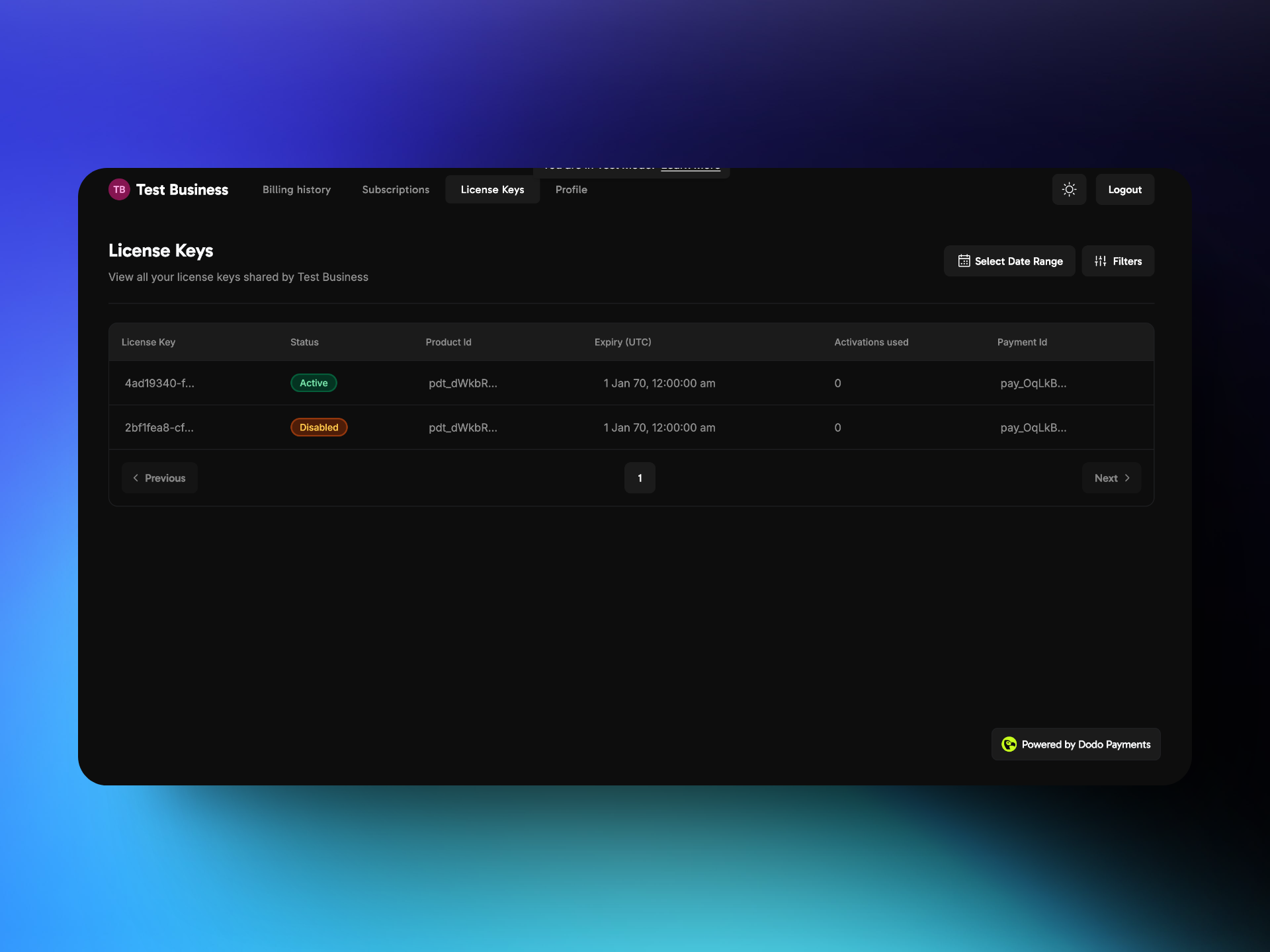

### License Keys

Lists all subscriptions.

Allows customers to cancel their active subscriptions.

### License Keys

Shows all license keys issued to the customer.

### Profile

Shows all license keys issued to the customer.

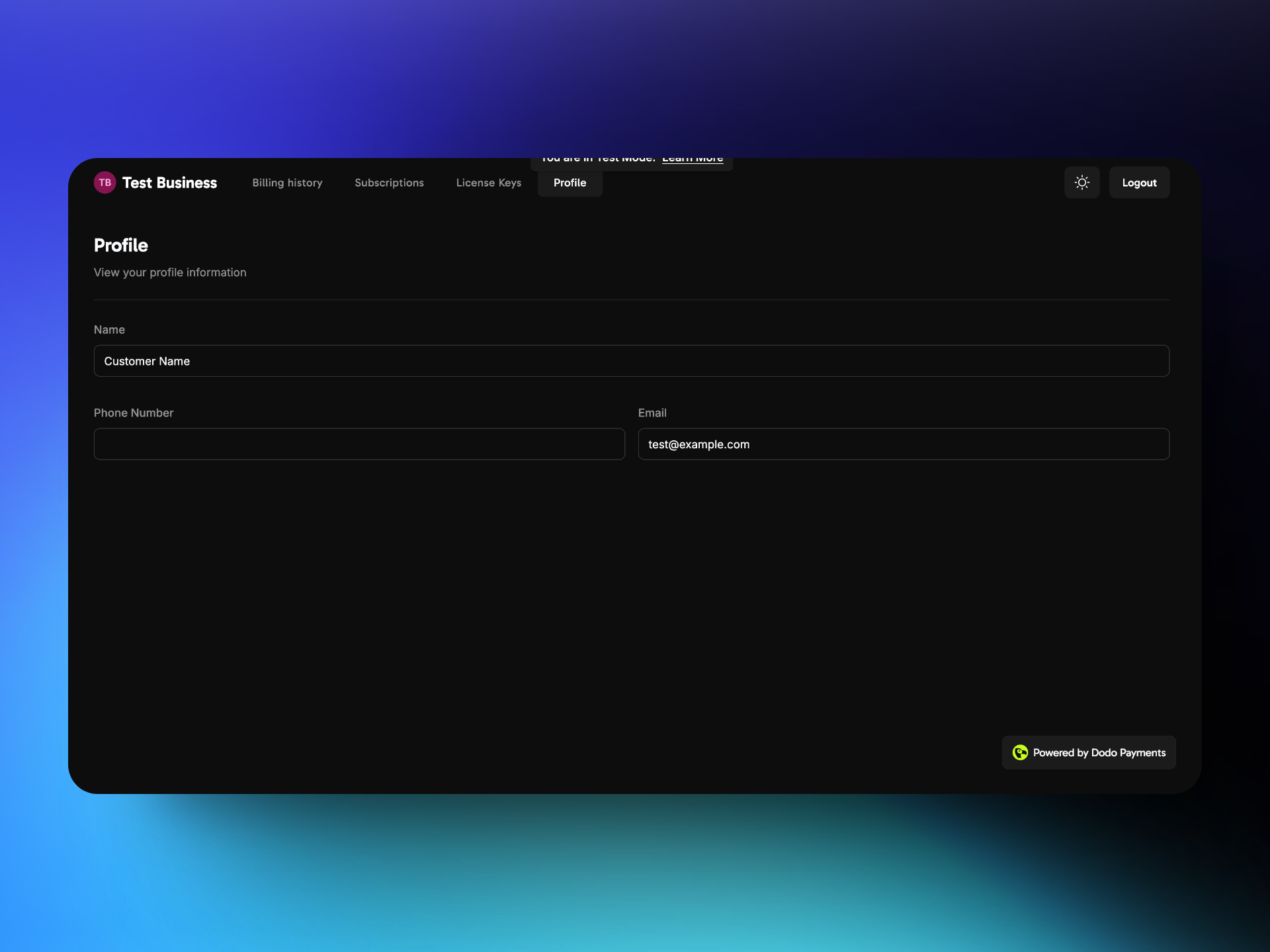

### Profile

Displays the customer's configured name, email, and phone number.

# Digital Product Delivery

Source: https://docs.dodopayments.com/features/digital-product-delivery

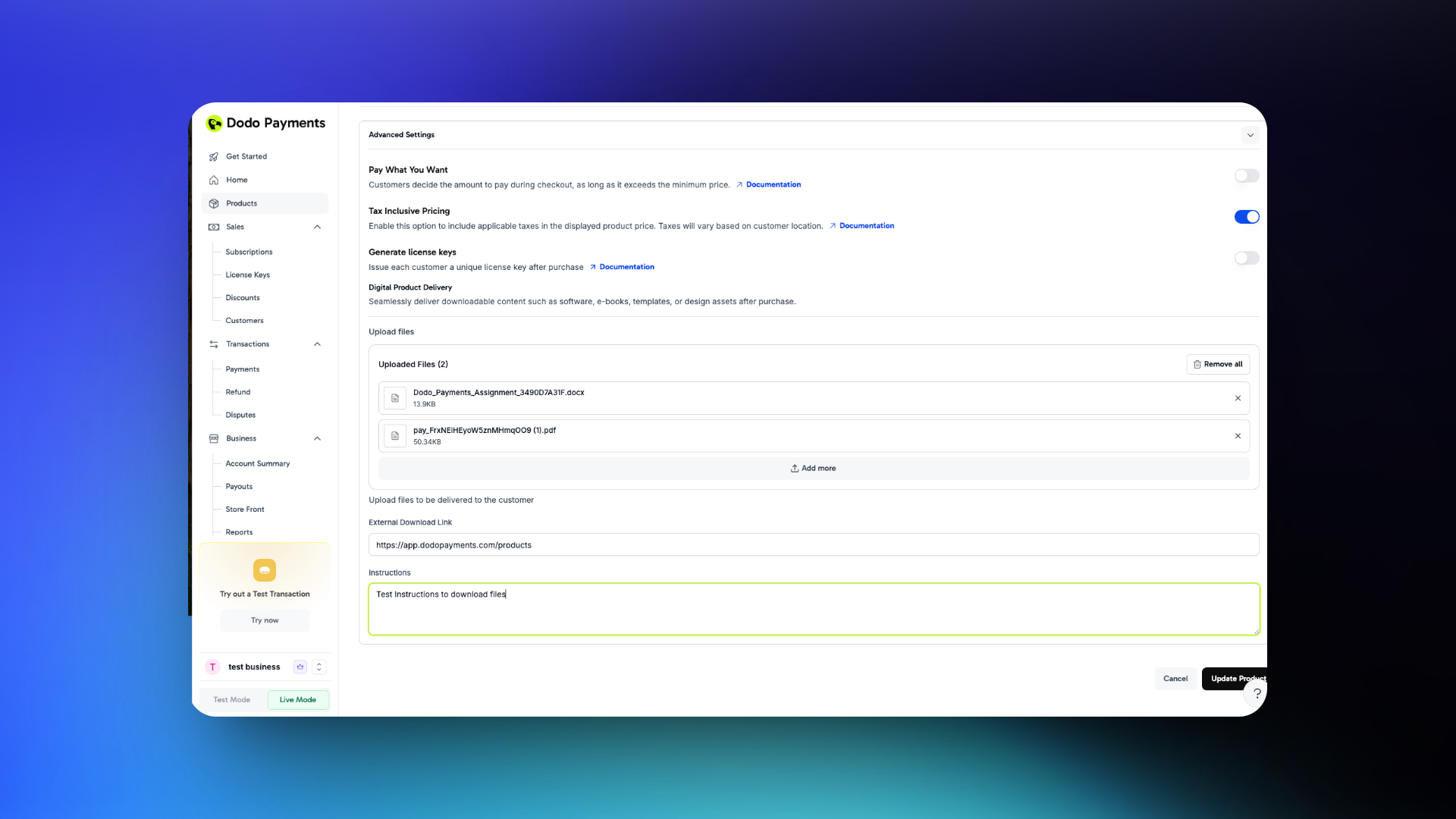

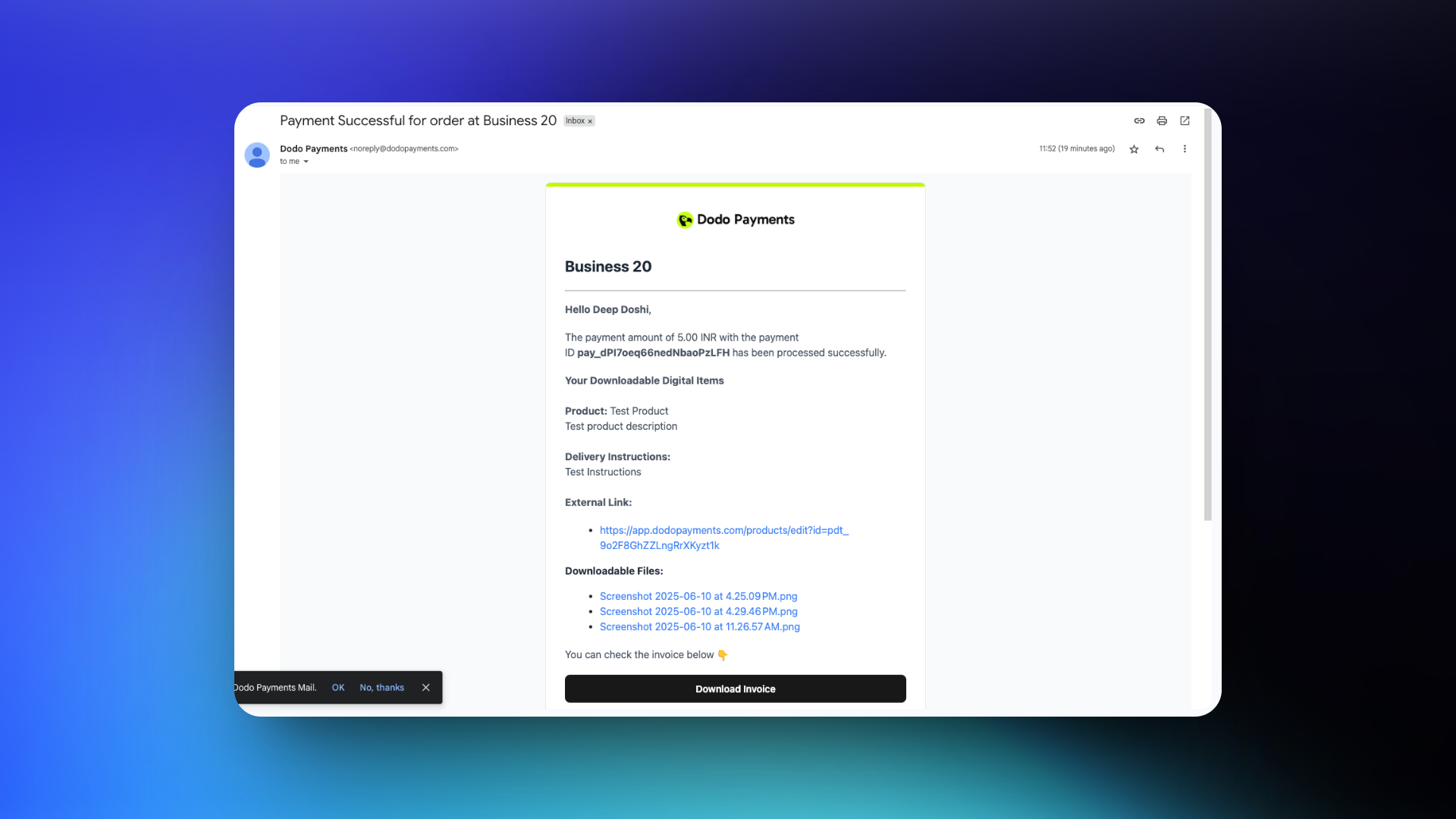

The Digital Product Delivery feature in Dodo Payments allows merchants to deliver digital products to their customers.

## Overview

The **Digital Product Delivery** feature enables merchants to automatically deliver digital files to customers after successful purchases. Whether you're selling e-books, design templates, software, or media packs, you can attach downloadable content to your products, providing instant access via email and the customer portal.

This feature supports both hosted file uploads and external download links, offering flexibility for various use cases.

## Key Features

Displays the customer's configured name, email, and phone number.

# Digital Product Delivery

Source: https://docs.dodopayments.com/features/digital-product-delivery

The Digital Product Delivery feature in Dodo Payments allows merchants to deliver digital products to their customers.

## Overview

The **Digital Product Delivery** feature enables merchants to automatically deliver digital files to customers after successful purchases. Whether you're selling e-books, design templates, software, or media packs, you can attach downloadable content to your products, providing instant access via email and the customer portal.

This feature supports both hosted file uploads and external download links, offering flexibility for various use cases.

## Key Features

### Customer Portal Access

Customers can access their digital products through the Customer Portal:

* Log in to view all past purchases

* Download files or access external links for each product

* Persistent access to purchased digital content

### Customer Portal Access

Customers can access their digital products through the Customer Portal:

* Log in to view all past purchases

* Download files or access external links for each product

* Persistent access to purchased digital content

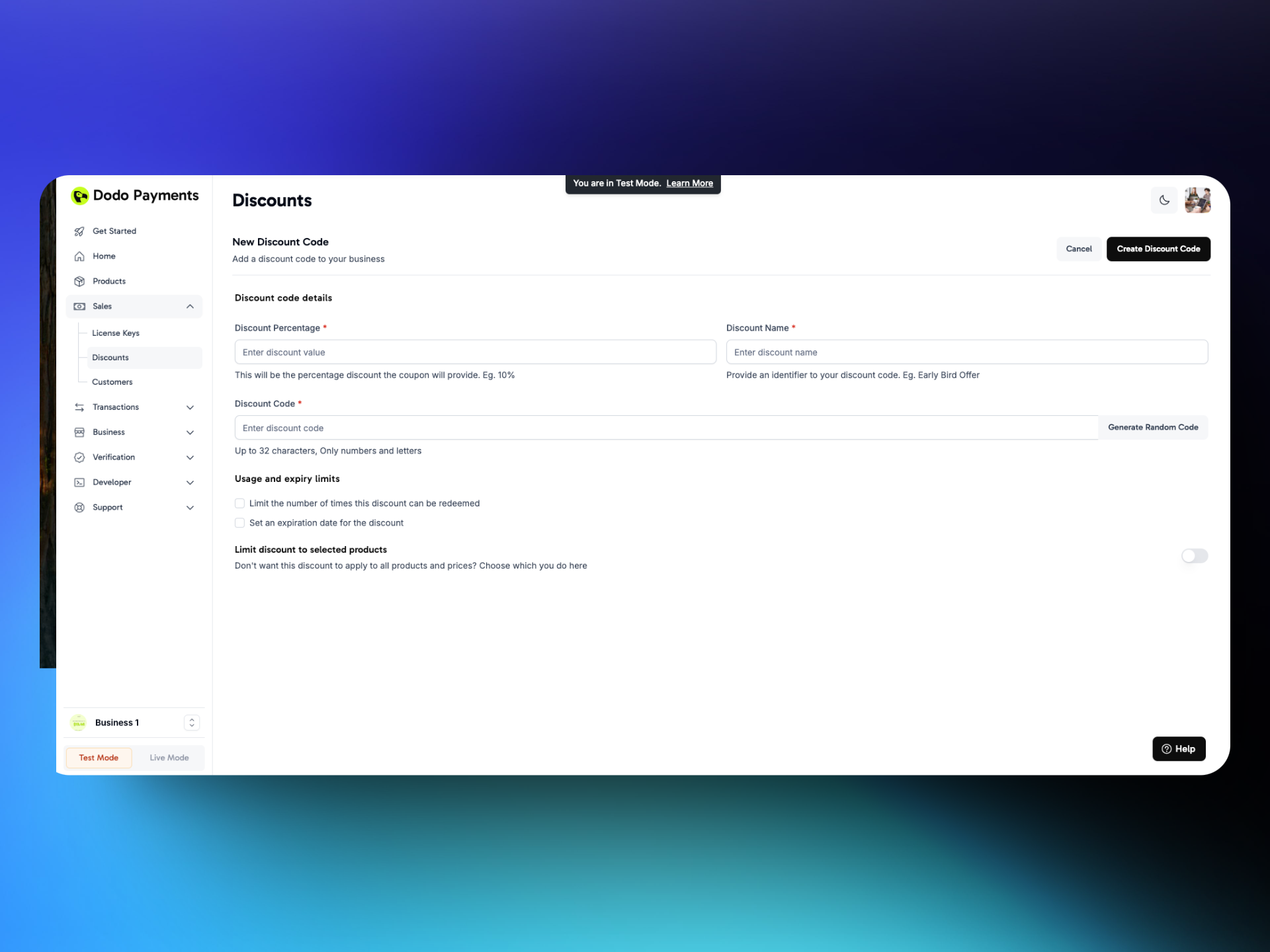

## **How to Create Discount Codes**

1. Go to the dashboard and, on the left navigation bar, click on **"Discounts"** under **Sales**.

2. Click **"New Discount Code"** to create a new discount code.

3. Enter the desired ***Discount Percentage*** and provide a name under ***Discount Name***.

4. For the ***Discount Code***, you can either create one manually or use the **"Generate Random Code"** option. And click on

## **How to Create Discount Codes**

1. Go to the dashboard and, on the left navigation bar, click on **"Discounts"** under **Sales**.

2. Click **"New Discount Code"** to create a new discount code.

3. Enter the desired ***Discount Percentage*** and provide a name under ***Discount Name***.

4. For the ***Discount Code***, you can either create one manually or use the **"Generate Random Code"** option. And click on

## Features

### Discount Code Expiration

You can set an expiration date for discount codes. Once expired, the discount codes will no longer be valid when used by customers. This feature allows you to run limited-time offers effectively.

**To set an expiration date for a discount code:**

1. Check the box next to **Set an expiration date for the discount** on the discount details page.

2. Click **Pick a Date**, then select the desired expiration date.

### Usage Limit

You can limit the number of times a discount code can be redeemed. This is useful for offering discounts to early adopters or controlling promotional usage.

**To set a redemption limit for a discount code:**

1. Check the box next to **Limit the number of times this discount can be redeemed** on the discount details page.

2. Enter the maximum number of redemptions in the input field that appears below.

### Limit Discount to Specific Products

You can restrict discount codes to specific products instead of applying them to all products by default.

**To limit a discount code to specific products:**

1. Enable the toggle **Limit discount to selected products**.

2. Select the products to which this discount code should be applied.

**Note:** If no products are selected, the discount code can be applied to all products by default.

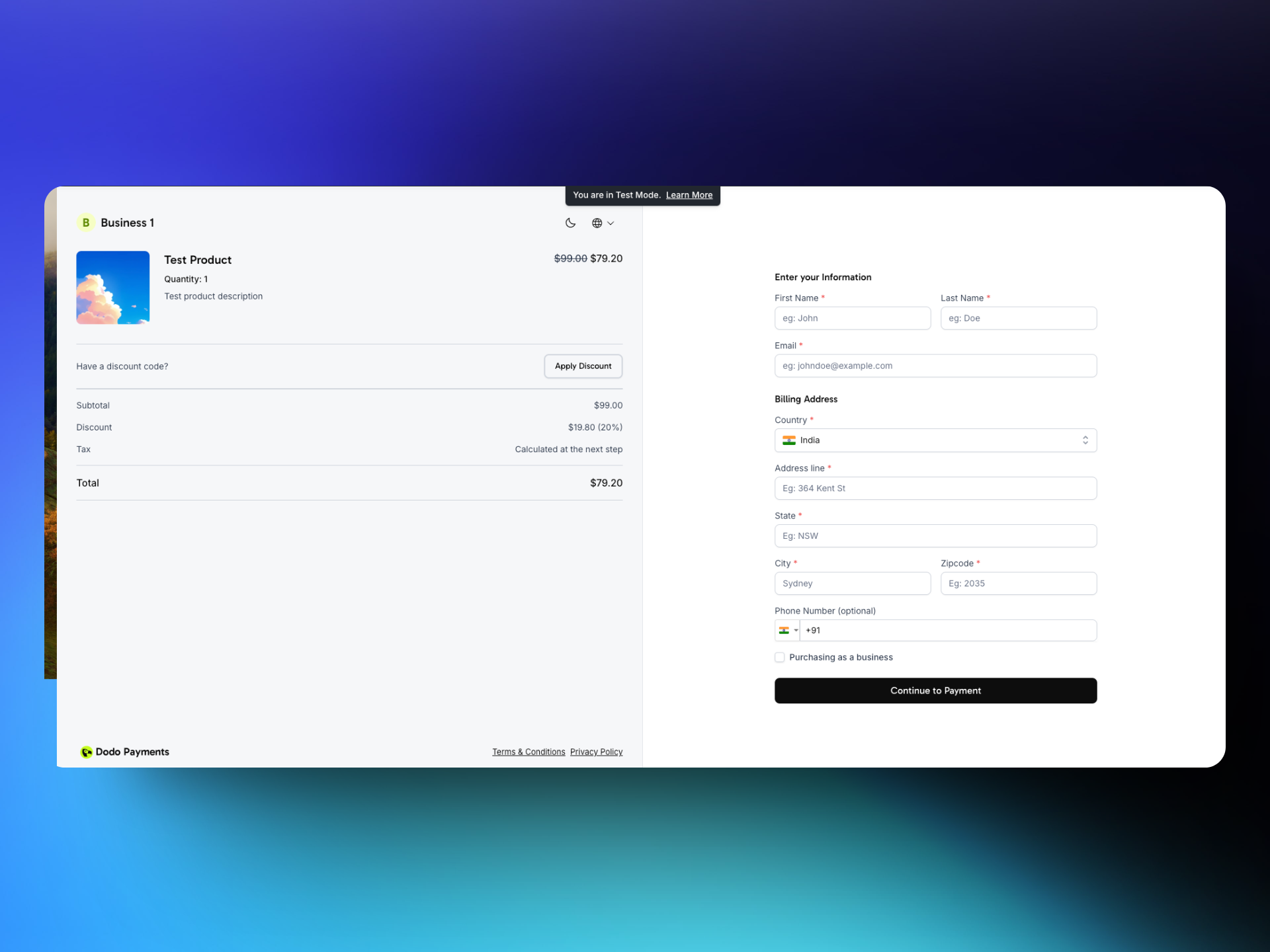

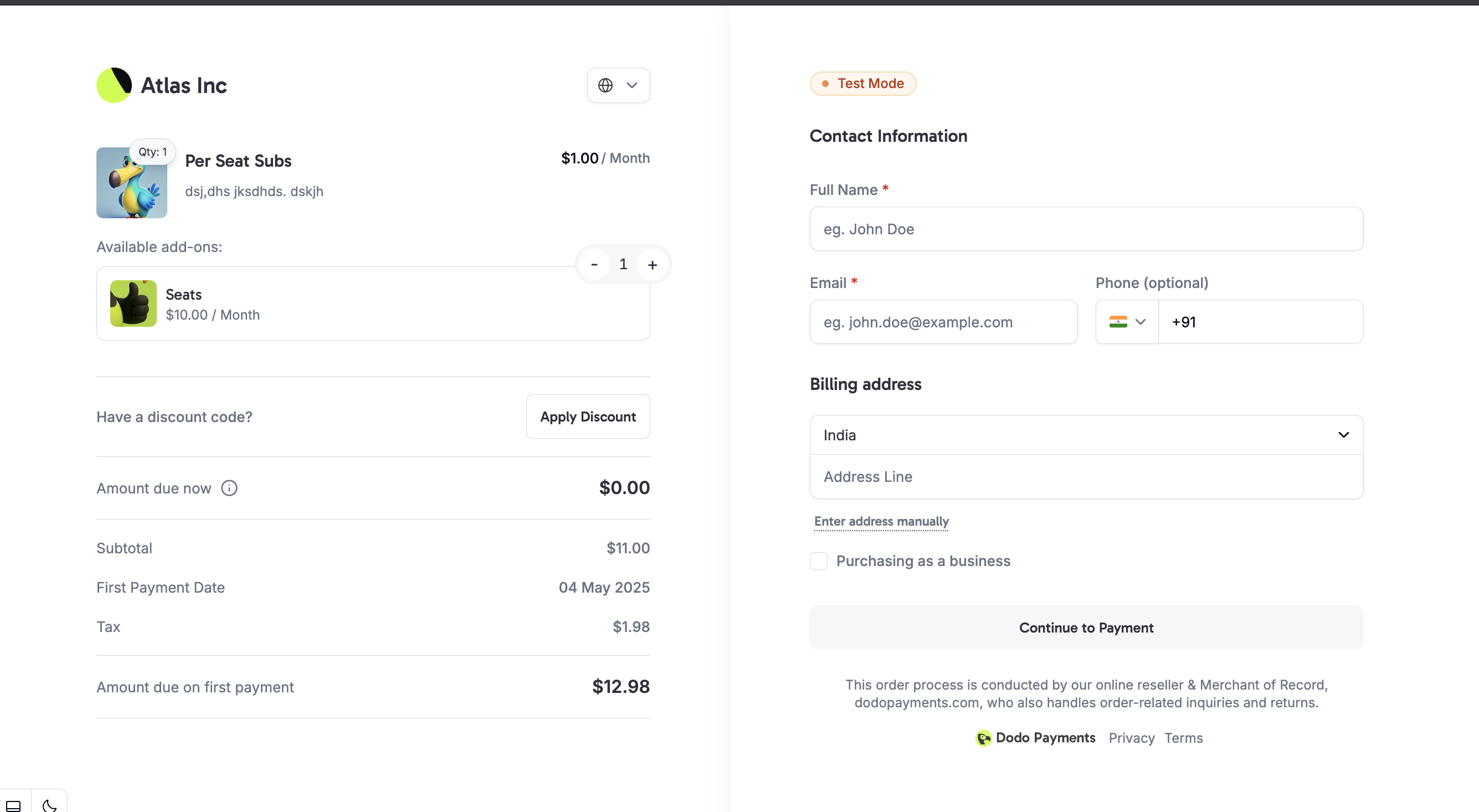

## Checkout experience

## Features

### Discount Code Expiration

You can set an expiration date for discount codes. Once expired, the discount codes will no longer be valid when used by customers. This feature allows you to run limited-time offers effectively.

**To set an expiration date for a discount code:**

1. Check the box next to **Set an expiration date for the discount** on the discount details page.

2. Click **Pick a Date**, then select the desired expiration date.

### Usage Limit

You can limit the number of times a discount code can be redeemed. This is useful for offering discounts to early adopters or controlling promotional usage.

**To set a redemption limit for a discount code:**

1. Check the box next to **Limit the number of times this discount can be redeemed** on the discount details page.

2. Enter the maximum number of redemptions in the input field that appears below.

### Limit Discount to Specific Products

You can restrict discount codes to specific products instead of applying them to all products by default.

**To limit a discount code to specific products:**

1. Enable the toggle **Limit discount to selected products**.

2. Select the products to which this discount code should be applied.

**Note:** If no products are selected, the discount code can be applied to all products by default.

## Checkout experience

1. Customer clicks on ***Apply Discount*** and enters the discount code.

2. Once discount code is applied, the product price would be adjusted based on it.

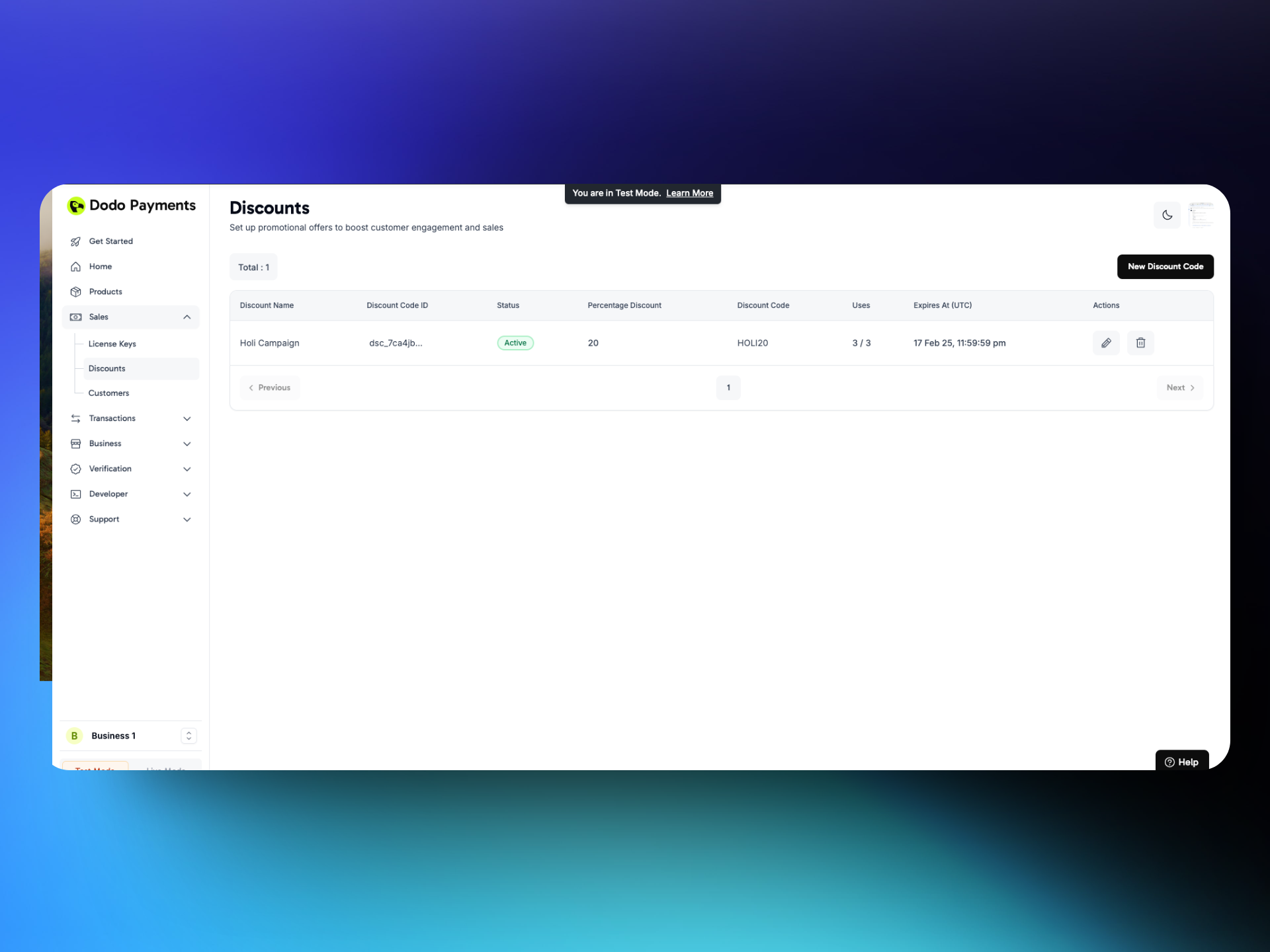

## Dashboard

Open Sales → Discounts section to view the status of all the discount codes used.

1. Customer clicks on ***Apply Discount*** and enters the discount code.

2. Once discount code is applied, the product price would be adjusted based on it.

## Dashboard

Open Sales → Discounts section to view the status of all the discount codes used.

The following information can be seen on the dashboard associated to discount codes

1. **Discount Details**:

* Discount Name

* Discount unique ID

* Status

* Discount Code

2. **Usage Activity**:

* Uses : Number of times discount is redeemed.

3. **Expiry and Limits**:

* Discount expiry date

* Number of times the discount code can be used

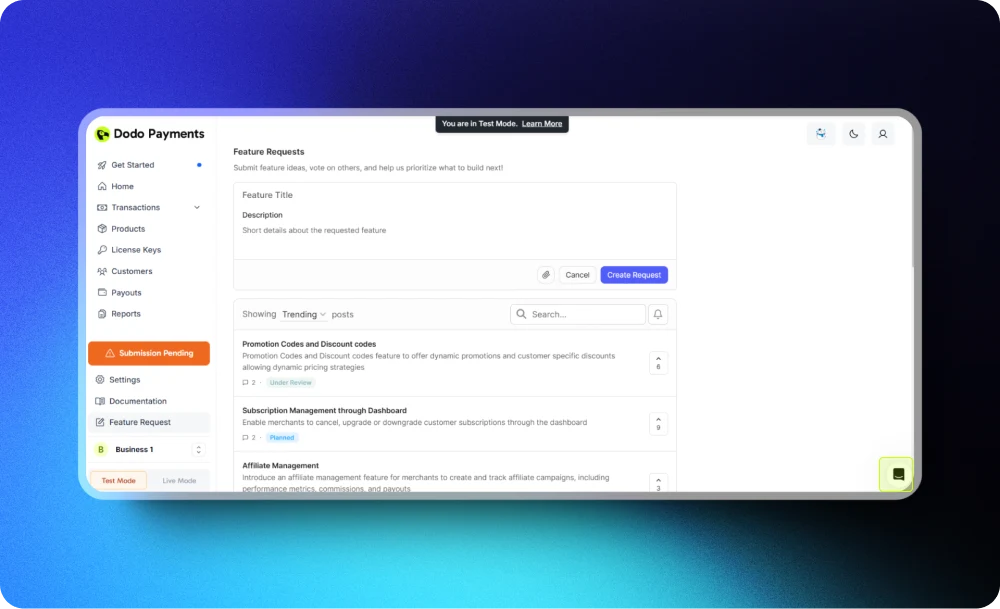

# Feature Request and Roadmap

Source: https://docs.dodopayments.com/features/feature-request

We value feedback from our merchants and aim to continuously improve Dodo Payments to meet your business needs. The **Feature Request and Roadmap** section allows you to directly contribute to our product development by suggesting new features, voting on existing requests, and staying informed about upcoming updates.

## **Request a New Feature**

If you have an idea for a feature that would enhance your experience with Dodo Payments, you can submit a feature request.

The following information can be seen on the dashboard associated to discount codes

1. **Discount Details**:

* Discount Name

* Discount unique ID

* Status

* Discount Code

2. **Usage Activity**:

* Uses : Number of times discount is redeemed.

3. **Expiry and Limits**:

* Discount expiry date

* Number of times the discount code can be used

# Feature Request and Roadmap

Source: https://docs.dodopayments.com/features/feature-request

We value feedback from our merchants and aim to continuously improve Dodo Payments to meet your business needs. The **Feature Request and Roadmap** section allows you to directly contribute to our product development by suggesting new features, voting on existing requests, and staying informed about upcoming updates.

## **Request a New Feature**

If you have an idea for a feature that would enhance your experience with Dodo Payments, you can submit a feature request.

* **How to Request a Feature**:

1. Navigate to the **Feature Request** section on the dashboard.

2. Click on **"Request a New Feature"**.

3. Provide the following details:

* **Feature Name**: A concise title for your feature idea.

* **Feature Description**: A brief explanation of the feature, including why it’s important and how it will help your business.

4. Submit the request.

* **Tips for Effective Requests**:

* Be clear and concise.

* Highlight the business impact of the feature.

* Provide examples, if applicable.

## **Vote for Existing Feature Requests**

We prioritize features that benefit the most merchants. You can browse existing feature requests and vote for those you find valuable.

* **How to Vote**:

1. Go to the **Feature Request** section.

2. Scroll through the list of submitted requests.

3. Click the **"Upvote"** button next to the feature(s) you support.

* **Benefits of Voting**:

* Influence the development priority for features you care about.

* Help our team identify features that have widespread demand.

## **View the Product Roadmap**

Stay informed about the status of feature development through the **Roadmap** section.

* **Roadmap Features**:

* **Planned**: Features that have been approved and are scheduled for development.

* **In Progress**: Features currently being worked on by our team.

* **Completed**: Features that have been successfully implemented and are live.

* **How to Access**:

* Navigate to the **Roadmap** tab within the Feature Request section.

* Browse the feature categories and their current statuses.

# Fraud Detection & Security

Source: https://docs.dodopayments.com/features/fraud-detection

The Fraud Detection & Security feature in Dodo Payments helps merchants protect their business from fraudulent activities and secure customer transactions.

* **How to Request a Feature**:

1. Navigate to the **Feature Request** section on the dashboard.

2. Click on **"Request a New Feature"**.

3. Provide the following details:

* **Feature Name**: A concise title for your feature idea.

* **Feature Description**: A brief explanation of the feature, including why it’s important and how it will help your business.

4. Submit the request.

* **Tips for Effective Requests**:

* Be clear and concise.

* Highlight the business impact of the feature.

* Provide examples, if applicable.

## **Vote for Existing Feature Requests**

We prioritize features that benefit the most merchants. You can browse existing feature requests and vote for those you find valuable.

* **How to Vote**:

1. Go to the **Feature Request** section.

2. Scroll through the list of submitted requests.

3. Click the **"Upvote"** button next to the feature(s) you support.

* **Benefits of Voting**:

* Influence the development priority for features you care about.

* Help our team identify features that have widespread demand.

## **View the Product Roadmap**

Stay informed about the status of feature development through the **Roadmap** section.

* **Roadmap Features**:

* **Planned**: Features that have been approved and are scheduled for development.

* **In Progress**: Features currently being worked on by our team.

* **Completed**: Features that have been successfully implemented and are live.

* **How to Access**:

* Navigate to the **Roadmap** tab within the Feature Request section.

* Browse the feature categories and their current statuses.

# Fraud Detection & Security

Source: https://docs.dodopayments.com/features/fraud-detection

The Fraud Detection & Security feature in Dodo Payments helps merchants protect their business from fraudulent activities and secure customer transactions.

## **Introduction**

At Dodo Payments, keeping your business and customer data safe is a top priority. We provide robust fraud prevention tools and security features designed to protect against fraudulent transactions, data breaches, and unauthorized access. Our security measures ensure that your payment processing is secure and compliant with industry standards, so you can focus on growing your business without worrying about fraud or data security.

## **Key Security Features**

**PCI-DSS Compliance**

Dodo Payments is fully compliant with the **Payment Card Industry Data Security Standard (PCI-DSS)**, which means we meet the highest security standards for handling, processing, and storing card information. This compliance ensures that all card transactions are processed securely and reduces the risk of data breaches.

**Data Encryption**

All sensitive data, such as payment information and personal details, is encrypted using the latest encryption technology. This ensures that your data is protected during transmission and storage, making it unreadable to unauthorized parties.

**Tokenization**

Instead of storing sensitive card information, Dodo Payments uses **tokenization**. This means that sensitive data is replaced with a unique identifier (token), ensuring that no card details are ever stored directly in our systems. This adds an extra layer of protection against fraud.

## **Fraud Prevention Tools**

**Fraud Detection**

Dodo Payments uses real-time fraud detection tools that monitor transactions for suspicious activity. This includes looking for unusual purchasing patterns, multiple failed payment attempts, or signs of account takeover. Any flagged transactions are immediately investigated, and merchants are notified if additional verification is needed.

## **Monitoring and Alerts**

Dodo Payments provides continuous monitoring of all transactions and account activity. If any unusual behavior or potential security threats are detected, we will block the transactions. These include suspicious login attempts, unusual transaction volumes, or possible fraud attempts.

## **Best Practices for Merchants**

To help keep your business secure, we recommend the following best practices

* **Monitor Transactions Regularly**: Keep an eye on your transaction history for any suspicious activity.

* **Use Strong Passwords**: Use unique, complex passwords for your account and change them regularly.

* **Report** any suspicious activity to our support team

# Feature Prioritization Tools

Source: https://docs.dodopayments.com/features/gtm-tools/feature-prioritization-tool

The **Feature Prioritization Tool** helps SaaS product teams prioritize feature development using the **RICE (Reach, Impact, Confidence, Effort) framework**. By assigning a RICE score to each feature, this tool ensures that high-impact, low-effort features are prioritized, maximizing development efficiency and business value.

## **Start Prioritizing Features for Maximum Impact**

Use the **Feature Prioritization Tool** to optimize product development and ensure your SaaS team focuses on features that drive engagement, user satisfaction, and revenue growth.

Link: [https://dodopayments.com/tools/product-prioritization-tool](https://dodopayments.com/tools/product-prioritization-tool)

## **Why Feature Prioritization is Essential for SaaS Businesses**

Prioritizing product features ensures that development teams focus on features with the highest user impact while efficiently managing resources. A structured prioritization process helps:

1. Improve customer satisfaction by delivering high-value features first

2. Maximize ROI on development efforts

3. Reduce time-to-market for essential features

4. Align product development with business objectives

By leveraging data-driven prioritization, SaaS companies can build products that drive engagement, retention, and revenue growth.

## **Key Input Metrics**

### **1. Reach Score (1-10)**

Represents the estimated number of users who will benefit from the feature within a specific period. High-reach features impact a large portion of the user base.

### **2. Impact Score (1-10)**

Measures the feature’s value to affected users. Higher impact scores indicate features that significantly enhance the user experience or solve a critical problem.

### **3. Confidence Level (%)**

Reflects the certainty of reach and impact estimates. A higher confidence percentage ensures that decisions are based on reliable data and user insights.

### **4. Effort Score (1-10)**

Represents the estimated resources required to implement the feature, including development time, personnel, and budget. Features requiring lower effort with high impact should be prioritized.

## **How the Feature Prioritization Tool Works**

Using the **RICE framework**, the tool ranks product features based on their potential value vs. effort. It provides:

1. A structured scoring system to evaluate feature importance

2. Automated ranking to ensure optimal resource allocation

3. Data-driven prioritization for faster decision-making

The tool generates a prioritized feature list, ensuring that the highest-impact features with the lowest resource investment are developed first.

## **Key Output Metrics**

### **1. Prioritized Feature List**

A feature ranking list is generated based on the RICE score, displayed in descending order. This list helps SaaS product teams focus on the most impactful features first, ensuring efficient roadmap planning.

## **Frequently Asked Questions (FAQs)**

### **FAQs:**

1. **What is the RICE framework?**

* The RICE framework is a prioritization method used to rank product features based on four factors: Reach (how many users it will affect), Impact (how much value it provides), Confidence (how sure you are of the estimates), and Effort (how much work it requires).

2. **How do I calculate Reach for a feature?**

* Reach is the estimated number of users who will benefit from the feature. For example, if a feature impacts 1,000 users per month, your reach score would reflect this number.

3. **Why is Confidence important in the RICE framework?**

* Confidence helps ensure that you’re making decisions based on reliable estimates. If you’re unsure about the impact or reach of a feature, a lower confidence score will prevent you from over-prioritizing a feature that may not deliver the expected value.

4. **How do I decide which features to prioritize?**

* Features with the highest RICE scores should be prioritized first because they offer the most value relative to the effort required. This ensures your team focuses on tasks that deliver maximum results quickly.

5. **What should I do if two features have the same RICE score?**

* If two features have the same RICE score, consider qualitative factors such as strategic importance, user feedback, or alignment with long-term business goals. You can also reassess confidence levels or adjust the impact estimate to break the tie.

# Freemium Model

Source: https://docs.dodopayments.com/features/gtm-tools/freemium-model

The Freemium Model ROI Analysis Tool helps SaaS businesses evaluate the effectiveness and financial viability of a freemium strategy. It provides insights into the costs associated with supporting free users and the revenue generated from conversions to paid plans. This tool enables businesses to assess whether their freemium model is sustainable and profitable.

## **Start Optimizing Your Freemium Strategy Today**

Evaluate your freemium model’s profitability with the Freemium Model ROI Calculator.

Link: [https://dodopayments.com/tools/freemium-model-calculator](https://dodopayments.com/tools/freemium-model-calculator)

Make data-driven decisions to maximize conversions and revenue!

## Importance of ROI Analysis for Freemium Models

Freemium models attract a large user base by offering free access to basic features, with the expectation that a percentage of users will convert to paid plans. However, if conversion rates are too low or operational costs are too high, the free tier can become unsustainable. Understanding the ROI of a freemium strategy is critical for:

* Evaluating the financial impact of supporting free users.

* Optimizing conversion strategies to increase paid users.

* Identifying cost inefficiencies and areas for improvement.

* Enhancing pricing models to maximize revenue potential.

## **Key Metrics Analyzed**

This tool provides insights into the following key factors affecting freemium profitability:

### **1. Free User Base**

Understanding the size of the free user base is essential, as these users form the primary pool for potential paid conversions.

### **2. Operational Costs**

The costs associated with supporting free users, including server infrastructure, customer support, and product maintenance, directly impact the financial sustainability of a freemium model.

### **3. Free-to-Paid Conversion Rate**

The percentage of free users upgrading to paid plans is a critical indicator of monetization success. A low conversion rate may suggest issues with feature differentiation, pricing, or user engagement.

### **4. Paid User Revenue & Costs**

Revenue generated from paid subscribers must offset both acquisition costs and the cost of maintaining free users. Understanding the balance between these factors ensures long-term profitability.

## **How This Tool Helps SaaS Businesses**

By analyzing these metrics, the Freemium Model ROI Analysis Tool enables businesses to:

1. Assess the financial impact of free users and determine if the model is sustainable.

2. Optimize the free-to-paid conversion funnel to improve monetization.

3. Identify opportunities to reduce costs while maintaining product quality.

4. Fine-tune pricing and feature differentiation to increase revenue.

## **Strategic Considerations**

* **ROI (Return on Investment)**: The tool provides an ROI percentage, showing the profitability of your freemium model. A positive ROI indicates that your free users are converting into paying customers at a rate that covers your costs and generates profit.

If the analysis indicates a negative ROI, businesses may need to:

* Refine pricing models by adjusting free and premium feature allocations.

* Enhance product value to improve user retention and encourage upgrades.

* Reduce operational costs associated with maintaining free users.

* Optimize conversion tactics, such as targeted promotions and in-app nudges.

### **FAQs:**

1. **What is a good conversion rate for freemium models?**

* A typical conversion rate for freemium models is between 2% and 5%, but it can vary depending on your product and market. Higher conversion rates indicate that your free users are finding enough value to upgrade to a paid plan.

2. **How do I reduce the costs of supporting free users?**

* You can reduce costs by optimizing server resources, automating customer support for free users, and limiting the features available in the free tier to reduce usage costs.

3. **What are the risks of a freemium model?**

* The biggest risk is that too many users stay on the free plan without converting to paid plans. This can lead to high costs without generating sufficient revenue. Balancing the value of the free tier and making the upgrade path attractive is key.

4. **How can I improve my freemium conversion rate?**

* You can improve conversion by offering clear value in the paid tiers, such as premium features, better support, or advanced analytics. Offering timely nudges to ask the user to upgrade may push the conversion

5. **What should I do if my freemium ROI is negative?**

* If your freemium ROI is negative, it’s important to reevaluate the value you’re offering in the free tier. Consider reducing the free features or increasing the incentives to upgrade to a paid plan to make your strategy more profitable.

# SaaS KPI Measurement

Source: https://docs.dodopayments.com/features/gtm-tools/saas-kpi-measurement

The SaaS KPI Measurement Tool enables SaaS businesses to monitor their key performance indicators (KPIs) such as Annual Recurring Revenue (ARR), Churn Rate, and Customer Lifetime Value (CLTV). By consolidating critical financial metrics in a single dashboard, businesses can gain insights into growth trends, customer retention, and long-term profitability.

## **Start Tracking Your SaaS KPIs Today**

Gain valuable business insights with the **SaaS KPI Measurement Tool**.

Link: [https://dodopayments.com/tools/saas-kpi-measurement](https://dodopayments.com/tools/saas-kpi-measurement)

**Optimize revenue, monitor churn, and scale with confidence!**

## **Why KPI Measurement is Essential for SaaS Businesses**

Accurate KPI tracking helps SaaS companies:

1. Understand monthly and annual revenue trends

2. Identify customer retention challenges and reduce churn

3. Forecast long-term financial performance

4. Optimize pricing and revenue models

5. Improve customer lifetime value (CLTV) and ROI

Tracking these KPIs consistently ensures better decision-making and business sustainability.

## **Key Input Metrics**

To generate accurate SaaS KPIs, the tool requires the following inputs:

### 1. Monthly Recurring Revenue (MRR)

The total recurring revenue generated per month from customer subscriptions. This metric is the foundation for calculating ARR and CLTV.

### 2. New Customers Added This Month

The number of new customers acquired during the current month. This input is essential for tracking growth and understanding customer acquisition effectiveness.

### 3. Customers Last Month

The total customer base at the start of the month. This metric is used to assess churn rate and retention trends.

### 4. Current Customer Base This Month

The number of active customers at the end of the month. This figure helps determine if the company is retaining or losing customers.

### 5. Average Customer Retention Period

The average length of time a customer remains subscribed (in months or years). This is crucial for calculating CLTV and evaluating long-term revenue potential.

## **How the SaaS KPI Measurement Tool Works**

The tool performs real-time calculations based on the provided inputs and generates key SaaS metrics:

1. **ARR Calculation** – Estimates Annual Recurring Revenue using MRR.

2. **Churn Rate Calculation** – Determines customer retention trends over time.

3. **CLTV Calculation** – Evaluates customer lifetime value to measure revenue potential per customer.

By consolidating these KPIs, the tool provides a comprehensive performance overview, allowing businesses to identify opportunities for growth and improvement.

## **Frequently Asked Questions (FAQs)**

1. **What is a good churn rate for a SaaS business?**

* A good churn rate for SaaS businesses varies depending on the industry but it typically falls below 10%. Lower churn means better customer retention, which directly impacts revenue stability. If your churn rate is higher, it may indicate issues with product fit or customer satisfaction.

2. **Why is tracking MRR important for SaaS companies?**

* MRR provides a clear, predictable revenue stream that you can count on month over month. It helps with financial forecasting, budgeting, and measuring the success of marketing and sales strategies.

3. **How can I increase my CLTV?**

* You can increase CLTV by improving customer retention, upselling customers to higher pricing tiers, and providing exceptional customer service. Happy customers are likely to stick around longer and spend more.

4. **What’s the difference between MRR and ARR?**

* MRR represents your monthly recurring revenue, while ARR is the annualized version of MRR. ARR provides a longer-term perspective on your recurring revenue, making it easier to assess yearly performance.

5. **Why should I monitor churn rate closely?**

* Churn rate directly affects your bottom line. High churn means that you’re losing customers faster than you’re acquiring new ones, which can lead to negative revenue growth. Monitoring churn helps you identify areas for improvement, like product enhancements or better customer support.

# SaaS Pricing calculator

Source: https://docs.dodopayments.com/features/gtm-tools/saas-pricing-calculator

The SaaS Pricing Calculator is designed to help SaaS businesses determine the ideal pricing strategy for their software products. Setting the right price is critical for remaining competitive, covering operational costs, and maximizing profitability. This tool enables businesses to explore different pricing models, including competitor-based, cost-based, and value-based pricing, to develop a pricing structure that aligns with market trends and customer expectations.

## **Optimize Your SaaS Pricing Strategy Today**

Use the **SaaS Pricing Calculator** to develop a pricing model that maximises profitability, competitiveness, and customer acquisition.

Link: [https://dodopayments.com/tools/saas-pricing-calculator](https://dodopayments.com/tools/saas-pricing-calculator)

**Find the perfect balance between cost, value, and market positioning!**

## **Why Pricing Strategy is Crucial for SaaS Businesses**

Pricing directly impacts customer acquisition, revenue growth, and profitability. A well-defined pricing strategy ensures:

1. **Competitive positioning** – Aligns your product pricing with market expectations

2. **Sustainable profitability** – Covers costs while maintaining profit margins

3. **Value-based pricing** – Ensures customers pay according to the benefits they receive

Choosing the right pricing strategy allows SaaS businesses to balance affordability, perceived value, and business growth.

## **Key Input Metrics**

### **1. Competitor Pricing**

Understanding the price points of similar SaaS solutions in the market helps in positioning your product effectively. Competitor pricing acts as a reference, enabling businesses to decide whether to price above, below, or at market rates.

### **2. Product Value Addition (%)**

Represents the relative value your product provides compared to competitors. If your software offers 30% more features or efficiency, pricing can be adjusted accordingly.

### **3. Cost per User**

Includes operational costs such as cloud hosting, development, maintenance, and support services. This metric helps in setting a profitable baseline price to ensure sustainability.

### **4. Estimated User Base**

Defines the projected number of users subscribing to the SaaS product over a set period. This estimation helps determine revenue potential and optimal pricing.

### **5. Target Revenue**

Businesses must set annual or monthly revenue goals to ensure pricing strategies align with profitability objectives. This metric helps determine minimum pricing thresholds.

### **6. Estimated Value for the Customer**

Assesses the financial impact or time savings the product delivers to users. For example, if the software saves businesses \$10,000 annually, pricing should reflect this value-based approach.

## **How the SaaS Pricing Calculator Works**

This tool enables businesses to compare multiple pricing models and identify the most suitable one based on financial goals, competitive landscape, and customer expectations. It supports:

1. **Competitor-Based Pricing** – Align pricing with industry benchmarks

2. **Cost-Based Pricing** – Ensure pricing covers operational costs and profit margins

3. **Value-Based Pricing** – Charge based on customer-perceived value

By leveraging data-driven pricing strategies, SaaS companies can optimize revenue, enhance customer acquisition, and drive business growth.

## **Key Output Metrics**

### **1. Recommended Price Range**

The tool provides a flexible pricing range, allowing businesses to adjust prices based on market trends and customer feedback. Pricing recommendations typically range between 0.8x and 1.2x the suggested price, ensuring adaptability.

### **2. Tiered Pricing Structure**

A well-defined tiered pricing model maximizes revenue potential by catering to different customer segments. The tool recommends three tiers:

**Basic Tier** – Lower-priced plan for budget-conscious users with essential features.

**Pro Tier** – Standard pricing plan offering a balanced set of features.

**Enterprise Tier** – Premium pricing model with advanced functionalities and personalized support.

## **Frequently Asked Questions (FAQs)**

1. **What is the best pricing strategy for SaaS companies?**

* There is no one-size-fits-all pricing strategy for SaaS companies. The best approach depends on your product, market, and business goals. Competitor-based pricing helps you align with market rates, cost-based pricing ensures you cover your expenses, and value-based pricing lets you charge based on the perceived value your product delivers to customers.

2. **How do I decide whether to use competitor-based, cost-based, or value-based pricing?**

* If your market is saturated with similar products, competitor-based pricing can keep you competitive. If you want to ensure profitability, cost-based pricing guarantees your costs are covered. If your product offers significant value to users, value-based pricing allows you to charge based on the results your product delivers, which can lead to higher pricing.

3. **How can I make my SaaS pricing more competitive?**

* To stay competitive, evaluate your competitors regularly, ensure your pricing reflects the value you provide, and consider offering tiered pricing or freemium models. Adjust your pricing based on user feedback and market trends to ensure you remain competitive.

4. **Why should I offer tiered pricing for my SaaS product?**

* Tiered pricing allows you to cater to different customer segments, offering basic features at lower prices and premium features at higher prices. This flexibility maximizes your revenue by appealing to both budget-conscious users and those willing to pay for advanced features.

5. **How often should I reevaluate my SaaS pricing?**

* It’s a good practice to review your pricing strategy at least once a year, or when significant changes occur in your product offerings, market conditions, or customer needs. This ensures your pricing remains competitive and aligned with your business goals.

# SaaS Revenue & Profit Growth

Source: https://docs.dodopayments.com/features/gtm-tools/saas-revenue-and-profit-growth

The **SaaS Revenue & Profit Growth Tool** is designed to help SaaS businesses accurately forecast their **financial performance** by analyzing revenue, costs, and growth rates. This tool enables businesses to make data-driven decisions about scaling, hiring, and long-term sustainability. By predicting future revenue and profit trends, SaaS companies can optimize growth strategies and maximize profitability.

Start Forecasting Your Business Growth with **SaaS Revenue and Profit Growth Tool**

**Link:** [https://dodopayments.com/tools/saas-revenue-profit-growth-tool](https://dodopayments.com/tools/saas-revenue-profit-growth-tool)